views

- Include provisions for existing property, investments, or other assets you want to keep as non-marital property in case of divorce or legal separation.

- Ensure any prior, separate debt remains the sole responsibility of the partner who accrued it by explicitly stating it in your prenuptial agreement.

- Safeguard your children’s inheritance by ensuring your partner can’t claim it as their own in your prenuptial agreement.

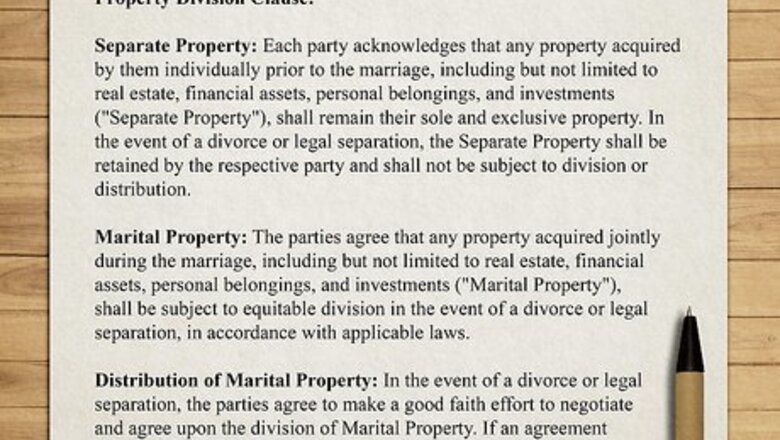

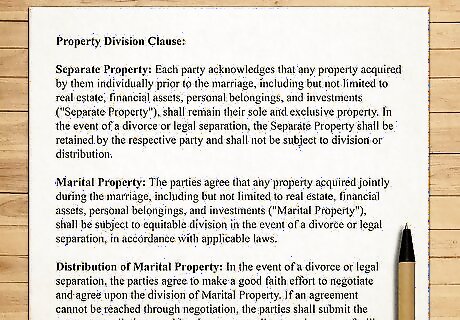

Property Division

Create a clear division of property. Including a plan for property division in the event of a divorce or a legal separation doesn’t mean it’s going to happen—it’s just smart to be prepared! If you’ve accumulated any property or assets separate from your partner, such as investments, real estate, retirement accounts such as 401ks and IRAs or other personal belongings, including these items as separate property in your prenuptial agreement will ensure that they stay in your hands if your marriage dissolves. For example, if your partner were to gain access (withdraw or deposit funds) to a bank account you held privately prior to your marriage (separate/non-marital property), that account may become considered marital/community property by the court in the event of a divorce or legal separation. Specify how you want your retirement funds (social security, 401ks, IRAs, etc.) to be divided or upheld as separate, non-marital property in your prenup, as these are typically women’s most valuable assets. Obtaining a full list of assets, debts, income sources, etc., from your partner as well as sharing your own, ensures that your prenup is based on fairness, full disclosure, and trust. Remember, this is a legal collaboration between the two of you and an experienced lawyer.

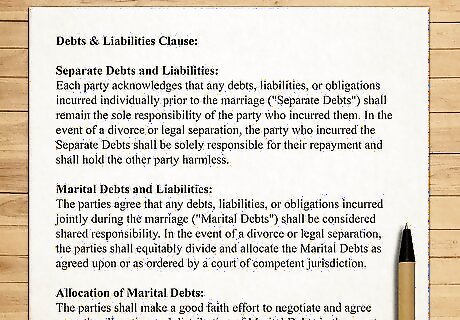

Debts & Liabilities

Explicitly state which partner is liable for what debt. Believe it or not, individual debt can become marital debt, so if you or your partner has financial debt such as college, credit card, business, etc., you may become responsible for it too after getting married. To protect yourself from accruing any of your partner’s debt, specify in your prenuptial agreement that any personal debt acquired before and during the marriage is separate from you and is your partner’s own responsibility. Any joint loans, such as a mortgage loan on a property you and your partner own together, cannot be separated.

