views

On a television debate with a prominent news channel on August 17, Finance Minister of Tamil Nadu P Thiagarajan made some baseless allegations about the Narendra Modi government and also indulged in false bravado based on vicious lies and conjectures.

Thiagarajan claimed that the MK Stalin-led government of the DMK is doing a great job in terms of managing Tamil Nadu’s fiscal health and the overall economy of the state. But that is far from the harsh truth.

Fiscal Deficit to GSDP Ratio

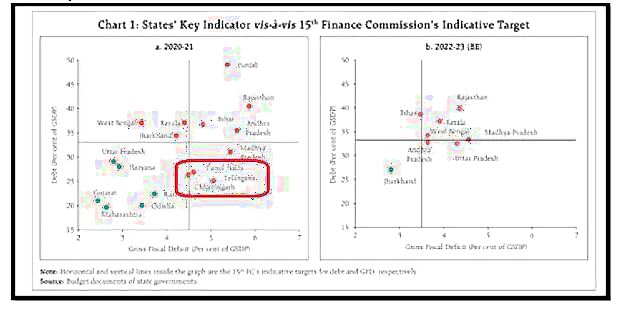

The lower this ratio, the better is the financial health of a state. Tamil Nadu, however, exceeds the limit set by the 15th Finance Commission in terms of gross fiscal deficit as a percentage of GSDP. The 15th Finance Commission suggested that states should consistently bring down fiscal deficit as percent of their GSDP. It recommended the fiscal deficit limit (as percent of GSDP) of: (i) 4 percent in 2021-22, (ii) 3.5 percent in 2022-23, and (iii) 3 percent during 2023-26. But the graphic representation below clearly shows that in terms of fiscal prudence, Tamil Nadu is lagging behind, along with Chhattisgarh and Telangana. Thiagarajan claimed otherwise on a television debate, showcasing his complete lack of knowledge on this subject.

IP-RR Ratio

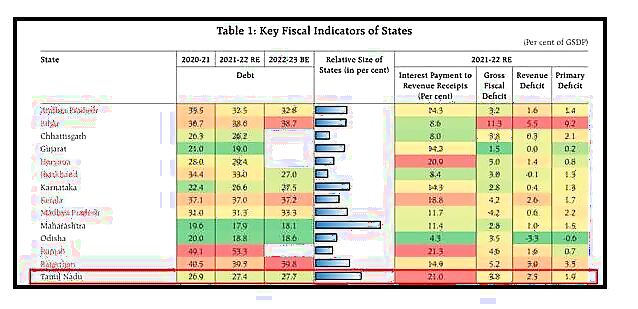

Interest payment to revenue receipts (IP-RR) ratio is a measure of the debt servicing burden on the state’s revenues. Lower this ratio, the better is the financial health of a state. Tamil Nadu, however, has a very high IP-RR Ratio of 21 per cent which is the second-highest in the country after Punjab. Similar figures for Gujarat and Karnataka are 14.2 per cent and 14.3 per cent respectively. This implies that the majority of the share of Tamil Nadu’s revenues is actually being used to simply service the debt burden of the state, which is a very dangerous situation to be in. On what grounds, therefore, did Thiagarajan make the bombastic claim that Tamil Nadu’s financial health is sound?

IP-RE Ratio (Interest Payments as a Percent of Revenue Expenditure)

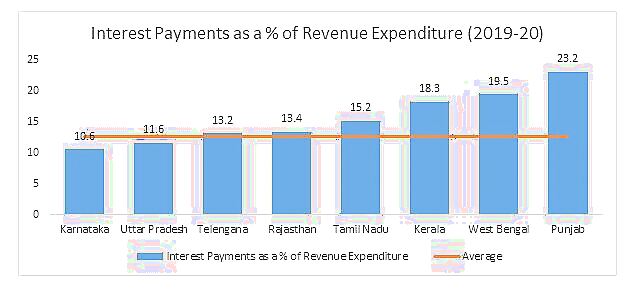

Interest Payments as a percent of Revenue Expenditure for 2019-20 for Tamil Nadu was 15.2 per cent, which implies that majority of the revenue expenditure went towards debt servicing, which is certainly not good news. In this regard, Uttar Pradesh and Karnataka have, on the contrary, performed far better with a ratio of 11.6 per cent and 10.6 per cent respectively. Needless to add that lower this ratio, the better are the finances of any given state. The graph below endorses how Tamil Nadu’s spiralling debt burden is a serious cause of concern.

