views

Preparing to Create Your Financial Plan

Understand the top-down approach to project budgeting. There are two approaches to creating a project budget. The first is known as the top-down approach, and this refers to projects where the total allowable cost is known before the project begins. The project budget must therefore be within those costs. For example, assume you own a construction business, and a large organization approaches you to see if you can enlarge their parking lot. They may tell you that they have $500,000 to allocate to the project, at which point you need to decide if you can do it or not. In the top-down situation, you would need to create a budget that costs less than $500,000.

Understand the bottom-up approach to project budgeting. The bottom-up approach is the alternative to the top-down approach, and this refers to figuring out what every part of the project will cost, and then adding it up to determine the total. If a customer approaches you to re-build a parking lot, and asks for a quote, you could use a bottom-up approach. You would consider everything that is necessary for the project, and then determine the total cost. In this case, you determine the cost of the project by figuring out what every piece will cost and then calculating a total. In the top-down approach, the cost is determined by available resources, and you must work within those limits.

Choose the approach for you. Sometimes, you may not have a choice, and you may need to work within the confines of somebody else's budget (meaning you would need to use a top-down approach). Other times, if you have full control over a project, you can select an approach. The advantage of the top-down approach is that it ensures a project is completed within available resources. If your organization has $1 million to spend on projects for a year, you can state that the new parking lot construction project must be done for under $500,000. These limitations can lead to efficiencies and the reduction of waste. This approach is useful if you have limited resources. Similarly, if you are running a project, it allows you to dictate to all the parties involved how much they are allowed to spend. This can keep costs down because each party will not be creating their own budgets. The bottom-up approach is useful because it can be very accurate. Without any immediate limit, you, or your employees can cost the project based on what the project needs. If you are constructing a new parking lot, you may task each member of your team to come up with the budget they need. The major con is this approach can lead to run-ups in cost.

Discuss the needs of the project with key stakeholders. Regardless of the approach you choose, you will need to discuss what the project will require with key project members. Knowing the needs of the project can allow you to determine what the costs of the project will be. This is called the "scope" of the project and it defines the requirements and limits of the work to be performed. For example, assume you have been approached to construct a parking lot for a large organization, and they have allowed you to cost the project (or provide an estimate). Your first step will be to discuss with them what their needs are, and what their timelines are. They may say they need a new lot with 100 spaces be constructed within three months. You may then survey the site to realize that you will need to cut down trees, blast rock, and then construct the new lot. From this, you can determine you will need planners to design the lot, people to blast and cut down trees, and construction workers to build the lot.

Creating your Project Financial Plan

Determine your core costs. These are the absolutely essential costs to complete the project. Core costs would include things like labor, equipment, and materials. The bulk of any projects costs will come from these key components. If you are constructing a parking lot, you will need laborers to do the work, and contractors to assist/plan the project. You will need materials (like asphalt, wood, paint), and you will need equipment (tractors, jackhammers, etc). If you know the timeline for the project, this helps in scheduling resources and expenses. For example, if the project is three months, you know you may need to pay labor for three full months, as well as rent any equipment for that period. You can determine costs by consulting with your team and contacting suppliers. If it is a large project, you can ask your construction foreman what specifically he needs in terms of labor, material, and equipment. You can then contact suppliers for quotes and choose the most appropriate quote. You will also need to determine any legal or owner-established limits. For instance, what is the legal minimum wage, and what is the minimum wage you will offer for the different types of work? What are the legal requirements when it comes to scheduling, and are there any additional rules you wish to establish (such as no weekend access to the site)?

Consider non-core expenses. Many projects go over-budget because they forget to include non-core expenses. Think very carefully about all the things outside of labor, materials, and equipment that you may need. Consider things like any required travel, insurance, legal advice, accounting advice, fuel, food/drinks, and extra telephone/internet bills. Make sure to put a number to each indirect cost. If you need to estimate, always assume it will be on the higher end rather than on the lower end. To determine costs, consider how long you will need the good/service, and what its price is. For example, if you need to set up internet at the work site, you know you may need three months of internet at $100 per month.

Add a reserve to help reduce your risk. After your direct and indirect costs have been added up, consider adding extra money to your total costs just in case your cost estimates were too low. In addition, often times projects are delayed, issues occur, or items cost more than was initially planned. How much you choose to add depends on how accurate you think your budget is. If many aspects of your budget needed to be estimated and could not be confirmed, consider adding 5 – 10% as a reserve.

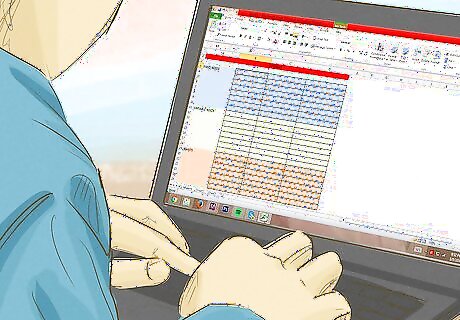

Create a table to record your costs. The final aspect of a financial plan is to record all your information. To do this, you can open up Microsoft Excel or any other table creating program, and create a table with four columns. From left to right, they would state: Expenditure, Cost, Running Total, and Notes. The expenditure column would list the name of the expenditure. For example, Tractor Rental, or Construction Laborers. The cost would indicate how much the expenditure cost. The running total would indicate the total cost up to that particular point. For example, if the first row had a cost of $10, and the second row had a cost of $10, the running total in the second row would be $20. Notes would include any special things to remember about the expense. While you can consider labor as one category, it is generally better to break labor down by the tasks performed and the wages paid. For example, a welder or the foreman of a crew is usually paid more than a laborer. So you may wish to group the construction laborers together in one expenditure category, plus categories for the foreman, specialists (this could include the welder), consultants, etc.

Comments

0 comment