views

X

Trustworthy Source

Internal Revenue Service

U.S. government agency in charge of managing the Federal Tax Code

Go to source

To determine if you are eligible, use the IRS tax assistant.

Checking if You Are Eligible

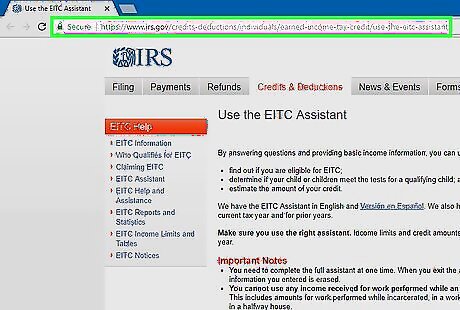

Select the tax assistant. The IRS has a tax assistant you can use to determine eligibility. Visit https://www.irs.gov/credits-deductions/individuals/earned-income-tax-credit/use-the-eitc-assistant and select the assistant half-way down the page. Choose the English or Spanish-language assistant. There is currently no tax assistant for the 2018 tax year. However, you can use the 2017 tax assistant to give you a rough idea if you qualify. When the 2018 filing season approaches, the IRS should create a new tax assistant. Plan on completing the assistant in one setting, since the program won’t save your information when you exit.

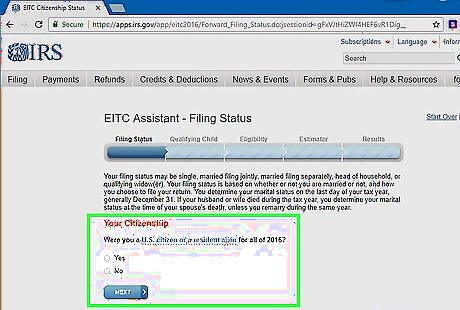

Provide required personal information. The assistant will lead you step-by-step through a series of questions. The first set of questions relate to your personal situation. Provide the following: Your citizenship status. You must be a U.S. citizen or a resident alien for the entire year in order to qualify. Whether you and your spouse are married and living together. Citizenship status of your spouse. Whether you are filing a joint return with your spouse. To qualify for the EITC, your filing status cannot be married filing separately.

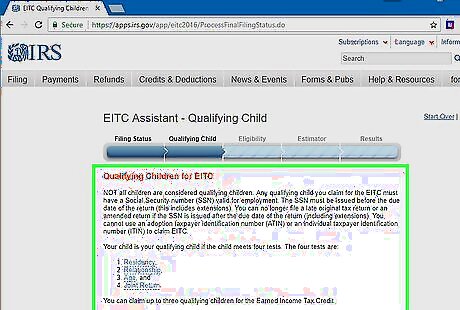

Answer questions about your child. People without children can still qualify for the EITC if they are older than 25 but younger than 65. If you do have a child, provide the following information: Whether you and your child shared the same main home in the U.S. for more than half of the year. To qualify, the child must live with you. Whether your child has a valid SSN, which is required. The child’s relationship to you. A qualifying child must be a daughter, son, stepchild, adopted child, eligible foster child, sibling, step-sibling, half-sibling, or a descendant of any of these (such as your grandchild or niece/nephew). The child’s age. They must be under 19 by the end of the year and be younger than you or your spouse. For example, you can’t claim a sister who is older than you. Whether the child is married.

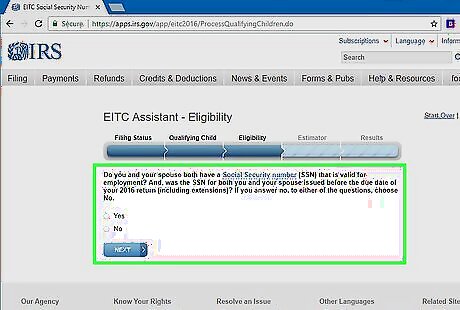

Check your eligibility. The assistant will ask several questions to determine whether you are eligible to claim the tax credit. You must provide information about the following: Whether you and your spouse have Social Security Numbers valid for employment before the due date of your return, which is required. Whether you had foreign income. You cannot file Form 2555 or Form 2555 EZ if you want to qualify for the EITC. The amount of your investment income, such as dividends, interest, and profits from selling stocks. Whether you have earned income: salary, wages, tips, etc. Whether anyone claimed you or your spouse as a qualifying child for the EITC.

