views

Responding to a Request for Information

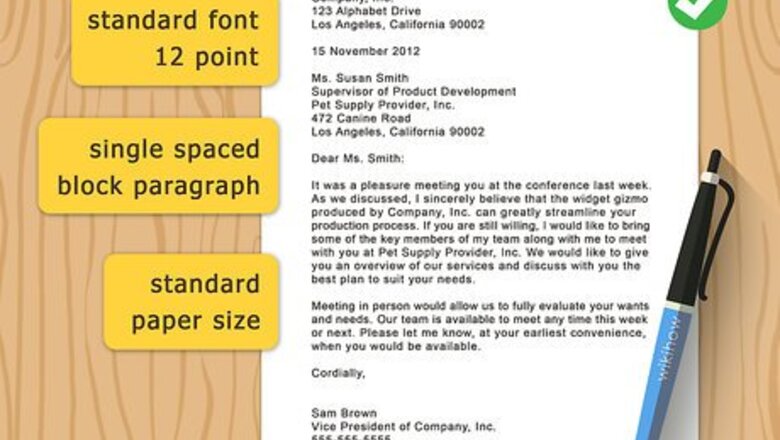

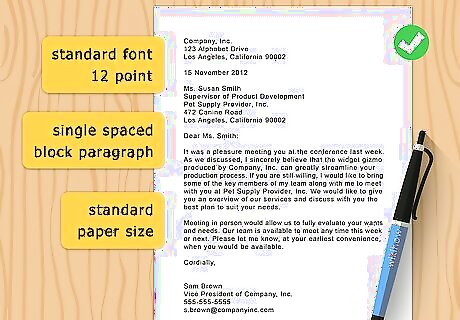

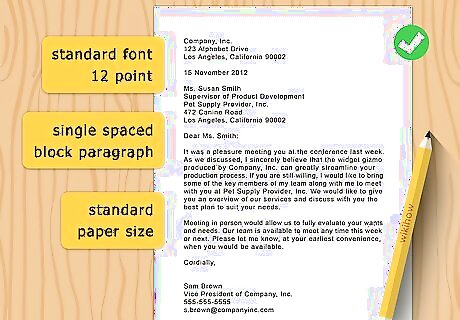

Format a business letter. Open a blank word processing document and set the font to something readable, such as Times New Roman 12 point. Remember that business letters are single spaced and use block paragraphing, which means you don’t indent with each new paragraph. Instead, you leave a blank line between paragraphs. You can use letterhead if you have it. Leave enough space at the top of the letter.

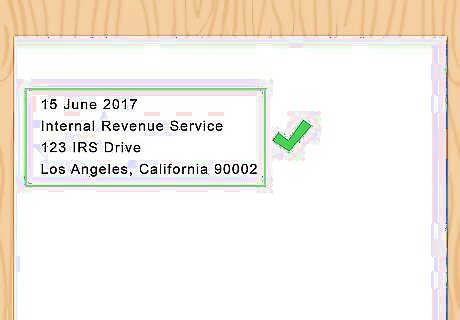

Add the IRS address. Insert this information at the top of the page. Include the street address, city, state, and zip code. Look at the letter you received from the IRS to find the address.

Include your personal information. In the block beneath the IRS address, insert the following personal information: Name, e.g., “Michael A. Jones” Social Security Number, e.g., “111-11-1111” Address Tax period, e.g., “2016” Tax form if any was referred to, such as Form 1099-MISC

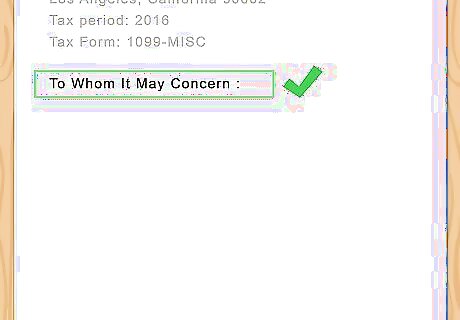

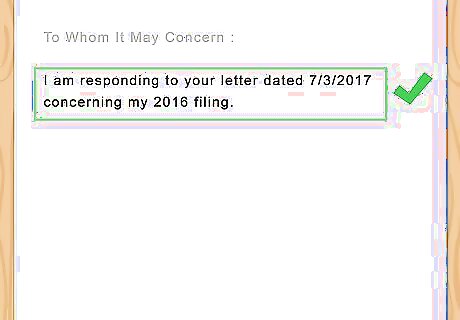

Insert your salutation. If you’ve been given the name of an IRS employee, you can use it. Otherwise, use “To Whom It May Concern” and insert a colon.

