views

Learning About Trading

Examine the exchange rate for the currency you want to buy based on the currency you want to sell. Look at how values for your chosen currency pairs have fluctuated over time. Currency exchange rates are quoted in pairs of currency. The exchange quote tells you how many units of currency will receive based on the currency you want to sell. For example, a USD/EUR quote of .91 means that you’ll receive 0.91 euros for every US dollar you sell. The value of currencies frequently fluctuates. Anything from political instability to a natural disaster may cause a fluctuation. Make sure you understand that ratios between currencies are constantly changing.

Develop a trading strategy. To make a profit on your transaction, aim to buy currency that you expect will increase in value (base currency) using currency that you expect to decrease in value (quote currency). For example, if you think that Currency A, which is currently $1.50, will increase, you could purchase a "call contract" for a certain amount of that currency. If its value increases to $1.75, you have made money. Assess the likelihood of big changes in currency values. The better that a country is doing economically, the more likely it is that its currency will remain stable or increase in value relative to other counties. Factors like interest rates, inflation rates, public debt, and political stability can all affect the value of a currency. Changes in economic factors like the country’s Consumer Price Index and Purchasing Managers Index can indicate that a currency’s value is about to change. For even more information, see Trade Forex.

Recognize the risks. Buying and selling foreign currency is a fraught prospect, even for expert investors. Many investors use leverage, the practice of borrowing money to help them buy more currency. For example, if you wanted to trade $10,000 of currency, you would probably borrow at a leverage rate of 200:1. You could deposit as little as $100 into your margin account. However, if a trade goes sour, you may end up not only losing your own money but owing your broker a great deal more than you might on stock or futures trades. Additionally, it can be difficult to manage how much currency to trade at any one time and when to do so. Prices of currency rise and fall rapidly, sometimes within hours. For example, during one 24-hour period in 2011, the US dollar dropped 4% to a record low against the Japanese yen and then rose 7.5%. For this reason, only about 30% of "retail" trades -- the kind that individual currency investors make -- are profitable.

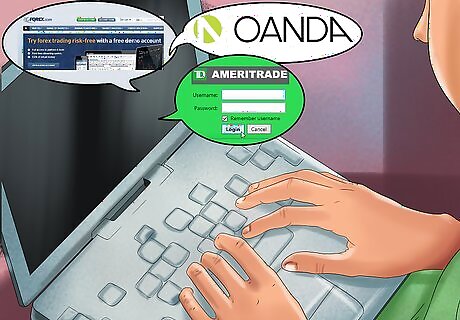

Sign up for a demo account and making some practice trades. This can help you understand the mechanics of the transactions. Websites like FXCM allow you to make mock investments in currency and practice trading the currencies with virtual money. Wait to trade on the actual market until you have consistently made a profit on your demo account.

Buying and Selling Currency

Obtain cash in your local currency. You’ll need this to convert into other currencies. Free up cash by selling your other assets. Consider selling stocks, bonds, or mutual funds, or take money out of a checking or savings account.

Find a currency exchange broker. In most cases, individual investors use a brokerage service to place their foreign currency transaction. Online broker OANDA offers a user-friendly retail platform called fxUnity for novices that want to buy and sell foreign currency. The online brokerage firms Forex.com and TDAmeritrade also allow you to trade on the Forex market.

Look for brokers that offer low spreads. Forex brokers don't charge traditional commissions or fees. Instead, they make money off the spread, which is the difference between how much a currency can be sold for and bought for. The higher the spread is, the more money you pay to the broker. For example, a broker that will buy a U.S. dollar for 0.8 euros but sells a U.S. dollar for 0.95 euros has a spread of 0.15 euros. Before you sign up for a brokerage account, check its website or the website of its parent company and ensure it’s registered with the Futures Commission Merchant and regulated by the Commodity Futures Trading Commission.

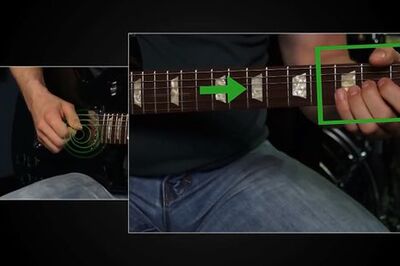

Start placing currency transactions with your broker. You should be able to track the progress of your investments with visual software or other resources. Do not "overtrade," or purchase too much currency at once. Experts recommend sticking with investing between 5% and 10% of your total account balance in any single currency trade. Pay attention to currency rate trends before you make the transaction. You have a better chance of making money if you trade with the trend than against it. For example, say that the U.S. dollar has been steadily rising in value against the euro. Unless you have a good reason to think otherwise, you should choose to sell euros and buy U.S. dollars.

Set stop-loss orders. Stop-loss orders are a crucial part of currency trading. A stop-loss order will automatically exit a position -- i.e., sell off your trade -- once it hits a certain price. This limits the amount of loss you take if the currency you purchased begins to take a nosedive. For example, if you are purchasing Japanese Yen with the US Dollar and the Yen is currently ¥120, you could set a stop-loss order for a certain price threshold, such as $1 hitting ¥115. The opposite of this is the "take-profit" order, which is set up to automatically sell out when you have hit a certain profit. For example, you could set a "take-profit" order to automatically cash out when $1 hits ¥125. This would guarantee you the profit made from the sale at that point.

Record the cost basis for your transactions. In many countries, you will need a record of this information for annual income tax filing. Note the price that you paid for the currency, the price you sold the currency for, the date that you bought the currency, and the date that you sold the currency. Most major brokerage firms will send you an annual statement that contains this information in case you didn’t collect it yourself.

Limit the amount of currency trading you do. In general, because currency trading is so fraught, experts recommend that you limit the amount of currency trading you do to a small percentage of your overall portfolio. If you do end up on the wrong end of the deal -- as 70% of retail currency trades do -- limiting how much you trade, and how much of your portfolio currency trades represent, will help limit the damage.

Comments

0 comment