views

- Concept testing is a combination of quantitative and qualitative research used to help predict the success of a new idea (product, logo, brand, ad, etc.).

- Tests are usually done by either having participants review one product in isolation and then take a survey, or having them compare two products side-by-side.

- The concepts being tested are often based on preliminary research that identifies consumers’ specific wants and gaps in the current market.

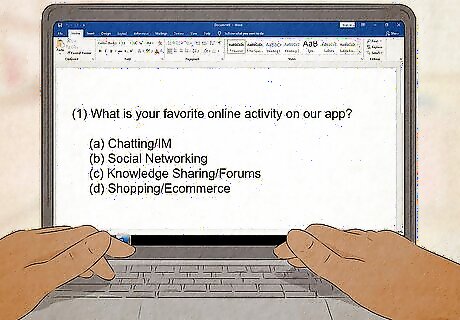

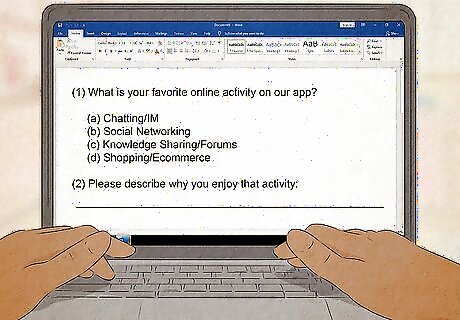

- Concept test surveys use a combination of open and closed-ended questions, with survey design being based on what specific information the company is trying to obtain.

What is concept testing?

Concept testing combines quantitative and qualitative research to evaluate a new product. This testing happens during the very early stages of product development. It’s kind of like the developer’s way of dipping their toes into the water before launching into selling their product or brand. It’s a way for businesses to understand consumers’ needs and make changes to their products early on so that they can save resources and avoid major losses later on. Some things developers might be looking to test include the likelihood of the product being used in the future, its perceived value, and expectations consumers have about the product. A “concept” can be many different things, including new inventions, upgrades to existing products, logos, slogans, or ad campaigns.

Benefits of Concept Testing

An edge over your competition Through concept testing, you’re getting to know your target audience on a more intimate level and are getting direct feedback from them. This gives you a slight edge over your competitors since you’re developing a unique way to get information that isn’t necessarily public knowledge. This is also a way to monitor possible threats posed by competitors. If participants reveal that they like a certain aspect of the competitor’s product, you can use that knowledge to your advantage in developing your product.

Customer satisfaction and loyalty By directly taking feedback from the consumer, you’re able to figure out exactly what it is you can do to make your concept more appealing to them. By implementing these suggestions, the hope is that you’ll come out with a product that will receive lots of positive reviews right off the bat. The results from concept tests can also be helpful when making upgrades to existing products. To maintain your customers’ loyalty, it’s important that you keep conducting concept tests since preferences will change over time.

Reduced production costs If you just go in and start selling something that hasn’t gone through concept testing and it doesn’t resonate with consumers, then you have to essentially start over from scratch. This is going to cost a lot in terms of production expenses and resources. Concept testing takes a lot of the guesswork out of this entire process and is a pretty cost-effective measure in the long run.

Common Concept Testing Techniques

Monadic testing presents one concept or feature at a time. Here, a test group is asked to evaluate a single product or one specific feature of a product. There’s no comparison being done with other products. The participants simply spend some time with the product they’re given and then usually answer survey questions about their experience and thoughts. This kind of technique best reflects how we interact with products in real life. We don’t usually have more than one of a certain product laying around to test and compare. Instead, we just use one product and base our feelings on that one experience. A downside is that a large group of participants is often needed to get a sufficient amount of data for each concept. Monadic tests are also great for evaluating innovative products that don’t yet have any benchmarks or competition to be compared to.

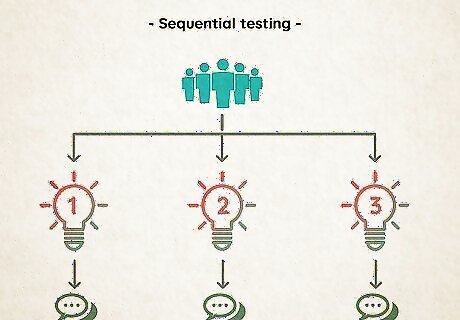

Sequential monadic tests present two products one after another. The participant is given one product to evaluate, then they go ahead and answer a survey about their experience. They’re then given a second product to review and answer a separate survey about it. An important part of sequential monadic testing is that the person doesn’t know they’ll be evaluating a second product. This allows the participants to rotate through the various concepts being tested, but they’re not directly comparing them. One downside of this technique is that once the first product is tested, the ratings of the second product are no longer monadic and can be difficult to interpret. If the participant sees the second product as being worse than the first, then they’ll often give it a disproportionately low score, and vice versa.