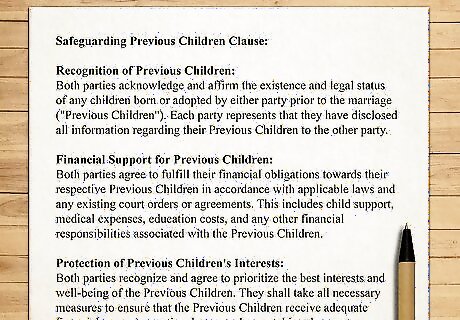

Safeguarding Previous Children

Ensure your children are protected by a prenup provision. If you had any children prior to your marriage, including them in your prenuptial agreement ensures their financial security in the event of a divorce or your passing. Explicitly outlining your children’s inheritance (items, funds, property, etc.) guarantees that your partner can’t claim them as their own. Consider including a provision in your prenup that covers any future assets or inheritance you’d want to be passed down accumulated throughout your marriage, such as property. Unborn children typically cannot be included in your prenuptial agreement. However, like all prenups, adjustments can be made to address new assets or milestones, such as having a child.

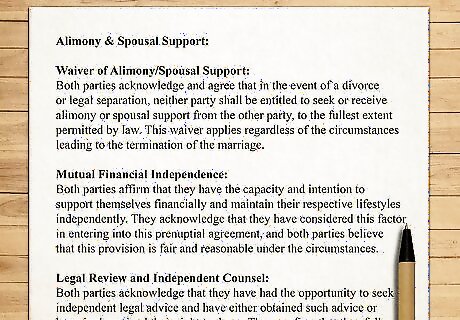

Alimony & Spousal Support

Determine how much aid will be provided for how long. Alimony (financial support after a divorce or legal separation) is a critical element of a prenup for parents (or future parents) to consider, as it ensures that if one partner gives up their career to stay home with their child, etc., their labor is compensated. For example, if you were to give up your career to stay at home and raise your child, establishing an alimony agreement might entitle you to half of your partner’s retirement or another agreed-upon alternative. Alternatives to alimony include lump-sum payments or the allocation of property. Consult your lawyer to learn about the plethora of options you and your partner have regarding this matter—you’re sure to find an option you can both agree upon. Consider asking for temporary and/or permanent provisions that would ensure your financial compensation is protected should any circumstances occur that may affect your payment.

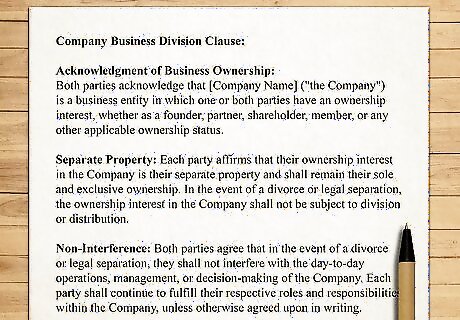

Business Interests

Outline the division of business interests to keep your company safe. Whether you own a business with your partner or have a business on your own or with family, outlining the exact division (or no division) of them ensures your assets are protected and/or distributed in a fair and equitable way that you’re comfortable with. Small or large, your business is like your child, so it’s important to ensure it’s protected in the event of a divorce or a legal separation. For example, if you and your partner own a business together, you might specify that you both retain 50% ownership of the company in the event of your divorce or separation.

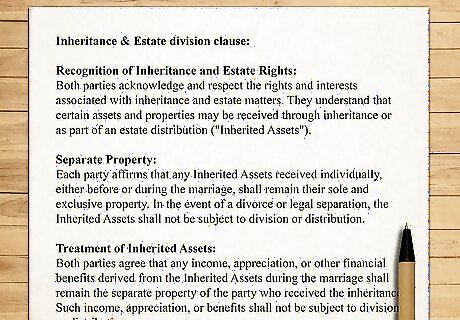

Inheritance & Estate Planning

Prevent your inheritance from being divided, if desired. If you’re set to inherit property, money, family heirlooms, etc., you may choose to keep these assets separate from your partner via a prenuptial agreement. By specifically citing any/all items you have or will inherit, you prevent them from becoming divided as marital property in the event of a divorce or legal separation. Additionally, you may choose to include a stipulation stating that specific items will be passed on to the people of your choosing, such as your children. Prenups are totally customizable to you and your partner. For example, you can share one part of your inheritance with your partner, such as a lump sum of money, and keep an item like a watch as separate, non-marital property.

