views

X

Expert Source

Alan Mehdiani, CPACertified Public Accountant

Expert Interview. 9 July 2020.

Don't use this form to correct typos or mathematical errors — the IRS will fix those for you. You only need to file a 1040-X to make changes to your filing status, income, deductions, or credits.[2]

X

Trustworthy Source

Internal Revenue Service

U.S. government agency in charge of managing the Federal Tax Code

Go to source

Completing the Form

Get a copy of the original tax return that you want to amend. You'll need at least one copy of the tax return you want to amend so you can copy the original numbers from that form onto your Form 1040-X. You can work with a digital copy, but it might be easier if you print it out so you can mark on it. If you originally filed your taxes using an online service, you can usually download copies of previous years' returns from your account. If you don't have a copy of the tax return you want to amend, go to https://www.irs.gov/individuals/get-transcript and get a transcript. Choose the "Tax Return Transcript" for the type, which provides all the information you need to fill out the 1040-X.

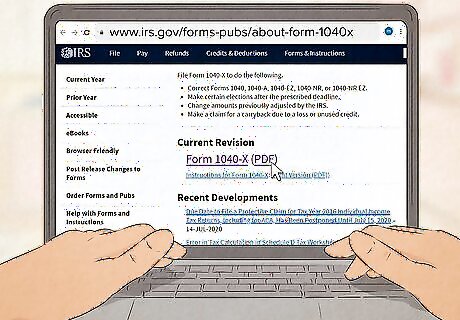

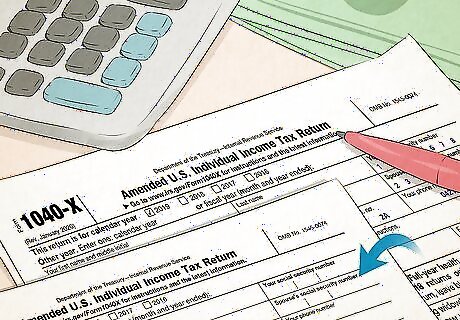

Download Form 1040-X from the IRS website. Go to https://www.irs.gov/forms-pubs/about-form-1040x to download Form 1040-X and its instructions. The instructions might seem rather complicated, but try to read through them as best you can before you start filling out the form. The instructions go through a lot of special circumstances and reasons for amending a return. Don't worry about reading anything that doesn't apply to your situation.

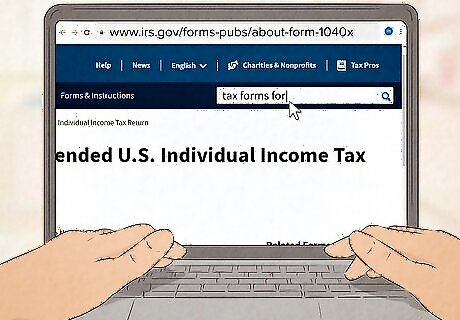

Search the IRS website for tax forms for the original return. In the upper right-hand corner of the IRS homepage, you'll see a search box. Type in the words "tax forms for" followed by the year of the original return you want to amend. You'll get all the forms that were valid for that year. To fill out the 1040-X, you'll need a blank copy of the tax return you completed and the instructions for filling out that form.

Complete the blank return with the amended information. On the blank return that matches the year of the original return, copy the correct information from your original return. Then, fill in the correct information for the lines that you wanted to change. Keep in mind that information you amend will likely cause further changes. For example, if your employer sent you an amended W-2, a change in your income would change your adjusted gross income and your tax liability. When you've completed the blank return, make a clean copy for the IRS and write "Amended Return" at the top of it. Use the other copy as your work copy. Mark or highlight the numbers you changed on your work copy so you can easily find and transfer the information to Form 1040-X.

