views

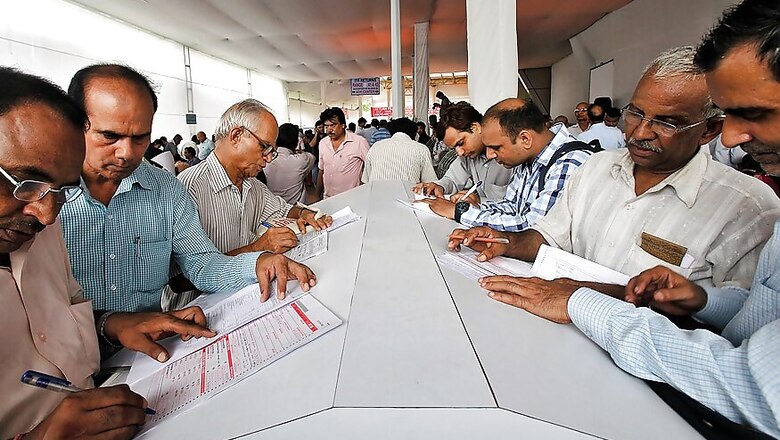

Income tax returns (ITR) are mandatorily filled by individuals whose annual income is greater than a pre-set threshold limit set by the finance department.

ITR forms are taxpayers statement detailing his/her earnings regular income (wages), interest, dividends, capital gains, or other profits, the total tax paid on earnings and the appropriate refunds to be repaid to him/her by the government.

According to the Central Board of Direct Taxes (CBDT), individual taxpayers need to file only 6 of the 9 ITR forms. These include: ITR-1, ITR-2, ITR-2A, ITR-3, ITR-4 and ITR-4S. The remaining three forms are to be filed by companies and firms alone: ITR-5, ITR-6 and ITR-7.

Here’s a look at the different ITR forms as issued by the income tax department:

Form ITR-1: Also known as the Sahaj Form, ITR-1 has to be filed by individual taxpayers alone. Individuals belonging to any of the following groups need to file ITR-1 Form:

-- Individuals who are salaried or claim pension.

-- Individuals whose only source of income includes a single housing property

-- Individuals with income sources like fixed deposits, investments, shares etc

-- Individuals with no income sources outside India.

-- Individuals whose net agriculture income is less than Rs 5,000.

-- Income from other sources (excluding winning from lottery and income from race horses, income tax under section 115BBDA or income of nature referred to in section 115BBE)

Form ITR-2: This form was introduced during the assessment year 2015-16 for use by Hindu Undivided Family (HUF) or any individuals who are not eligible for Form ITR-1 or who don’t derive income by way of “profits and gains of business and profession”. ITR2 is the second most used form to file return. Basically it is to be used by individuals having capital gains or more than one house property.

Form ITR-3: The ITR 3 is meant for individuals or HUF who earn their income, profits and gains from business or profession or generate income from property such as house, salary/pension and other sources.

Form ITR-4: Also known as Sugam, ITR 4 Form is for use by HUF/ individual / partnership firm whose total income subsumes:

-- Business income evaluated in reference with special provisions mentioned in section 44AD and section 44AE of the Act for computation of business income

-- Professional income evaluated in reference to special provisions of sections 44ADA

-- Salary/ Pension

-- Income from one house property (excluding cases where a loss is brought forward from previous years)

-- Income from other sources (excluding windfalls like lotteries or horse racing)

Form ITR-5: ITR-5 is for firms, LLPs, AoPs (association of persons) and BoIs (body of individuals). Further, it is also meant for an artificial juridical person referred to in section 2(31)(vii), cooperative society and local authority.

Form ITR-6: ITR 6 can be used by companies claiming exemption on income from property held for charitable or religious purposes under section 11.

Form ITR-7: ITR 7 Form can be used by persons as well as companies which are required to furnish return under section 139(4A), section 139(4B), section 139(4C), section 139(4D), section 139(4E) or section 139(4F).

Important income tax return filing due dates for FY 2018-19 (AY 2019-20)

The income tax due dates this year are specified below:

-- For individuals, HUF, BoI, AoP (income tax return by assesse whose books of account are not required), the due date is 31 July 2019

-- For businesses whose books of account are not required to be audited, the due date is 31 July 2019

-- For businesses whose books of account require an audit, the due date is 30 September 2019

-- For assessee who is required to furnish report under section 92E, due date is 30 November 2019. Section 92E of the Income Tax Act, 1961, requires a report to be issued by a chartered accountant wherever there are cross border transaction between two associated enterprises.

The dates presented above is the income tax return due date, but the returns can be filed even after the due dates with interest. The last date to file the income tax return is one year from the end of relevant assessment year. For instance, the due date of income tax return for FY 2018-19 is 31 July 2019. This return can be filed until 31 March 2020. It is because one year for the AY 2019-20 gets over on 31 March 2020.

Comments

0 comment