Include a copy of the notice you received from the IRS. If you are responding to a notice the IRS sent to you, copy the notice and include it with your reply. Let them know in the first paragraph what date they sent you a letter and what it was about. This paragraph can be a single sentence. For example, you can write, “I am responding to your letter dated 7/3/2017 concerning my 2016 filing.”

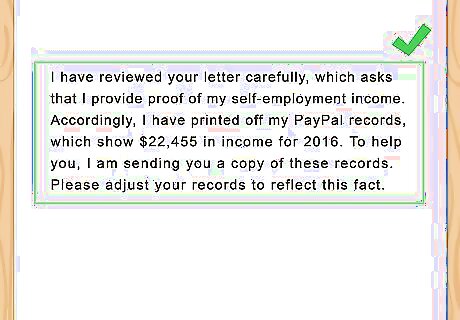

Identify the information you are providing. The IRS probably is requesting additional documentation. Tell them what you are providing. For example, you can write, “I have reviewed your letter carefully, which asks that I provide proof of my self-employment income. Accordingly, I have printed off my PayPal records, which show $22,455 in income for 2016. To help you, I am sending you a copy of these records. Please adjust your records to reflect this fact.”

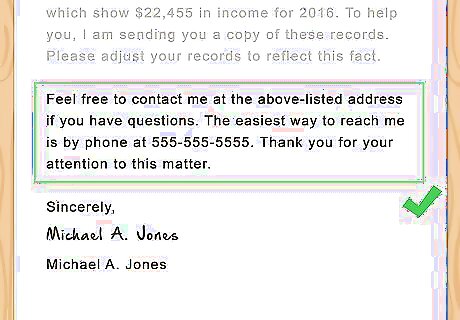

Close the letter on a friendly note. Tell the IRS you are available to answer any questions they have. Provide your phone number and thank them for their attention to this issue. For example, you can write, “Feel free to contact me at the above-listed address if you have questions. The easiest way to reach me is by phone at 555-555-5555. Thank you for your attention to this matter.” Remember to sign your letter. Put the word “Sincerely,” and then a few blank lines underneath for your signature. Underneath your signature, type your name.

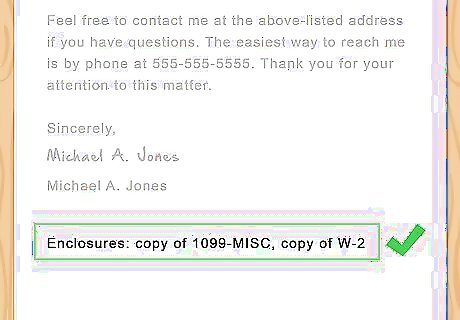

Identify any enclosures. You might be sending documents to the IRS. Identify what they are at the bottom of the page. Insert the word “Enclosures” and then state what they are. For example, it might read, “Enclosures: copy of 1099-MISC, copy of W-2.”

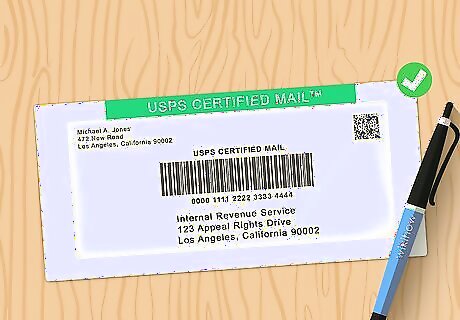

Submit the letter by the request date. Look over the notice you received from the IRS to find out what date they have requested the information by and make sure you reply before this date. Make copies of whatever supporting documents you are giving the IRS. Never send originals, since the IRS frequently loses them. Keep the originals at home with you. Mail the complete packet certified mail, return receipt requested and hold onto your receipt.

Asking for an Abatement

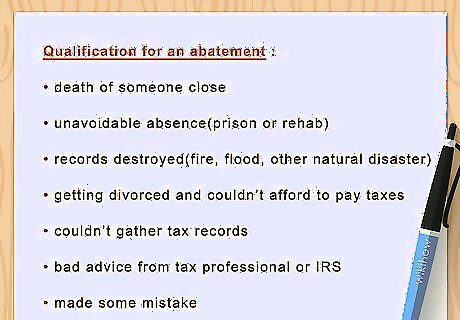

Identify why you qualify for an abatement. You might be assessed penalties if you file or pay late. Generally, the IRS will remove the penalties if you had “reasonable cause” for being late. The IRS determines reasonable cause on a case by case basis, but common reasons include the following: Someone close to you died. You had an unavoidable absence, such as being in prison or in rehab. Your records were destroyed in fire, flood, or other natural disaster. You were getting divorced and couldn’t afford to pay the taxes. You couldn’t gather your tax records for some reason. A tax professional gave you inaccurate advice. The IRS gave you bad advice. You made some mistake although you were acting carefully. The IRS may provide a first-time penalty abatement if you had no penalties for the 3 tax years prior to the tax year you received the penalty or you didn't previously have a tax filing requirement, you have filed all currently required returns or have filed extensions for any currently required returns, and you have paid or arranged to pay any tax due.

