views

X

Research source

Completing the Form

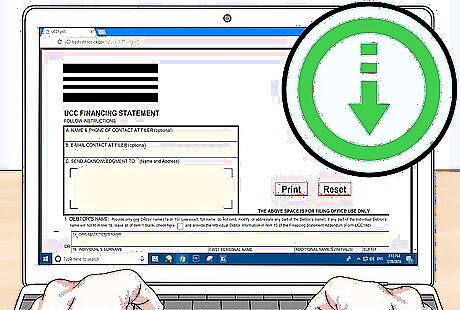

Download the UCC-1 form. A PDF version of the UCC-1 form typically is available on the website of the state's Secretary of State office. Download the form for your state. Although these forms are for the most part universal, some states have additional fields or requirements. The state form's instructions also tell you what the filing fees are, which vary among states. To find the correct website, do an internet search for "secretary of state" with the name of your state.

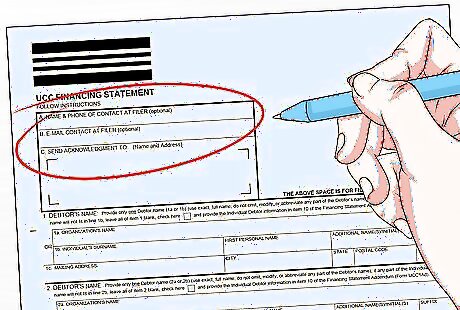

Provide direct contact information if desired. The first part of the form allows you to provide a phone number, email address, and mailing address if you want to make it easier to be contacted. These fields are optional. Once filed, the form is a public record, so be careful about the identifying information you include.

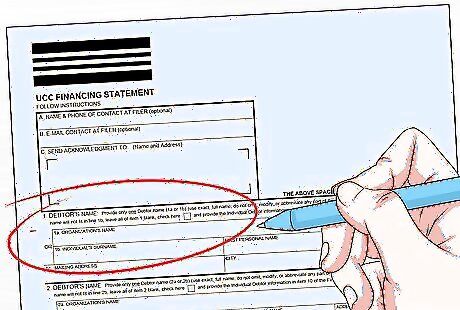

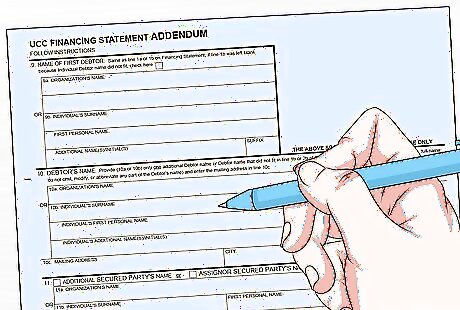

Fill in the debtor's name and mailing address. The debtor is the person who took out the loan. It may be an individual, or it may be in the name of a business or organization. If the loan is in the name of the business, include the business mailing address. There is space for additional debtors. Include them exactly as they appeared on the loan agreement. If there are additional named debtors that won't fit on the main form, you can file an addendum to include them.

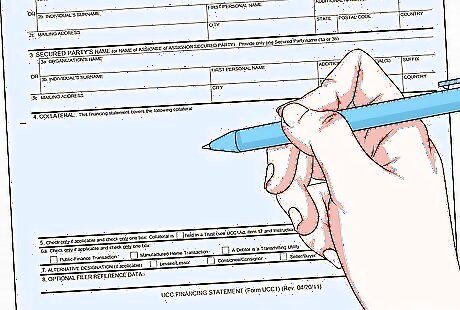

List the name and address of the secured party. The secured party is the lender who made the secured loan. Usually this will be the name of the bank or lending company. Check to find out what address they prefer to be listed on UCC financing forms – don't just list the name of your local branch, for example.

Indicate the collateral covered by the financing statement. Following the name and address of the secured party, there is space to identify the collateral that secures the loan. Be as specific as possible. For example, if the loan is secured by real property, provide the legal description of the property that is listed on the property's deed. If you need additional space for collateral, you can fill out an addendum.

Include applicable descriptions of the transaction. At the bottom of the UCC form, there are several boxes you can check if any of them apply to the particular transaction. If nothing suits the loan covered by the statement, you can leave this section blank.

Fill out an addendum if necessary. If there was extra information that wouldn't fit on the original form, you can include it on an addendum. This form is also available from the website of the state's secretary of state, and may be included with the main UCC financing statement form. Some states require additional information for specific loans or transactions. If so, you'll enter this information on the addendum as well.

Recording the Form

Identify the proper location to file the statement. UCC financing statements are filed based on the residence of an individual debtor, or the location of the main offices of a business debtor. Usually the form is filed with the state's UCC office. If real property is used as collateral, you may also need to file a copy of the UCC financing statement with the register of deeds in the county where that property is located.

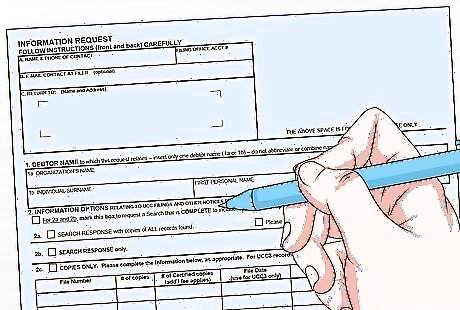

Complete an Information Form if you want copies. While you may receive an acknowledgement copy when your statement is recorded, the information form allows you to order additional copies of the official recorded statement. For example, if there are multiple debtors, you may want to order a copy for each debtor's records. You can download an information form from the website of the state's secretary of state.

Submit form and fees online if possible. It's usually easier to file your UCC financing statement online with the UCC office, and often the fees are lower than if you file print forms. Check on the website of the state's secretary of state office to see if this option is available. If the loan is secured with real property, you may still need to file a paper copy with the register of deeds for the county where the property is located.

Mail your financing statement with filing fee. If you don't want to file online, or if that option isn't available, you can mail paper copies to the state's UCC office. You may want to check for acceptable methods of payment. Typically you can pay by check or money order. The filing fees are minimal, typically less than $20. Some states may charge a per-page fee if you file a paper statement.

Receive your acknowledgement letter. When your financing statement is recorded by the state's UCC office, you'll receive a letter in the mail along with an acknowledged copy of the official statement. Keep these documents for your records. You may want to file them along with the documents related to the loan they cover.

Comments

0 comment