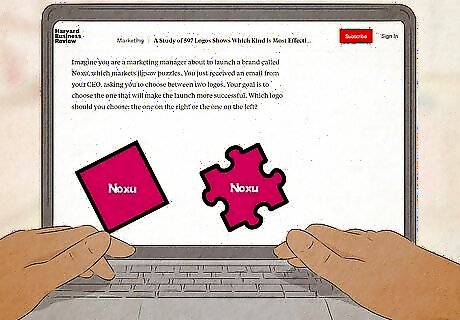

Paired-comparison testing directly compares two concepts. Participants are presented with two or more concepts and asked to evaluate them at the same time. These tests can be done by simply asking the participant which product, design, or feature they think is best among the two choices. Or, participants will be asked to rate the two choices using a fixed set of criteria. These tests can be used to have consumers review really small details of a product, such as the placement of a certain feature, the difference between two font types, or differences between two shades of the same color. This technique can be advantageous in some cases because it often doesn’t take as large of a testing group to get a sufficient amount of data.

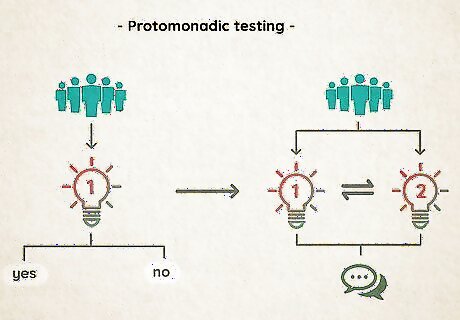

Protomonadic testing is a monadic test followed by a comparative test. It’s often a sequential monadic test that’s then followed up with a paired-comparison test. The participant evaluates one product, then answers a monadic survey about it. They then are given a second product which they evaluate with another monadic survey, and are given a comparative survey at the very end. Usually, each participant or group receives the products in a different order. This kind of testing can be used to help validate answers that may be seen as too biased in sequential monadic tests since participants are directly asked to compare the two concepts at the end.

Deciding on a Concept

Do preliminary research to determine current consumer needs. The entire purpose of coming up with a new product, brand, or idea is to fill in the gaps that current products have left in the consumer market. What are consumers looking for that current products don't already have? Usually, during this phase of research, it’s common to use qualitative techniques such as focus groups or group-depth interviews to get super detailed answers from real people. For example, a pharmaceutical company might ask a group of young mothers how they treat their child’s cold. This will reveal the strengths and weaknesses of current products. These initial interviews allow the developer to come up with a sort of hypothesis about what kinds of products might work, which they can then further verify with other quantitative surveys and tests. When conducting such surveys or interviews, use language that’s familiar to your participants. Don’t bombard them with lots of technical terms that they may not understand. Instead, use easily understandable words so that you can get the most detailed answers.

Develop multiple concepts based on your qualitative research. The key here is to have multiple ideas for concepts. This list will be whittled down later, but start by coming up with various ideas that take inspiration from the data from your preliminary research. Every concept doesn’t need to be drastically different from the others. Some may differ by just one feature, but even this small difference could make a large impact on consumers.

Go through your list of concepts and eliminate all but a few. Consider things such as which concepts will have the most positive impact on consumers, which products will be most cost-effective to develop, and which ones most closely align with your company’s brand and reputation. This is a rather subjective experience, and it’s best to get opinions from diverse areas in your company and take each viewpoint into account. The final number of concepts you ultimately land on depends on your company’s resources and its strategy for producing and marketing these products. If you have limited resources, you’ll likely have to decide between having 1 or 2 concepts and investing more in developing communication plans with stakeholders, or having 4 or 5 concepts and testing only a few communication plans for each one.

Conducting a Concept Test

Select participants based on your company’s market share. How much influence your company already has over consumers will affect what types of people you recruit to participate in your test. If your company is well-established and has high-share products, get people who already use your products to participate, since you’re trying to maintain customer loyalty. For less well-established companies, the opinions of nonusers of your brand are more important. In both situations, survey a mix of both users and nonusers but put more emphasis on one specific group depending on your company’s market share.