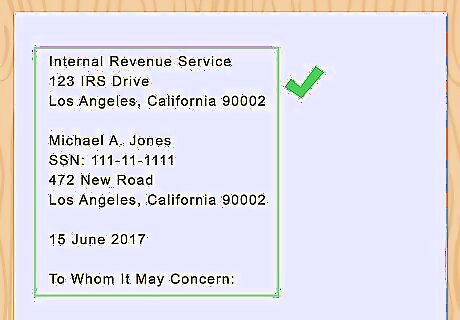

Format your letter. Set it up as a standard business letter, using 12 point Times New Roman and block paragraphing. Include the following information at the top: The IRS address (see your IRS notice) Your name and address The date A salutation, such as “To Whom It May Concern”

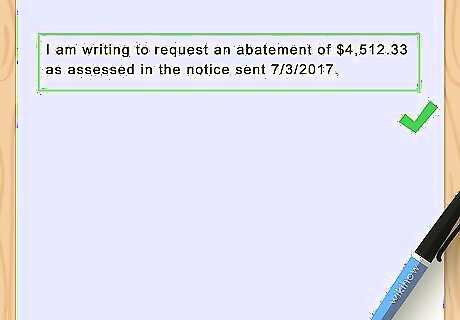

Enclose a copy of the IRS notice. Make a copy of the notice you received from the IRS and include it with your letter. In the first paragraph of your letter, explain why you are writing the IRS. Mention the date of their notice. For example, you can write, “I am writing to request an abatement of $4,512.33 as assessed in the notice sent 7/3/2017.”

Identify why you should receive an abatement. Mention all of the legitimate reasons that apply to you. Remember that you will need to provide documentary proof, so don’t stretch the truth. For example, you can write, “The reason why I filed late was because my husband died in early April, right around the time I usually do my taxes. I have included a copy of his death certificate as proof. Please accept this petition for abatement of penalties owed for reasonable cause.”

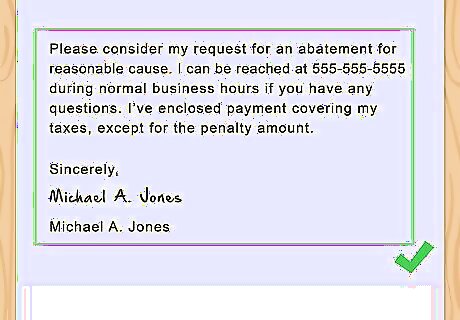

Conclude your letter. Thank the IRS for considering your request and tell them where they can reach you. If you’re including unpaid taxes, then state that information as well. For example, you might write, “Please consider my request for an abatement for reasonable cause. I can be reached at 555-555-5555 during normal business hours if you have any questions. I’ve enclosed payment covering my taxes, except for the penalty amount.” Also remember to sign. Include “Sincerely” and then three or four blank lines. After the blank lines, type your name. Sign using black or blue ink.

Filing an Appeal Letter

Consult with a tax attorney. If you are dealing with an appeal, it's in your best interest to get advice and guidance from a qualified tax attorney. They can help you navigate this process and draft the appeal letter.

Identify when to write this letter. You don’t draft an appeal letter when the IRS is still gathering information or when you are asking for an abatement. Instead, you write an appeal letter after the IRS proposes certain actions, such as collections actions.

Format a business letter. Set it up in block paragraph style, and include your name, address, and daytime phone number at the top. Set the font to something comfortable to read, such as Times New Roman 12 point.

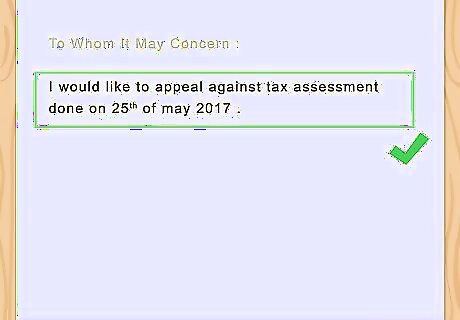

State you are appealing. In the first paragraph, state you want to appeal the IRS findings to the Office of Appeals. Identify the IRS decision letter by date so the IRS knows what you are referring to.

