views

Earning profits through investing money is a decision-based task. It entails grasping the fundamentals of the product or policy and considering budget availability. Payment methods also significantly impact financial planning. The systematic investment plan (SIP) is a method gaining popularity, especially among young, novice retail investors aiming to secure retirement or achieve goals like homeownership or higher education.

In addition to SIPs, the ‘lump sum’ method is also prevalent. Mutual fund investors often confront this dual-choice scenario at the beginning of their investment journey.

Both methods hold utility for investors in various scenarios. The approach to investing money is determined by factors like fund type, investment amount, and the prevailing market conditions.

Also Read: Investing SOS: Missed Mutual Fund SIP? Must Read What Happens After That

SIPs and lump sum investments in mutual funds are advantageous in distinct situations. Based on your financial capacity, opt for either SIP or lump sum investment.

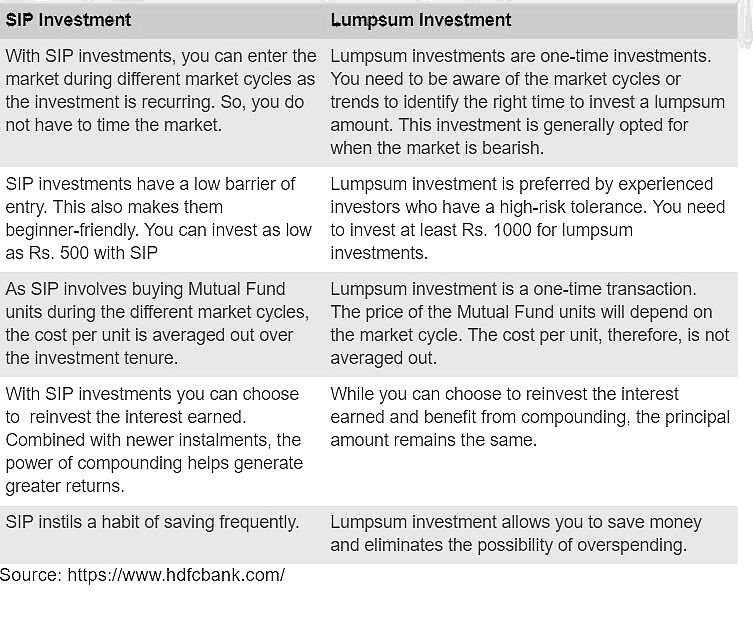

What is the difference between SIP and lump sum?

Lump sum is a one-time investment by a fund buyer, when there is a substantial disposable amount in hand.

A lump sum investment is of the entire amount at one go. For example when one receives a windfall in the form of bonus, leave encashment or otherwise.

In SIP, you can invest in mutual funds in a staggered manner where you invest a small amount regularly, say monthly as low as Rs 500. SIP has been gaining popularity among Indian investors, as it helps in ‘Rupee Cost Averaging’ and also in investing in a disciplined manner without worrying about market volatility and timing the market.

In an earlier article on this portal, Rahul Jain, president and head, Nuvama Wealth, said, “SIP is a convenient and effective investment method to create wealth using equity funds. On a given date, money is automatically invested into a fund without human intervention, thus eliminating the ‘noise’ and role of fear in investments, the biggest impediment to wealth creation.”

SIP vs Lump Sum: The Decision

Selecting an investment avenue must depend on your short-term and long-term goals. One must consider crucial factors such as monthly income, financial stability, investment goals and risk-appetite before opting for any mutual fund.

It’s important to recognise that the returns yielded by investments, whether achieved through lump sum or SIP, are contingent on market conditions. During market rallies, a lump sum investment might yield greater profits, benefiting from compounding. Conversely, in bearish or volatile trends, SIPs, with their rupee-cost averaging, could prove more advantageous.

Nevertheless, investors should grasp the unpredictability of markets; no one can accurately predict when upward or downward trends or bullish/bearish cycles will commence or conclude.

Declaring that lump sum investments could consistently outperform SIPs, or the reverse, is not definitive. Thus, constructing a diversified portfolio in line with your objectives and risk tolerance remains crucial.

Ultimately, the best way to decide which investment strategy is right for you is to speak to a financial advisor. They can help you to assess your individual circumstances and risk tolerance and recommend the best investment strategy for you.

Investors must note that mutual funds are subject to market risk and they are advised to read all scheme related documents carefully before investing.

Comments

0 comment