views

Financial planning is crucial for everyone, including millennials in India. Financial planning is essential for everyone regardless of age. There are a number of different investment options available to millennials in India, including stocks, bonds, and real estate. It is important to do your research and choose investments that are right for your risk tolerance and financial goals.

Millennials are also known as Generation Y. The Pew Research Center defines millennials as adults born between 1981 and 1996, or ages 27 to 42 in 2023.

Here are key things to keep in mind for financial planning for millennials in India:

Initiate Early & Harness Power of Compounding:

Time is a crucial asset for millennials, offering a distinct advantage when it comes to the effectiveness of compounding over extended periods. Commencing investment endeavours early facilitates exponential growth of your funds. Even modest contributions can yield substantial wealth over time. The sooner you embark on saving, the greater the opportunity for your money to flourish.

Even with limited monthly savings, the cumulative effect over time can be significant. Various savings instruments, including savings accounts, mutual funds, and public provident funds, are accessible to millennials in India.

Emergency Fund:

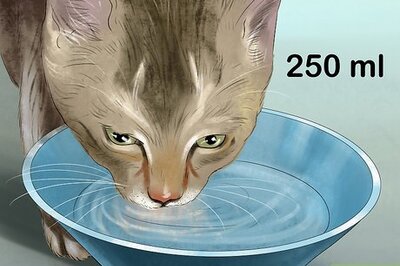

Construct an emergency fund capable of covering three to six months’ worth of living expenses. This financial safety net ensures resilience against unforeseen expenses, safeguarding your long-term financial objectives. Maintain the emergency fund in a readily accessible and liquid account.

Invest With Specific Goals in Mind:

Define your financial objectives explicitly, whether it involves purchasing a home, financing higher education, or planning for retirement. Customise your investment approach based on the time frame and risk tolerance associated with each goal. Opt for safer, more liquid investments for short-term goals, while long-term goals can accommodate a more assertive investment strategy.

Effectively Manage Student Loans:

Given that many millennials may have student loans, it is imperative to manage and plan for their repayment diligently. Familiarise yourself with the loan terms, explore refinancing options if applicable, and formulate a repayment strategy that aligns with your overall financial plan.

Diversification and Prudent Risk Management:

Diversify your investment portfolio to mitigate risk. Incorporate a mix of asset classes, such as stocks, bonds, and real estate, to create a well-balanced and diversified portfolio. Periodically reassess and rebalance your portfolio in response to evolving market conditions and your risk tolerance. Avoid concentrating all your funds in a single investment or asset class.

Settle Outstanding Debts Promptly:

Recognise that debt can pose a significant financial burden and prioritise its swift repayment. Employ various strategies, such as making additional payments, consolidating debt, and negotiating lower interest rates, to expedite the debt repayment process.

Protect Yourself With Insurance:

Insurance can help protect you from financial hardship in the event of an unexpected event, such as an illness or accident. There are a number of different types of insurance available to millennials in India, such as health insurance, life insurance, and disability insurance.

Financial planning is a dynamic process, and it’s crucial to periodically review and adjust your plan based on changes in your financial situation, goals, and market conditions. Seeking advice from a financial planner can also provide personalised guidance tailored to your specific circumstances.

Comments

0 comment