views

Digital payments and financial services platform Paytm is seeing a massive spike in transactions via its app and website, as users are switching to digital payments during the nationwide lockdown in an attempt to flatten the COVID-19 curve. Interestingly, not only are users paying for recharges and bill payments via the Paytm app, but also using the payment app to pay for their bills at physical stores, such as the neighborhood departmental stores, dairies and pharmacies.

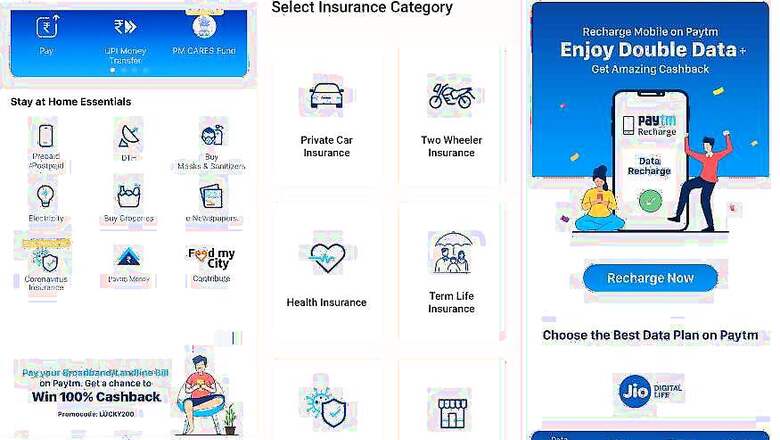

Paytm says that in period between March 22 and April 15, they saw a 42% increase in mobile recharges on the platform. There was also a 200% increase in the number of payments made for broadband and data card bills and there was a 58% jump in the number of DTH recharges. This was perhaps to be expected, as people are relying more than ever on their smartphones and home broadband connections or data cards to get work done while working from home. Also, since television remains one of the few avenues of entertainment, DTH recharge increase is also perhaps to be expected. Paytm was also the payment gateway for 230% more payments for video streaming app subscriptions—this could be from a variety of payment methods including UPI, Paytm wallet and credit cards.

It is the payment spike in offline stores which is quite interesting, however. The company says people are using the Paytm app, more than ever before, to make payments for purchases made at departmental stores, dairies and pharmacies. There is a 30% increase in payments made at grocery stores between March 22 and April 15, as well as a 30% increase in payments at pharmacies and a 15% increase in transactions at dairies. Paytm has been pushing the #PaytmKaro promotion for a while now, to urge users to make transactions via the Paytm app, even in stores.

Insurance is also in the spotlight now, with Paytm seeing a 50% increase in purchases of new insurance policies. At this time, Paytm is offering options for health insurance, term life insurance, Coronavirus insurance, car and two-wheeler insurance as well as shop insurance.

In this period of the lockdown, Paytm also clocked as much as 90kg Gold sales on the platform—many are perhaps seeing investment in digital Gold as a secure investment for the future.

We would expect the volume of transactions on the Paytm platform to see a further jump, as ecommerce platforms and shopping websites such as Flipkart, Amazon and others, will be able to resume the full scale of operations, at least in terms of what they can sell, from April 20. The Ministry of Home Affairs guidelines suggest that from April 20, ecommerce operations will be allowed across the country, which should see users order more using digital payment methods.

Comments

0 comment