Capital Outlay to Total Expenditure

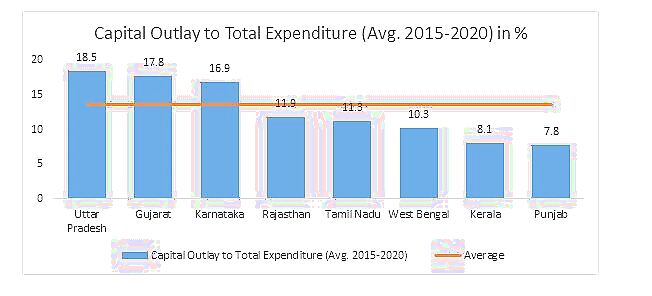

If we consider Capital Outlay to Total Expenditure (average between 2015 and 2020), states like UP, Gujarat and Karnataka perform better, standing at 18.5 per cent, 17.8 per cent and 16.9 per cent respectively. It is to be noted here that higher this ratio, the better is the financial health of the state. For Tamil Nadu, the ratio is only 11.3 per cent, which implies that new productive assets in Tamil Nadu are being created at a far slower pace, compared to say, Uttar Pradesh, Gujarat or Karnataka. Hence, once again, Thiagarajan’s claims of how Tamil Nadu is on a fast growth trajectory under the DMK are a hogwash, which is proved by this graph below.

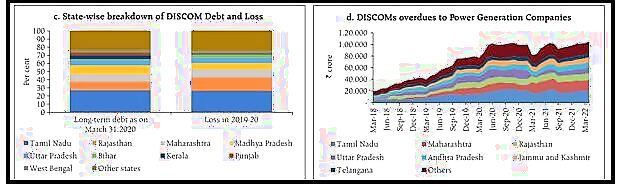

Overdues of State DISCOMs

Overdues of states to power generating companies (GENCOs) have increased which may require fresh liquidity injections to ensure uninterrupted power supply. Tamil Nadu is among the states which is the most vulnerable for a possible DISCOM bailout. Tamil Nadu has the second highest overdue of Rs 21,299 crore in the country. According to the RBI, the cost of the bailout might be 5.2% of its combined GSDP, which means the burden on the state exchequer of Tamil Nadu and honest taxpayers of Tamil Nadu will be significant.

Overdues of States/Discoms towards Gencos (CPSE, IPP, RE) excluding State Owned Gencos as on 12.07.2022:

The top four states in terms of overdues on this count are as given below:

Maharashtra –Rs.22,702 crore

Tamil Nadu –Rs.21,299 crore

Telangana –Rs.17,244 crore

Andhra Pradesh –Rs.9,945 crore

The graph below again debunks Thiagarajan’s bombastic claims. Tamil Nadu could actually be hurtling towards a serious power crisis.

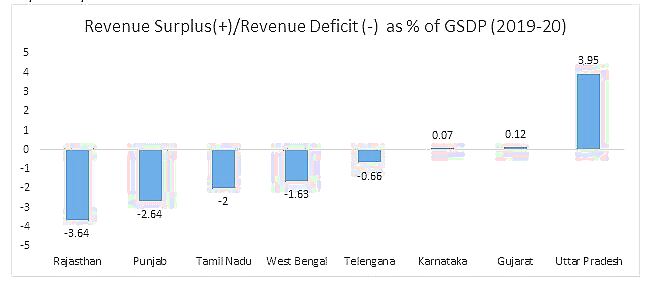

Revenue Deficit: A state with higher revenue deficit will need more debt to meet its expenditures and might go into a vicious circle of debt entrapment. In 2019-20, Telangana, Punjab and Tamil Nadu had revenue deficits while Gujarat and Uttar Pradesh actually had a revenue surplus as shown by the graph below.

Why did Tamil Nadu’s finance minister lie about how Tamil Nadu is on a strong wicket? His claims are untrue, if this graph below is any indication to go by. The Stalin-led DMK government is spending taxes of hard-working taxpayers on freebies, unproductive expenses, fat salaries to bureaucrats and the like.

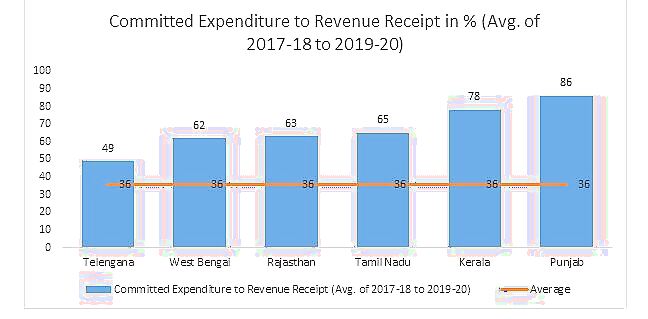

Committed Expenditure to Revenue Receipt: Committed expenditure includes interest payments, pensions and administrative expenses, which leaves limited fiscal space for undertaking developmental expenditure. Tamil Nadu had a whopping 65% Committed Expenditure to Revenue Receipt ratio (in percent) between 2017-18 and 2019-20 (Average). Higher this ratio, worse is the financial health of a state and clearly at 65%, Mr. P Thiagarajan, as the state’s finance minister, is doing a pretty shoddy job.