Decide what method you’re going to use to deliver the concept. Depending on the type of concept you’re having participants evaluate, the way you present your product will differ. For example, if you’re developing a logo or brand name, giving your participants a visual or sketch will probably be most effective. On the other hand, if you’re doing something like an ad campaign, a storyboard might help them grasp the full concept better. Some other methods you might use to deliver your concepts include: Verbal description Sketch Photograph or rendering Storyboard Video Simulation Interactive multimedia Physical appearance model Working prototype

Choose a testing method that fits with your concepts. A big decision is having to decide between monadic and comparison testing. If you’re looking to have one product tested in isolation, much like it would be in real life, monadic testing might be best. But if you’re looking to find the best concept and compare very small details, comparison testing would be a good choice. Another thing to consider is your available resources. Monadic testing will require a larger amount of participants to get enough data and can be time-consuming. However, it will likely yield valuable data. Comparison testing requires a smaller sample size, but the results you get might be biased and more difficult to interpret.

Set an objective for your concept test. What kind of information are you hoping to get out of this test? Thinking about this will help you in coming up with questions for your surveys and give you an idea of what styles of questions to ask. Don’t make your survey too long since this will likely discourage participants and lead them to answer less thoughtfully. Some examples of objectives include: Determining which feature is easiest for consumers to use. Checking how easily understandable a logo or ad campaign is. Seeing which design of a product is most visually appealing to users. Getting an estimate of how much customers would be willing to pay for your product.

Design your survey questions based on the test’s objective. The type of data you’re hoping to collect will determine the style of questions you use when creating your survey. Open-ended questions will give you much more detailed and subjective answers but can take longer. Closed-ended questions provide participants with a set number of choices to select from and are easy to answer quickly. However, they don’t allow much wiggle room for asking more in-depth questions without the survey getting super long. Here are a few question styles you might consider using: Demographic questions (age, race, ethnicity, gender, income, etc.) are necessary for any concept test to help identify participants who fall within your target audience. Likert scale questions are easy to answer, and the data they yield is relatively easy to collect and analyze. Images are necessary if you’re asking for feedback on a visual idea. For something like a logo, include images of the various logos you’re testing for participants to rank or comment on.

Structure your survey so that the questions flow naturally. Start with an introduction of your concept(s) using your decided method of delivery. After that, move on to general questions about your participant’s overall knowledge of your product or brand. Then, move on to the specific questions that ask them to review and evaluate the concept. Ask demographic questions at the end since these can be sensitive topics that may deter the participant if placed at the very beginning. If you’re asking a series of similar questions (such as asking the participant to rate each feature of your product), randomizing the order each person receives the questions can help improve data. General questions to ask participants include things like “Have you heard of this brand before?” and “How often do you think you use this brand in your everyday life?”

Administer your test and analyze the results. After all of your participants have taken your surveys, it’s time to look over the results for any patterns. Split the data into overall results to look for any major trends, then look at the individual answers to better understand each person’s thinking. Using software to analyze your data is another option.

Real-World Examples

Lego’s product inclusivity survey. This is a good example of qualitative testing used to decide on a new concept. The company announced in 2021 that it would work hard to remove gender stereotypes from its toys. This move came after the company conducted a survey of nearly 7,000 parents and their children aged 6 to 14 from China, the Czech Republic, Japan, Poland, Russia, the UK, and the US. Traditionally, the toy company’s products have been more targeted towards boys, but they’re now making an effort to make their products more inclusive and appealing to everyone equally.

Harvard Business Review logo test. The was a monadic test conducted to find out whether people preferred descriptive logos (logos that explicitly reveal what the company is and does) or nondescriptive logos (logos that are just pictures or not easily tied to the company). The results revealed that people who were shown a descriptive logo found the brand more authentic and liked it more than people who were shown a nondescriptive logo. Participants were randomly assigned to one of two groups. One group was shown a descriptive version of the logo of a sushi restaurant, while the other was shown a nondescriptive version of the same logo. Each logo was accompanied by the same short description of the restaurant. After participants read the description of the restaurant and viewed their assigned logos, they indicated on Likert scales how authentic they thought the restaurant was and how much they liked it.

Comments

0 comment