views

X

Research source

Choosing Your Beneficiaries

Decide who you want to receive each account's proceeds. Who you choose as your beneficiary will likely depend on the type of the account and the amount of its proceeds. Accounts with beneficiary designations can be the quickest and most efficient way to get money into the hands of the right people after your death. However, you have to submit the information correctly and make sure it is up to date. For some accounts, it may have been that you chose a beneficiary when you opened the account without thinking much about it. You may want to start by making a list of the accounts you have for which you can designate a beneficiary, along with the approximate amount they're worth. This will allow you to distribute your assets the way you want. For example, if you intend to distribute your estate evenly between your two children, this includes your financial accounts. Assessing those accounts and their value allows you to divide them as evenly as possible.

Add contingent beneficiaries. In the event something happens to your named beneficiary, you should consider naming a backup to avoid having the account's proceeds fall into probate. Keep in mind that if you don't have a contingent beneficiary, the account will be distributed along with the rest of your estate. Although you have the option to have that money in a beneficiary's hands relatively quickly, if it is distributed through probate it could be months or even years before they see it. If you don't have a will, any accounts that fall to your estate will go to your heirs using a schedule predetermined by state law – and this may not necessarily reflect your wishes. A contingent beneficiary also is important in case your primary beneficiary elects to disclaim all or a portion of the account, leaving money unclaimed.

Choose a guardian for minor beneficiaries. If you want to name a beneficiary who is under the age of 18, don't assume he or she won't receive the account's proceeds until after he or she reaches the age of majority. If the beneficiary is your own child, the financial guardian you choose need not be the same person as the guardian you've chosen to care for the child in the event something happens to you. However, in many cases this will be the most efficient and logical choice.

Discuss the account with your chosen beneficiary. You typically want to make sure your beneficiary knows about the account and what he or she must do to claim it. Let your beneficiaries know where you store your financial documents and information, so they'll know where to find the information they need. You also might want to provide them with the name of the financial institution and a phone number, or the name and contact information of your financial advisor. It's also important to let people know if you've designated them as contingent beneficiaries, or as guardians for minor beneficiaries.

Filling Out the Beneficiary Forms

Request a form from your bank or investment company. Each financial institution has its own form that must be filled out to designate or change the beneficiaries for its accounts. Read the form and any accompanying instructions carefully before you fill it out. Make sure you have all the information you'll need to fill it out completely.

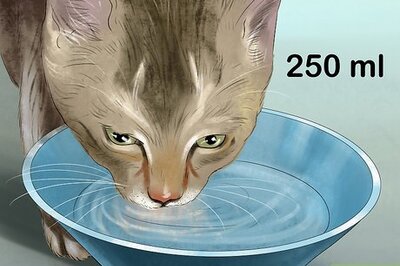

Provide all required information. Typically you will have to provide names and contact information for those you want to designate as beneficiaries, as well as information about your account. Keep in mind you likely will need your beneficiary's date of birth and Social Security number. If you don't have this information handy, you may want to call the person you want to name as a beneficiary and get it before proceeding. If you specify multiple beneficiaries who are each entitled to a portion of your account, the percentages must add up to 100 percent. Pay attention to the wording you use when you are designating beneficiaries. If your financial institution supplies recommended wording, use it as necessary to ensure you've communicated your intent.

Submit your form. For your beneficiary designation to be legally binding, you must submit your form to the appropriate account administrator using the procedure set by that financial institution. Your form should include a name or address where it should be sent. If you can't find this information on the form or instructions, ask your financial advisor or the company representative who gave you the form.

Update your will. If you've named someone as a financial beneficiary, you may want to remove them from your will. Unlike a will, accounts with a beneficiary designation don't have to pass through probate. If you mention accounts with beneficiary designations in your will, it can only cause confusion. For this reason, if you've named someone as a beneficiary on a financial account, it's generally better to leave them out of your will (unless you're also leaving them something else).

Updating Your Beneficiary Designations

Review your accounts on a regular basis. You may want to set a particular date each year to go over your accounts and evaluate your chosen beneficiaries to make sure they still reflect your desires. If you make an inventory of your accounts and list the beneficiaries of each, it should only take you a few minutes each year to review them. Along with your account inventory, you should include the names and contact information of your attorney, financial advisor, accountant, or any other professional who assisted you either with the accounts or with your estate planning.

Change beneficiaries to account for major life events. Even if you have a regular date to review your accounts, you should update them as soon as possible when something significant such as a death or a divorce occurs. Keep in mind that your divorce decree won't change your beneficiaries on your financial accounts – even if they are mentioned in the final divorce settlement. You still must contact your financial institution to remove your former spouse. Keeping your beneficiaries updated ensures your assets don't fall into the wrong hands. For example, if you opened a retirement account as a newlywed, you likely listed your spouse as the beneficiary. However, if you divorced 10 years later you probably want to change the designated beneficiary on that account to keep your ex-spouse from getting that money. Similarly, if someone dies that you had designated as a beneficiary and you don't update your designation, that account will fall into your estate to be distributed as part of probate, which can cause significant delay.

Keep your named beneficiaries informed of any changes. Letting a former beneficiary know if you've removed them from the account can save a lot of hassle and confusion. Just as you let people know when you add them as beneficiaries, you should let them know if you remove them, or if you change the division of your assets or accounts. You also should make sure that you update any other estate planning documents at the same time you change financial beneficiaries, to ensure all of these documents are up-to-date and reflect the same information.

Comments

0 comment