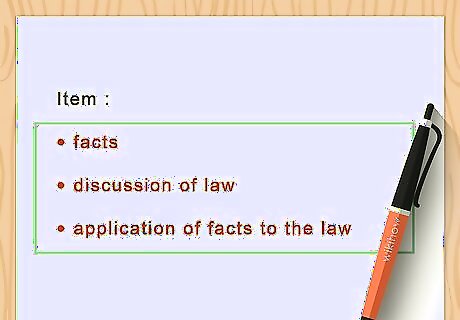

Organize your letter. Identify all of the items that you disagree with. You will need to identify the item and then provide the facts and applicable law underneath. If you have two items you disagree with, then your letter will be organized as follows: Item 1: facts, discussion of law, application of facts to the law. Item 2: facts, discussion of law, application of facts to the law.

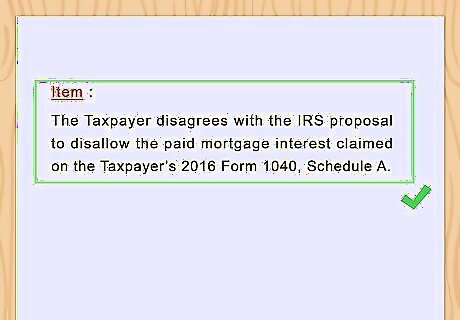

Identify the item you disagree with. Make this a section heading. You should write something like the following: “The Taxpayer disagrees with the IRS proposal to disallow the miscellaneous deductions of Taxpayer’s 2016 Form 1040, Schedule A.”

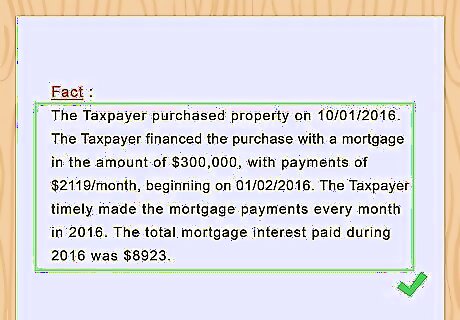

Explain the facts favorably. Underneath your heading, you should provide facts that are favorable. You can also minimize any facts that are unfavorable. Remember to be absolutely accurate and don’t omit any key facts, even if they are unfavorable. For example, you might be deducting job hunting expenses. You would need to provide the dates of your trip and what you spent money on.

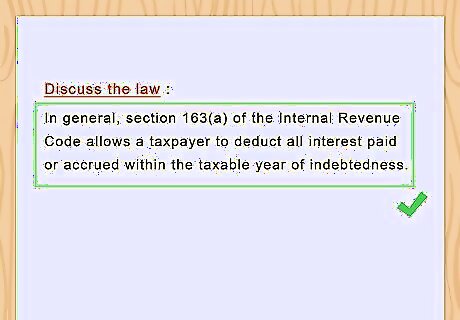

Discuss the law. You’ll need to do research on tax law in order to bring a successful appeal. Find statutes, court decisions, and scholarly articles online. Don’t overlook unfavorable law, but try to distinguish it from your current situation. If you don’t understand tax law, you should consult with a tax attorney who can do research for you. Continuing with the job hunting example, you might explain the law as follows: “According to U.S. Internal Revenue Code Section 161, "Taxpayers may deduct for amounts spent ‘for preparing and mailing copies of a resume to prospective employers,’ so long as the Taxpayer is seeking a job in their ‘present occupation.’”

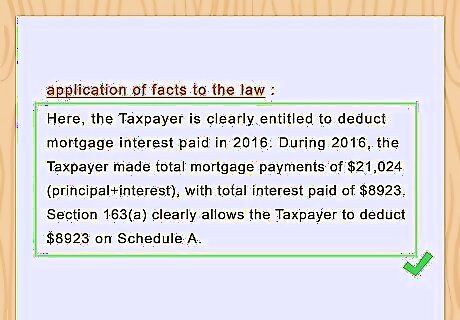

Apply the law to your facts. Explain to the IRS how the law, when applied to your set of facts, is clearly in your favor. Any fact you mention in this section should be mentioned up above in the letter, when you described the key facts. For example, you might write, “Here, Taxpayer is clearly entitled to deduct the $26.73 for printing and mailing her resume, since all of the jobs she sought were in her current field as a dental hygienist.”

Include a penalties of perjury statement. Right above your signature, you need to include the following information: “Under the penalties of perjury, I declare that the facts stated in this protest and any accompanying documents are true, correct, and complete to the best of my knowledge and belief.” Put your name and signature underneath this statement.

Gather supporting documents. You must include a copy of the letter the IRS sent you. Also pull together any documents that support your case. The IRS should be able to find its own regulations and statutes, but you might want to print off a scholarly article or court decision that is favorable. Only send copies, never originals, since the IRS often loses documents.

Submit your letter to the correct address. Don’t send your appeal to the Office of Appeals. Instead, send it to the address provided in the letter explaining your appeal rights. Keep a copy of the letter for your files.

Comments

0 comment