views

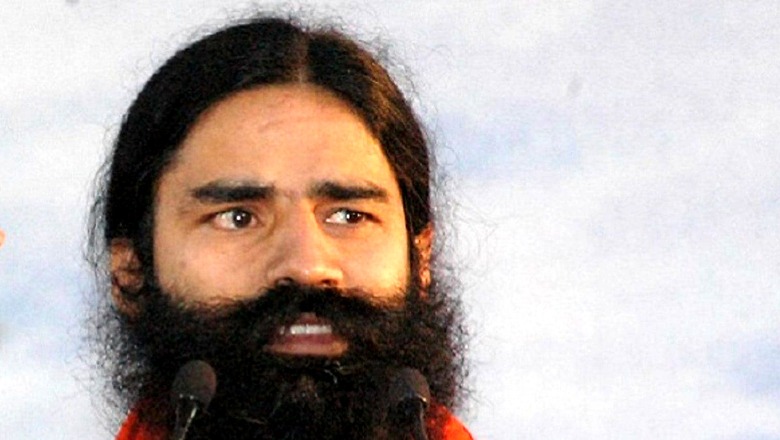

Ruchi Soya FPO: Market regulator Securities and Exchange Board of India (SEBI) has provided an option to the investors in Ruchi Soya’s Rs 4,300 crore follow-on public offer (FPO) to withdraw their applications. The withdrawal window will remain open till March 30. The regulatory body’s directive came amidst the “circulation of unsolicited SMSes advertising the issue”. The messages, that were allegedly sent to Patanjali Ayurved users, recommended them to invest in the offer. “Great news for all beloved members of Patanjali parivar. A good investment opportunity in Patanjali Group. Patanjali Group company- Ruchi Soya Industries Ltd has opened the Follow-On Public offer (FPO) for retail investors. The issue closes on 28 March 2022. This is available in the price band- Rs 615-650 rupees per share, i.e discount of about 30 per cent to market price. You can apply for shares through your bank/ broker/ ASBA/UPI in your Demat account”, the unsolicited message read.

An SMS is to be sent to all the applicants of the received bids, informing them of the additional window of withdrawal. A notice to investors shall be issued in the form of an advertisement in the newspapers, which will be issued on March 29 and March 30, 2022, said Ruchi Soya in a stock exchange filing.

Explaining what led to Sebi allowing retail investors an exit window, Vikram Kasat, Head – Advisory and Western Region at Prabhudas Lilladher, said that SEBI held a meeting with representatives of the book running lead managers over unsolicited SMSs advertising the follow-on public offer of Ruchi Soya — prima facie the contents of which appear to be misleading/fraudulent and not in consonance with SEBI (ICRD) Regulations, 2018.”

Ruchi Soya Clarifucation

However, shares of Ruchi Soya Industries added 15 per cent after investors in Ruchi Soya’s Follow-on Public Offer (FPO) have been allowed to withdraw their bids, all because of an advertisement that was termed as misleading by the market regulator SEBI. Meanwhile, the extension of FPO, only for withdrawal of bids briefly caused confusion among investors.

Ruchi Soya primarily operates in the business of processing oilseeds, refining crude edible oil for use as cooking oil, manufacturing soya products and value-added products. The company has an integrated value chain in palm and soya segments, having a farm-to-fork business model. It has brands like Mahakosh, Sunrich, Ruchi Gold and Nutrela. In 2019, Patanjali acquired Ruchi Soya, which is listed on the stock exchanges, through an insolvency process for Rs 4,350 crore.

The follow-on public offer of Ruchi Soya has been subscribed 3.6 times as the FPO garnered bids for 17.60 crore equity shares against the size of 4.89 crore equity shares on the final day of bidding, March 28. The retail quota, which is 35 percent of the issue, has seen a 90 percent subscription. The company has reserved half of the offer for qualified institutional buyers and 15 percent for non-institutional investors. Their portions were subscribed 2.2 times and 11.75 times respectively. Employees have put in bids for 77,616 equity shares against the 10,000 shares reserved for them. The issue closed on March 28. The price band has been fixed at Rs 615 to Rs 650 per share.

The Patanjali-backed company had already mopped up Rs 1,290 crore through the anchor book, out of the total fundraising aim of Rs 4,300 crore. The foreign investors, which received allocation under the anchor investor portion of the FPO, include Societe Generale, BNP Paribas, The Sultanate of Oman, Ministry of Defence Pension Fund, Yas Takaful PJSC (an Abu Dhabi based insurance company), MK Cohesion, UPS Group, and Alchemy.

Post the FPO, Patanjali Group’s holding in Ruchi Soya will come down to about 81 per cent, and the public will hold about 19 per cent.

Read all the Latest Business News and Breaking News here

Comments

0 comment