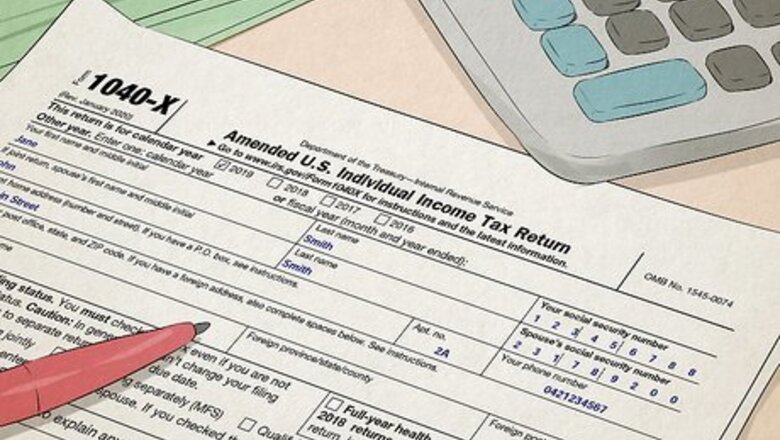

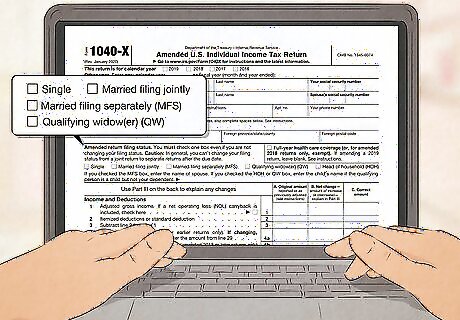

Fill in your personal information on Form 1040-X. At the very top of Form 1040-X, check the box next to the year of the tax return you're amending. If the year isn't provided, write it in next to "Other year." Then, fill out your name, address, and Social Security number. If you're married, include your spouse's name and Social Security number as well.

Choose a filing status. This is the one part of the form that you have to fill out even if you're not changing anything. You have to check one box for your filing status. If you're not changing your filing status as part of your amendments, check the same box you checked on your original return. You can check a different box if you want to change your filing status. You'll explain this in writing in a different part of the form. If you are married and originally filed a joint return, you can't change to "married filing separately" after the due date for the original return.

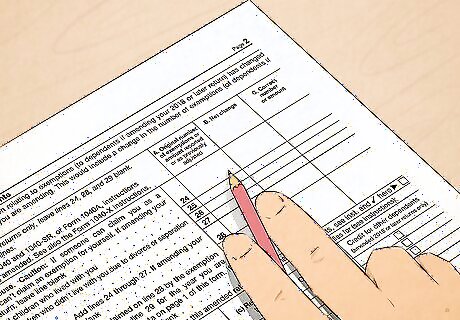

Find the lines that correspond to the information you need to change. Each line on the 1040-X relates to a specific line on your original tax form. The numbers of the lines may vary depending on the year of the return you want to amend, but the description of the information on the line will be the same. If you highlighted the changes on your amended return If you mark the lines you need to use on the 1040-X, you don't have to worry about inadvertently leaving something off.

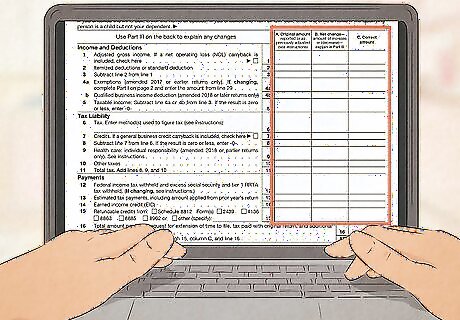

Enter your information in all 3 columns only for amended items. Go to your original return and write down the value you provided for the items you need to change in Column A of the appropriate line on Form 1040-X. Then, look at your amended return and write the amended value in Column C. In Column B, write the difference between Column A and Column B. If the amended value is lower than the original value, put a negative sign ( - ) in front of the number. For example, if you originally reported $18,000 in income, then got an amended W-2 from your employer showing that your income was actually $18,250, you would put $18,000 in Column A, $250 in Column B, and $18,250 in Column C.