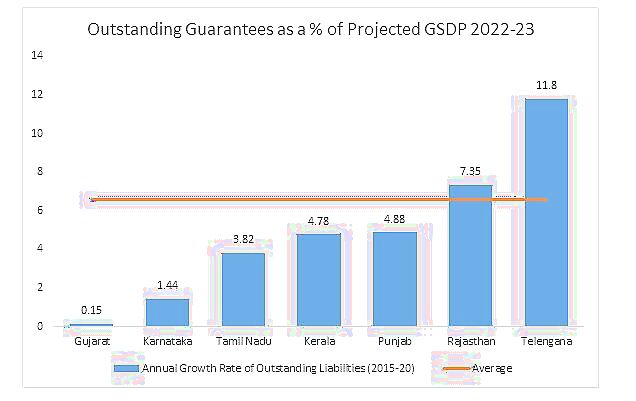

Outstanding Guarantees as a percentage of Projected GSDP 2022-23

Some states are taking secured loans against assets like municipal parks, collector’s office, taluk office, courts, hospitals, etc. Entities which do not have revenue streams to service the said loans are getting loans based on a state government’s guarantees. Although legal, debt undertaken through these avenues should be kept at a minimum. These guarantees should be lower. Tamil Nadu has a guarantee of 3.8 per cent of projected GSDP (2022-23), which is greater than Karnataka and Gujarat. Similar figure for Karnataka is 1.44 per cent and 0.15 per cent for Gujarat. Lower this ratio, better is the financial health of a state. Again, on this count, Tamil Nadu fares very poorly, thanks to policies of financial appeasement followed by the Stalin-led government.

Inflation

Even with respect to retail inflation in Tamil Nadu, Thiagarajan conveniently quoted only figures starting April 2022, whereas if data on inflation is taken for the last 19 months, average retail inflation in Tamil Nadu has been far higher than, say, for Uttar Pradesh or Gujarat, relatively speaking.

The high price of fuel due to globally high crude oil prices was a big issue across the country. Fuel inflation has started falling of late across India, given that Brent crude oil prices are now down to $87 a barrel from a peak of over $130 a barrel in February and March this year. While the Modi government cut excise on petrol and diesel in November 2021 and May 2022, the Stalin government, driven by greed, only paid lip service, refusing to meaningfully cut VAT on fuel.

According to the latest National Health and Family Survey (2019-21), only 6.5 per cent of Tamil Nadu’s population owns cars. Hence, in mid-2021, the state had introduced free bus travel for women.

According to the state government, following this, the proportion of women opting for bus travel initially rose from 40 per cent to 61 per cent. This may have brought down transportation costs in the state and a fall in transportation-related inflation, but only temporarily so. While free bus travel for senior citizens and economically deprived sections is always welcome, the DMK government put no thought into the proposal of free bus travel and today, this scheme is mired in the den of corruption and state apathy, only adding to Tamil Nadu’s already stretched finances which are threatening to burst at the seams. Hence, the fall in inflation in Tamil Nadu is only an illusion.

Moreover, according to the Centre for Monitoring Indian Economy (CMIE), average Consumer Sentiment Index (CSI) has consistently been quite low for both Kerala and Tamil Nadu, compared to, say, BJP-governed states such as Karnataka, Uttar Pradesh and Gujarat.

Conclusion

Ahead of presenting the TN Budget in April 2021, Thiagarajan released a White Paper where he highlighted the deplorable condition of Tamil Nadu’s finances and said: “The fiscal situation of the state is in dire circumstances, in part due to extraneous circumstances, but in substantial measure due to structural flaws in governance which have not been rectified in a timely manner. The Covid pandemic has greatly exacerbated the situation and highlighted how vulnerable Tamil Nadu currently is. There are no buffers left. No fiscal headroom that will allow for delay.”

What a shame that despite knowing fully well of Tamil Nadu’s perilous fiscal position, which Thiagarajan himself publicly acknowledged in April 2021, the Stalin government has only hurtled from one financial disaster to another, throwing good money after bad. Rather than addressing Tamil Nadu’s growing debt burden, Thiagarajan chose to behave like the proverbial ostrich with his head buried in the sand, on this television debate on August 17.

Tamil Nadu’s FM should realise that the mandate of the people in a democracy should be respected via concrete action on the ground and not by making false claims and indulging in false bravado under the arclights in a TV studio.

Read the Latest News and Breaking News here

Comments

0 comment