views

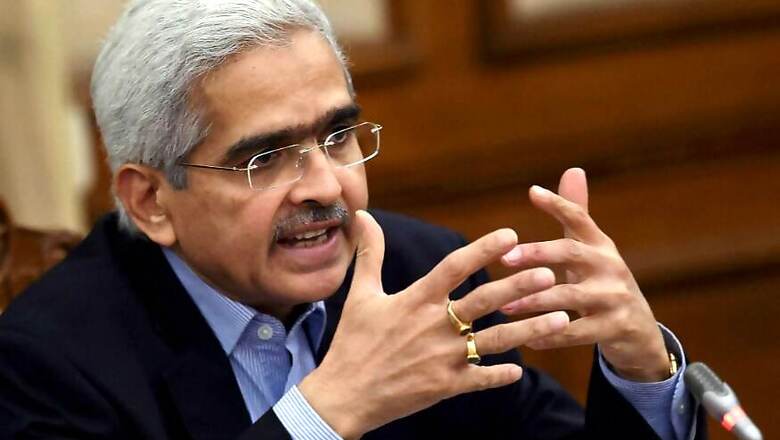

New Delhi: The Reserve Bank is closely monitoring the situation at scam-hit PMC Bank and a forensic audit is underway, Governor Shaktikanta Das said on Thursday, amid persisting uncertainty over depositors' funds.

Besides, he said an agency has been appointed to assess the realisable value of the bank's assets spread across various states for monetisation.

Punjab & Maharashtra Cooperative Bank (PMC Bank), among the top 10 urban cooperative banks in the country, was placed under an RBI administrator on September 23 for six months due to massive under-reporting of dud loans.

RBI had imposed withdrawal restrictions on account holders after it found alleged irregularities to the tune of Rs 4,355 crore due to diversion of money to infrastructure firm HDIL.

"PMC Bank situation is being very closely monitored by the Reserve Bank of India. We have had and we are having discussion with the various investigative agencies and...there are two things which are going on.

"Forensic audit, which has been ordered, that is underway. Second thing is the realizable value of the assets which were offered as a security to the PMC Bank are being assessed," Das told reporters after a meeting of the Financial Stability and Development Council (FSDC) here.

These assets are spread over various parts of Maharashtra and some in other states, he said.

"So, an agency has been appointed and... the market value of these assets is being assessed and we have to also see whether the assets have been encumbered to somebody else.

"The valuation process is going on, the forensic audit is going on, we have had discussions with the various investigation agencies about the other assets which they have identified. So, based on that, the Reserve Bank will take further decision with regard to the PMC Bank," he said.

On Tuesday, the apex bank enhanced the cash withdrawal limit to Rs 50,000 per account, which was the fourth such increase since PMC Bank was placed under its direct control.

Five persons, including HDIL promoters Rakesh and Sarang Wadhawan, have been arrested by the police in the case.

Several protests have been held by the depositors in Mumbai and at least 10 depositors have died since the alleged scam came to light. Scattered protests have happened in front of the RBI main office in Delhi as well.

With regard to strengthening regulatory mechanism, Das said there is a need for certain amendments to the law which governs multi-state cooperative societies.

"Earlier, the finance minister stated and even I said somewhere that there is need make some amendment...so the process of amending certain provisions of the Multi State Cooperative Societies Act, that proposal of carrying out certain legislative changes is being taken forward.

"The government is taking it forward in consultation with the Reserve Bank of India and based on the suggestions which we have made, the government will take a view and they will approach the Parliament," he added.

Comments

0 comment