views

Filing Income Tax Return (ITR) is an important financial obligation for individuals and entities to report their income and pay taxes to the government. It’s important to note that the process and requirements may vary based on individual circumstances, and it’s always recommended to refer to the Income Tax Department’s website or consult a tax professional for the most accurate and up-to-date information for filing your ITR.

E-filing of tax returns is mandatory for certain categories of taxpayers in India. Read more

To register for e-Filing as a taxpayer on the Income Tax Portal, follow these step-by-step instructions:

Prerequisite for Individual Users

Before taxpayers start registration, ensure the following details should be hand-in-hand.

- Valid PAN

- Valid Mobile Number

- Valid Current Address

- Valid Email Address, preferably your own

Registration Process

Perform the following steps to register as an ‘Individual User’:

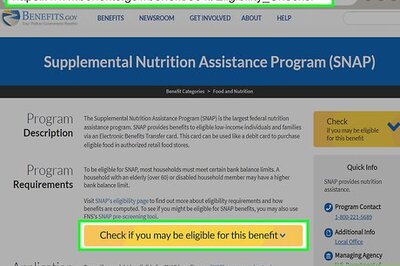

Step 1: Visit the ‘e-Filing’ Portal https://www.incometax.gov.in/iec/foportal/

Step 2: Click ‘Register Yourself’ button located at right side of the Home Page.

Step 3: Select the user type as ‘Individual’.

Step 4: Click Continue

Provide the following basic details:

PAN; Surname, First Name and Middle Name; Date of birth; Residential Status

Step 5: Click ‘Continue’

Step 6: Fill in the following mandatory details:

- Password Details

- Contact Details

- Current Address

- Click ‘Submit’

Step 7: After registration,

- For Residents, a six digit OTP1 and OTP2 will be shared on your mobile number and email ID, specified at the time of registration.

- For Non-residents, OTP will be shared on your primary email ID, specified at the time of registration.

Step 8: Enter the correct OTP to complete the registration process

Upon successful login, you will be directed to your e-Filing dashboard, where you can access various services and features provided by the Income Tax Department.

To file your Income Tax Return (ITR) online on the Income Tax Portal, follow these step-by-step instructions:

- Visit the official website of the Income Tax Department of India.

- On the homepage, click on the “Login” button to access your e-Filing account. Enter your User ID (which is your PAN) and the password associated with your account. Also, enter the captcha code displayed on the screen and click on the “Login” button.

- Once you log in, you will be directed to your e-Filing dashboard.

- On the dashboard, click on the “e-File” tab.

- From the drop-down menu, select “Income Tax Return.”

- Choose the assessment year for which you want to file the tax return.

- Select the appropriate ITR (Income Tax Return) form applicable to your income sources.

Remember to keep a copy of all the documents and maintain records for future reference.

Comments

0 comment