views

The Indian equity market is in the midst of uncertainty and as a result, the volatility has raised its ugly head. From the highs of October 2021, the benchmark index Nifty50 has corrected over 15% before recovering marginally from lower levels. However, the marquee growth stocks have been punished mercilessly as many of these stocks have crumbled over 20%, thus causing a lot of pain to investors’ portfolios. Even the defensive sectors like FMCG and IT haven’t held on to their nature and have slipped lower, and diversified portfolios too haven’t kept their promise.

In such a volatile phase and disrupting times, investors have been tearing their hair out trying to decide what to do and how to safeguard their portfolios from the risk of volatility? So, here we are to help you out to answer this billion-dollar question regarding how to safeguard your portfolios from the risk of volatility. And the answer to this question, invest in stocks that offer a high dividend yield. These stocks tend to be Mr Dependable when the stock markets are going through a rough patch or uncertainty.

Though we have answered your question, a new query that might have immediately crossed your mind is why invest in high dividend stocks during tough times? Here are the reasons:

1. Dividends provide a floor of safety: Fundamentally strong dividend-paying companies tend to hold up better than their non-dividend-paying counterparts during market fluctuations. When the price of high-quality dividend stocks falls to the point where the dividend yield is historically attractive, seasoned investors with substantial amounts of capital earmarked opportunities that represent good value being to accumulate the stock. As a result, the aggressive demand for stock in the market halts the decline, stabilizes the price, and then the stock reverses its trend. If a stock shows a reversal, other investors start buying which pushes the price higher. And once a rising trend has established in the stock and seems to still have room for an upside, the FOMO traders are likely to take position taking stock prices further higher.

2. Boosting returns via dividend reinvestment: Simply put, dividend reinvestment is using cash dividend paid by a company to buy more shares of the same stock. So, with this, investor has actually increased the number of stocks he holds and that means an increase in the regular flow of income or more dividend income which can again aid additional purchase of the same stock.

3. Helps to keep your emotions in check: Investors are driven by two emotions: fear and greed. Too much fear can result in panic selling, while greed can bid up stock prices to the moon. Let’s now consider that your stocks don’t pay dividends, and you might need some cash in the near term, given the fact that markets are volatile, you would get emotional and the only way you can wring cash out of your investment is by selling your shares. On the other hand, if your stocks pay dividends, you would not take decisions in a haste and you are less likely to take decisions based on emotion.

The above reasoning sounds too theoretical, isn’t it?!

Here are some visual evidences to solidify our point that the dividend paying stocks are safer bet in a volatile market!

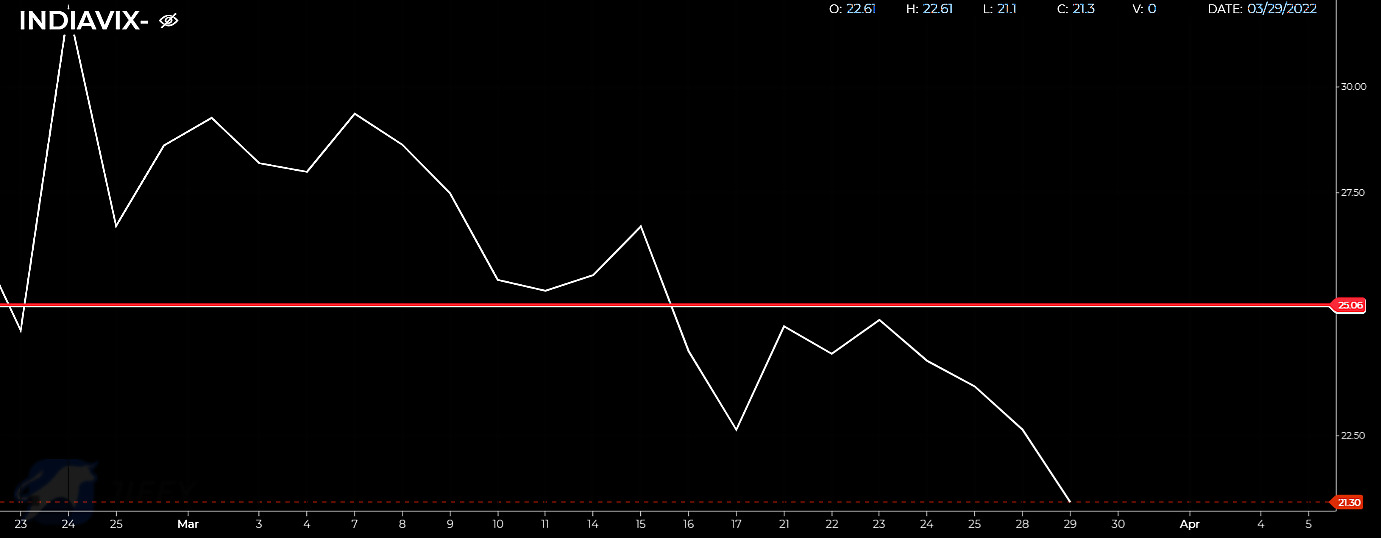

Now we will compare performance of Vedanta Limited (company has a good dividend track record and has consistently declared dividend for the last 5 years) under volatile market condition. However, the main question over here is how we would define a volatile market condition? The answer is, whenever the India VIX is greater than 25, we will assume that the market is volatile and during the period when VIX is above 25, we will see performance of the Vedanta Limited.

In the above chart we can see that the stock of Vedanta (VEDL) made a swing low as on February 24, 2022. At the same time, the India VIX (Figure 2) broke above the 25-mark (volatile market condition) and thereafter, the stock of VEDL was seen surging higher with India VIX staying above the 25-mark for some time.

Here is the list of some promising name with good dividend yield

Conclusion: As per the book Investing in Dividends for Dummies “Dividends made up 43.27% of the S&P’s total return and 41.96% of the Dow’s total return. These numbers are pretty consistent and clearly indicate that if you forgo dividends, you give up more than 40% of the potential profits you can derive from the stock market.” Moreover, dividends remain an indicator by the majority owners to the minority shareholders that all is well within the company!

Sunil Bagaria is the Director of Choice Equity Broking Private Limited

Read all the Latest Business News and Breaking News here

Comments

0 comment