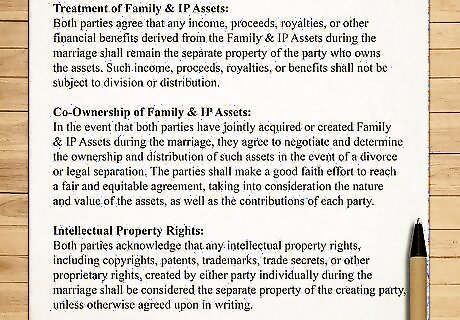

Family & Intellectual Property

Separate any website domains, social media accounts, etc. Intellectual property such as IP addresses, social media accounts, inventions, literary works, you name it, can all be established as separate, non-marital property should you choose to outline them as so in your prenuptial agreement. Whether you’re set to inherit intellectual property or have your own, designating your private ownership of them in your prenuptial agreement ensures that they are protected from division or allocation in the event of a divorce or separation from your partner. Keep in mind that every state has different laws regarding prenuptial agreements. Ask your lawyer to help familiarize you and your partner with any relevant legal terms, jargon, and regulations regarding your prenuptial agreement to ensure it’s fair and equitable.

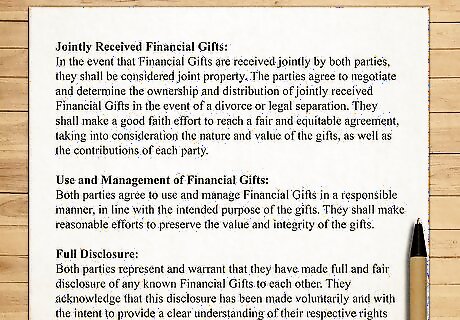

Gifts

Declare financial gifts as separate property, if desired. As a general rule of thumb, gifts such as your yearly birthday check from grandma, a painting from your father, or even your future inheritance are considered separate, non-marital property. That said, if you don’t want to worry about the possibility of having to part with these current or future items or funds should you and your partner ever divorce or legally separate, outlining your explicit, separate ownership of these items or any items to come throughout your marriage may be a wise addition. Outlining your explicit, non-marital ownership of items can extend to gifts your partner gives you, too, such as a diamond necklace for your anniversary. It’s critical to have an experienced lawyer help you and your partner draft and approve a fair and equitable legal prenup. This is not something you and your partner can do on your own.

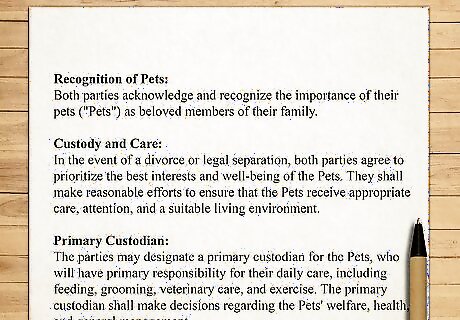

Pet Clause

Determine who will get your pet or establish joint custody. Pets are like children, so it’s no wonder why you might want to ensure your ownership of something so dear to you. If you have a pet prior to your relationship that you don’t want to lose rights to in the event of a divorce or legal separation from your partner, consider including a fair and equitable plan for their care and ownership in your prenup. For example, you may choose to outline who makes their medical decisions, how custody will be shared, who will pay for their care, etc. Unlike children, pets are considered legal property.

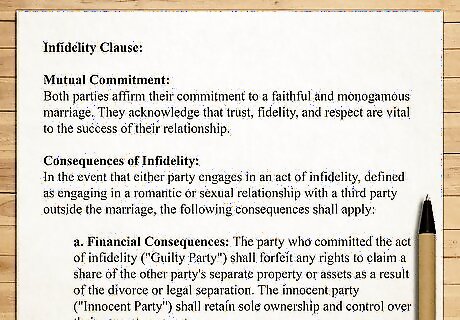

Infidelity Clause

Detail provisions should a partner be unfaithful. While it may be awkward to talk about, including an infidelity clause in your prenuptial agreement may be financially beneficial. For example, both parties may decide on an amount the cheater would have to pay the cheated on. Remember, being prepared for the worst doesn’t mean it’s going to happen—there’s nothing wrong with protecting yourself. Some states, such as California, won’t recognize an infidelity clause, as infidelity is considered an unforeseeable, unpunishable incident. While it may be challenging, try to leave your emotions out of your prenup. Love is intoxicating and can make you forget your financial responsibilities.

Comments

0 comment