views

X

Research source

Depending on the county, the business license may be referred to simply as a "business license" or as a "business tax certificate."

- Visit the CalGold website, select your city/county and business type, and click "search" to find the appropriate licensing office.

- Go to the business license department in person or visit their website to obtain the correct forms.

- Complete the forms and pay the required fee to submit the forms for approval.

- If your application is denied, go to the county clerk’s office and ask to file a notice of appeal.

Locating the Appropriate Business Permit Office

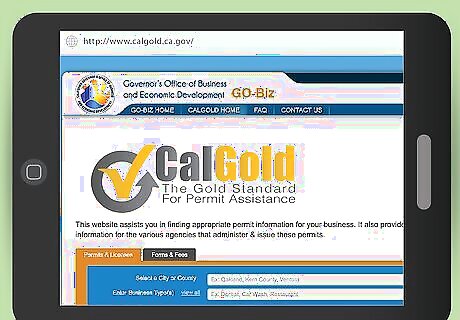

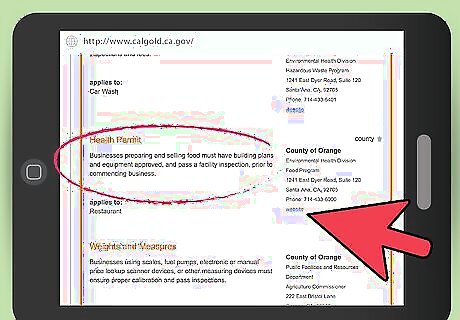

Visit CalGold. The California Governor's Office of Business and Economic Development maintains a web-based permit assistance program called CalGold to assist business owners with identifying and finding the appropriate permit office they must contact. To visit this website, click the hyperlink here.

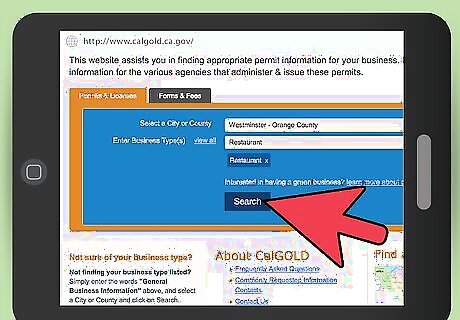

Select your city or county. To find the local agency responsible for issuing business permits, you should select the city or county where you will be conducting business as well as the business type. After selecting this information, click the “search” icon. To search by business type, you can either enter the business type in the box or click “view all” and scroll through a list. Click the business types that apply.

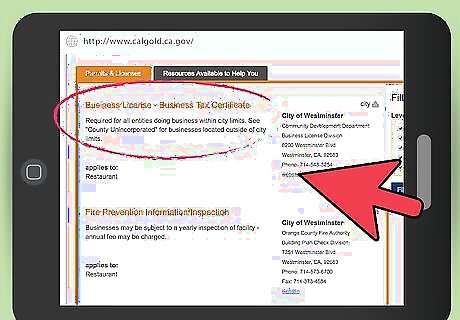

Select the link for business licenses. After clicking the search button, a list of possible “Permits & Licenses” will come up. The second entry should state "Business License-Business Tax Certificate." Use the information on the right side to determine where and how to contact the appropriate licensing office. The address, phone number, fax, and website should be listed.

Applying for the Business License

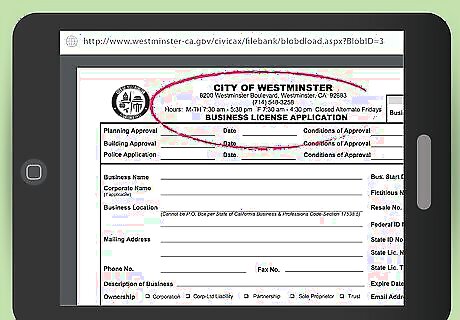

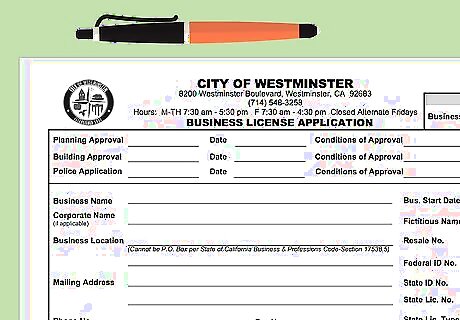

Get the forms. Using the information you obtained from CalGold, visit the appropriate business license department in person, or visit their website for additional information. Some offices will have their forms online. For example, the city of Alameda provides an online PDF of its business license application, which you may print off and complete before mailing in. Some cities, such as San Diego, allow businesses the option of applying for a business tax certificate online or via U.S. mail.

Complete the forms. Each form will require different information, but most commonly you will be asked to provide the following: trader business address contact information (mailing address, phone number, email, website address) type of business (whether LLC, partnership, etc.) Federal Tax ID number (FEIN) or Social Security Number (SSN) names and addresses of each individual owner expected annual sales number of employees

Pay the fee. You will have to pay a fee to apply. The fee will depend on the size of your business and the number of people you employ. Fees generally range from $50-100.

Find out if you need additional licenses. Depending on the nature and type of business, you may be required to get additional licenses. For example, if you intend to operate a car wash, then you must obtain a "Car Washing & Polishing Registration Certificate" from the Division of Labor Standards. Similarly, if you plan on selling or leasing products, then you must obtain a Seller’s Permit, which you can obtain online by accessing the California State Board of Equalization. Other common licenses businesses need include: an Alcoholic Beverage License and a Sales and Use Permit (restaurant), a Barbering and Cosmetology License (Beauty Salon), Produce Dealers License (grocery store), and Vehicle Dealer License (Automobile Dealer). To find if you need additional certificates or licenses, revisit the search results under “Permit & Licenses” on CalGold. Not all permits and licenses listed will apply. For example, you may get a result for “Building Permit” even if you are starting a law firm. If you need help deciding which licenses to apply for, you should contact an attorney or visit one of the state’s “legal incubator programs.”

Appealing a Denial

Understand reasons for denial. A new business license application may be rejected. Each municipality has its own reasons, which can include the following: Making a misrepresentation in the application. Conviction of a crime in the past five years which illustrates a trait inconsistent with carrying on a business or activity. Failure to correct objectionable conditions.

Appeal a denial. If your application is denied, then you may be able to appeal that decision. Go to the county clerk’s office and ask to file a notice of appeal. There will probably be a time limit. For example, in Diamond Bar you have 15 days.

Attend the hearing. You will probably appear before the city council or other body. You can present witnesses, though the hearing will probably not be held according to technical rules of evidence. The decision of the city council is usually final. There is no other forum to bring an appeal.

Comments

0 comment