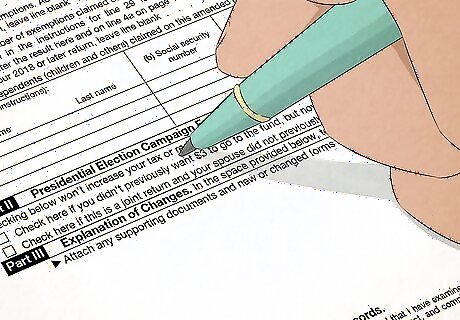

Explain the changes you made in Part III of Form 1040-X. Write a brief description of the changes that you made. If you made multiple changes, write a separate explanation for each change. If you have any tax documents that relate to those changes, attach them to the form. For example, if you amended your income because you got an amended W-2 from your employer, you might write: "Amended income to reflect amended W-2 received after I had already filed my return." Then, you would attach a copy of that amended W-2 to the form.

Submitting the Form

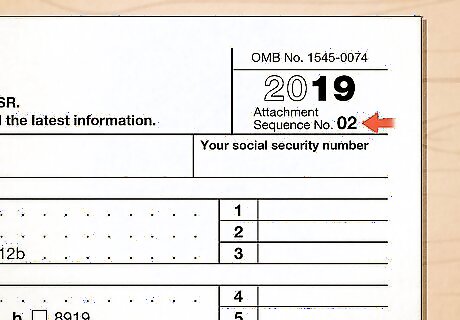

Attach your supporting documents to the front of Form 1040-X. In the upper-right corner of each form you're attaching, you'll see the phrase "Attachment Sequence No." followed by a number. Order your amended tax return and other documents with the numbers in order. If the changes you made also required you to make changes to other schedules, arrange those schedules in order behind the form they relate to. For example, if you have an amended return and schedules related to the original return, you would order the schedules behind the amended return. You only need schedules that have changed information. If you had schedules with your original return but nothing on them changed, you don't need to include them with your Form 1040-X. You usually don't need to include a copy of your original return, unless you're amending your return in response to a letter from the IRS and the letter told you to include a copy of your original return. You don't need to include a copy of the letter.

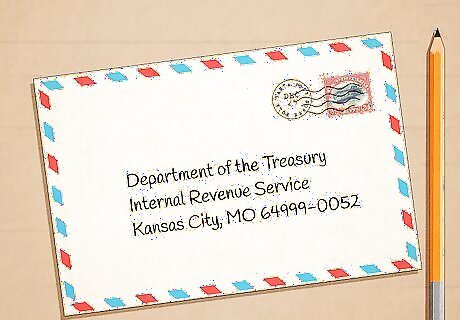

Mail the form and attachments to the appropriate address. As of 2020, you cannot file form 1040-X online. Instead, there are 5 different addresses listed in the instructions for Form 1040-X. The address you use depends on where you live. You can also mail in your form using DHL Express, FedEx, or UPS. These are the only private delivery services approved by the IRS. If you're using a private delivery service, use the address listed at https://www.irs.gov/filing/submission-processing-center-street-addresses-for-private-delivery-service-pds that corresponds to the same city where you would mail your return using USPS.

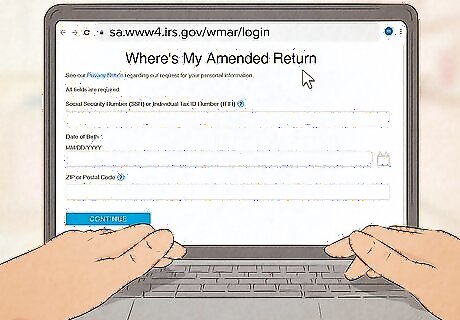

Check the status of your return online after 3 weeks. It takes at least 3 weeks from the date you mailed your amended return for it to show up in the IRS system. After that, get updates at https://www.irs.gov/filing/wheres-my-amended-return. Enter your Social Security number, date of birth, and ZIP code to check your return's status. You can also check the status of your return by calling 866-464-2050. It's an automated line, you just enter your information the same as you would online. Keep in mind that it can take up to 16 weeks for the IRS to process an amended return.

Comments

0 comment