views

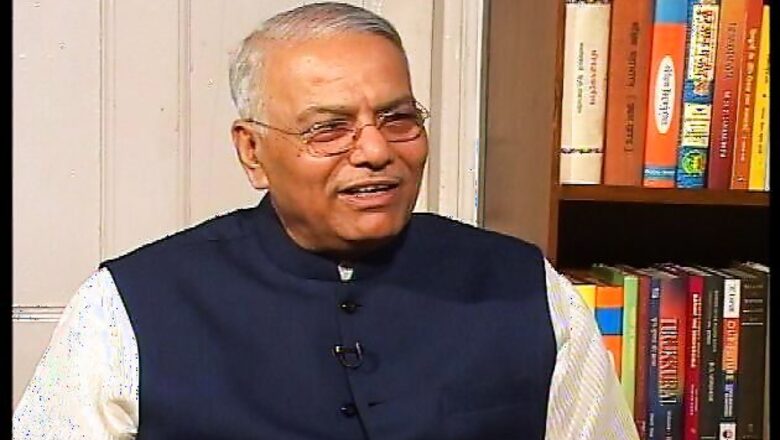

Former Finance Minister Yashwant Sinha has said his party will bring down inflation and create space for the Reserve Bank to cut interest rates if it comes to power.

"If BJP comes to power, then we will undo damage done by this government, by containing inflation and making space for RBI to start bringing down interest rates," he told PTI. Buoyed by BJP's good showing at the recently-concluded assembly elections, Sinha, who was finance minister during 1998-2002 in the BJP-led NDA government, exuded confidence that BJP would get around 200 seats in the Lok Sabha elections and would be able to form government.

The general elections are due early next year. His advice to the Congress, which got a drubbing in the assembly elections, on dealing with the current price situation is "flooding the market with foodgrains and bring inflationary expectations down". "We have done it," he said.

Food Corporation of India (FCI) has at present a stock of 65 million tonnes of foodgrains in its godowns compared to an annual requirement of 61 million tonnes of foodgrains to meet the requirements under the Food Security Law.

During the last five years, food inflation and retail inflation have remained high causing great discomfort to common man. Costly vegetables, particularly potato and onion, had pushed the November wholesale inflation to a 14-month high of 7.52 per cent. Retail inflation had jumped to 11.24 per cent in November from 10.17 per cent in October.

Elaborating further Sinha said: "You start with food inflation, release foodgrains liberally in the market, you release foodgrains to the Public Distribution System (PDS), you release foodgrains for food for work programmes.

"We did in those days when we were in power, released foodgrains for food for work programme. Now they have MNREGA, they can say half of wages will be paid in foodgrains. Third give it to the millers liberally so that they can make aata, maida and release it in market."

"Look how RBI Governor Raghuram Rajan created so much happiness in industry by not raising rates by 25 basis points. When he starts reducing interest rates by 25 basis points or 50 basis points, it would automatically create euphoria, create confidence," he said.

Last week, RBI in its Mid-Quarter Monetary Policy review surprised markets by leaving all key policy rates unchanged, notwithstanding persistent high inflationary pressure.

The short-term lending rate was kept unchanged at 7.75 per cent, while the cash reserve ratio (CRR) remained at 4 per cent.

Comments

0 comment