Calculating the Amount of Your Tax Credit

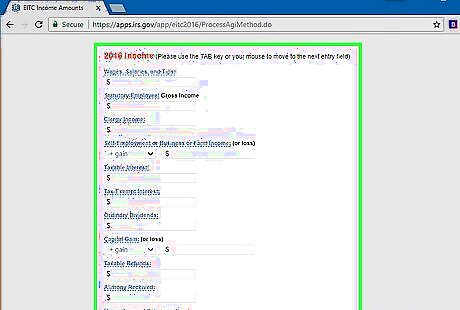

Submit information about your total income. The tax assistant will also help you calculate your total earned income. You must report all sources, including the following: Wages, salaries, and tips Self-employment or business income Taxable interest Ordinary dividends Capital gains or losses Alimony received Unemployment compensation

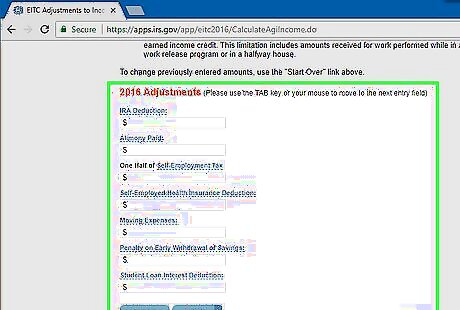

Identify your deductions. Whether you qualify for the EITC will depend on your adjusted gross income, which is your total income less any qualifying deductions. Your adjustments will include deductions for the following: Contributions to an IRA Alimony you paid Half of your self-employment tax Qualifying moving expenses Self-employed health insurance deduction Student loan interest deduction

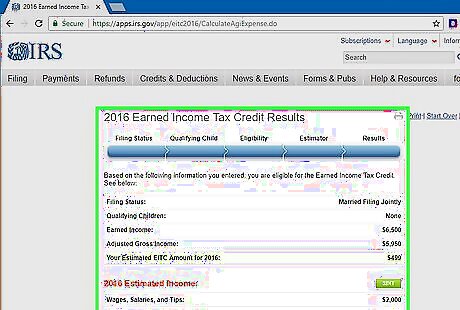

Receive your results. After you provide all information, the tax assistant will estimate the amount of your tax credit. If you need to edit income information, click on the green button. However, you’ll have to start over if you want to change your filing status or the number of qualifying children. In 2016, the maximum amount you could receive was $6,269 with 3 or more children. If you had no qualifying children, then the maximum you could receive was $506.

Claiming the EITC on Your Taxes

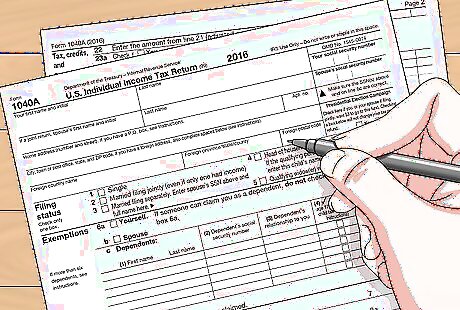

File a tax return. In order to get your credit, you must file even if you aren’t required to file or don’t owe any income tax. Remember to complete and attach Schedule EIC to your tax form. This schedule contains information about your qualifying child. If you have a qualifying child, you must complete either Form 1040A or Form 1040. The Volunteer Income Tax Assistance (VITA) program provides free tax help to people who make less than $54,000. You can find the nearest VITA program by calling 800-906-9887.

Let the IRS calculate the credit. When it comes time to file taxes, you can let the IRS calculate your credit. Follow the instructions for Line 8a on Form 1040EZ, Line 64 on Form 1040, or Line 38a on Form 1040A.

Complete the worksheet yourself instead. If you want to calculate your credit, then use the EIC Worksheet. You can find the worksheet in the instruction booklet for whatever tax form you use. The worksheet will ask for the same questions that the Tax Assistant does.

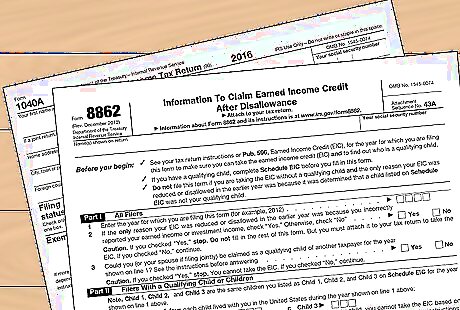

Attach Form 8862. If the IRS denied or reduced your EITC in a previous year, you must complete and attach Form 8862, Information to Claim Earned Income Credit After Disallowance. The reduction or denial must have been for something other than a math or clerical error. However, you must wait 2 years if the IRS determined your mistake in a prior year was due to your recklessness or intentional disregard for the rules. You must wait 10 years if your error was due to fraud.

Comments

0 comment