views

For empowerment of senior citizens, the Union Budget 2023-24 announced that the maximum deposit limit for Senior Citizens Savings Scheme will be enhanced from the current Rs 15 lakh to Rs 30 lakh.

Also, the maximum deposit limit for Monthly Income Account Scheme has been enhanced from Rs 4.5 lakh to Rs 9 lakh for single account and from Rs 9 lakh to Rs 15 lakh for joint account.

What is a Senior Citizens Savings Scheme (SCSS)?

To open the account minimum deposit Rs 1000 in the multiples thereof with maximum deposit of Rs 30 lakh (After Budget 2023).

There shall be only one deposit in the account in multiple of Rs 1000/- maximum not exceeding Rs 30 lakh. Multiple withdrawals from an account is not permitted.

Who can open a Senior Citizens Savings Scheme account?

An individual who has attained the age of 60 years or above on the date of opening of an account or an individual who has attained the age of 55 years or more but less than 60 years and has retired under Superannuation, VRS or Special VRS, can open an account.

Budget 2023: What Is Mahila Samman Saving Certificate; Check Tenure, Interest And Other Details

Retired personnel of Defence Services (excluding Civilian Defence employees) can also open an account on attaining the age of fifty years subject to the fulfilment of other specified conditions.

A depositor can open an account individually or jointly with a spouse. However, the whole amount of deposit in a joint account shall be attributable to the first account holder only.

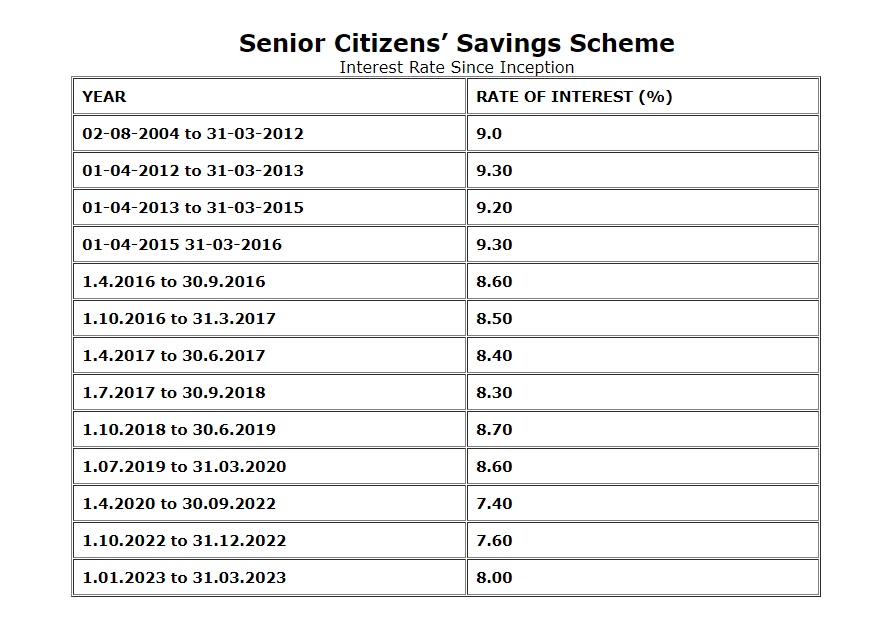

Senior Citizens Savings Scheme interest rate

Interest shall be payable from the date of deposit to 31st March/ 30th June/30th September/31st December on 1st working day of April/July/October/January as the case may be, in the first instance and thereafter, interest shall be payable on 1st working day of April/July/October/January.

For the quarter ending March 31, 2023, the rate of interest on senior citizen saving scheme is 8%.

Interest is taxable if total interest in all SCSS accounts exceeds Rs.50,000/- in a financial year and TDS at the prescribed rate shall be deducted from the total interest paid. No TDS will be deducted if form 15 G/15H is submitted and accrued interest is not above prescribed limit.

The account can be closed after expiry of 5 years from the date of opening of account. The depositor may extend the account for further period of 3 years.

Premature closure is permissible subject to certain conditions. Deposits in SCSS qualify for deduction u/s 80-C of Income Tax Act.

Where to open Senior Citizens Savings Scheme account?

One can open Senior Citizens Savings Scheme account in banks and post offices in India. Investment under this scheme qualifies for the benefit of section 80C of Income Tax Act, 1961.

Read all the Latest Business News here

Comments

0 comment