views

Mumbai: Nearly 9 months after Prime Minister Narendra Modi’s surprise move to demonetise Rs 500 and Rs 1,000 notes, the Reserve Bank of India (RBI) presented its annual report. Scores of articles and opinion pieces have been written on the subject from both sides of the political and economic spectrum, leaving people confused. Here, I try to demystify the rhetoric and bring out the reality:

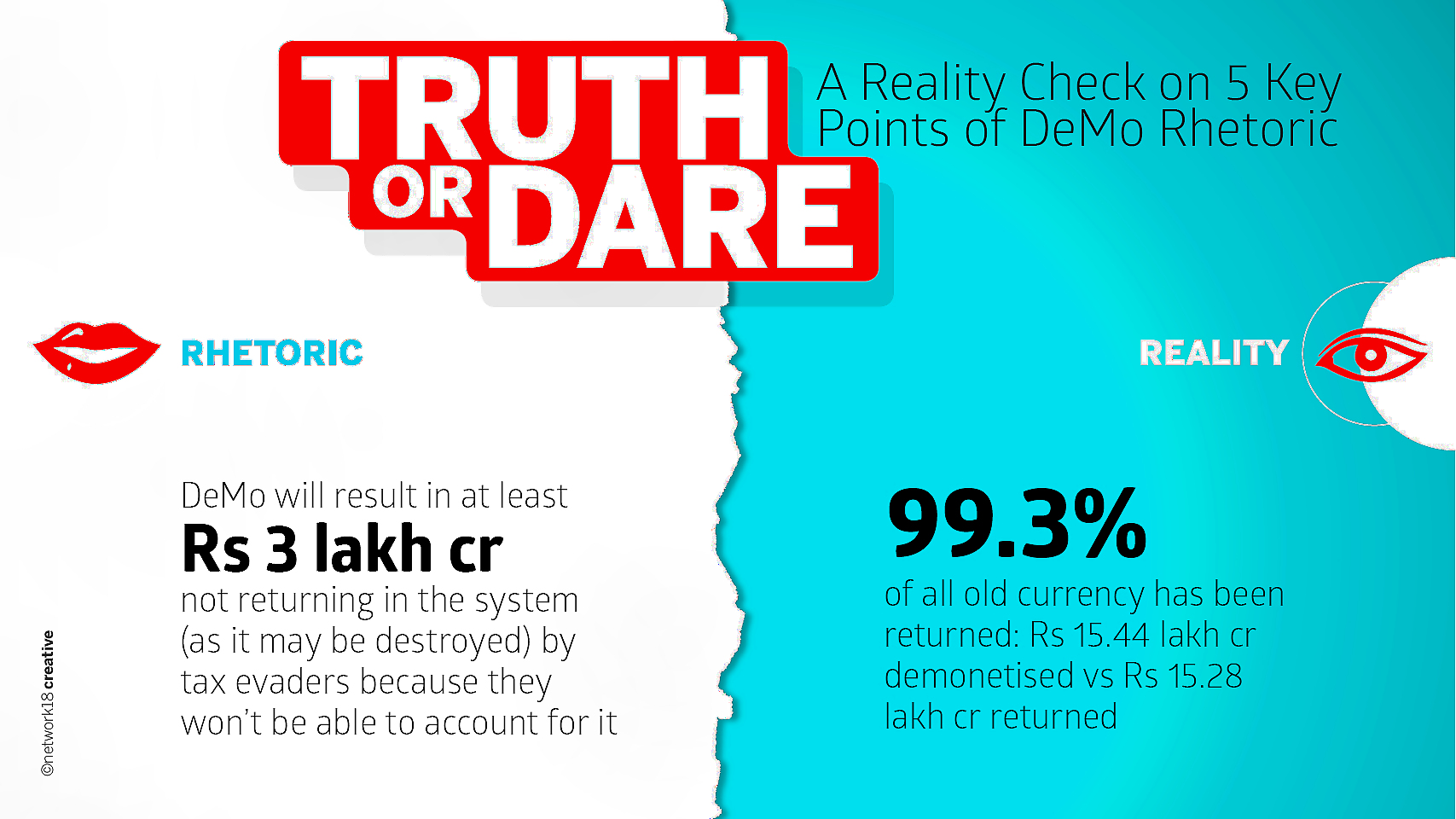

Rhetoric: Demonetisation will result in at least Rs 3 lakh crore not returning in the system (as it may be destroyed) by the tax evaders because they won't be able to account for it.

Reality: 99.3% of all the old currency has been returned: Rs 15.44 lakh crore demonetised vs Rs 15.28 lakh crore returned.

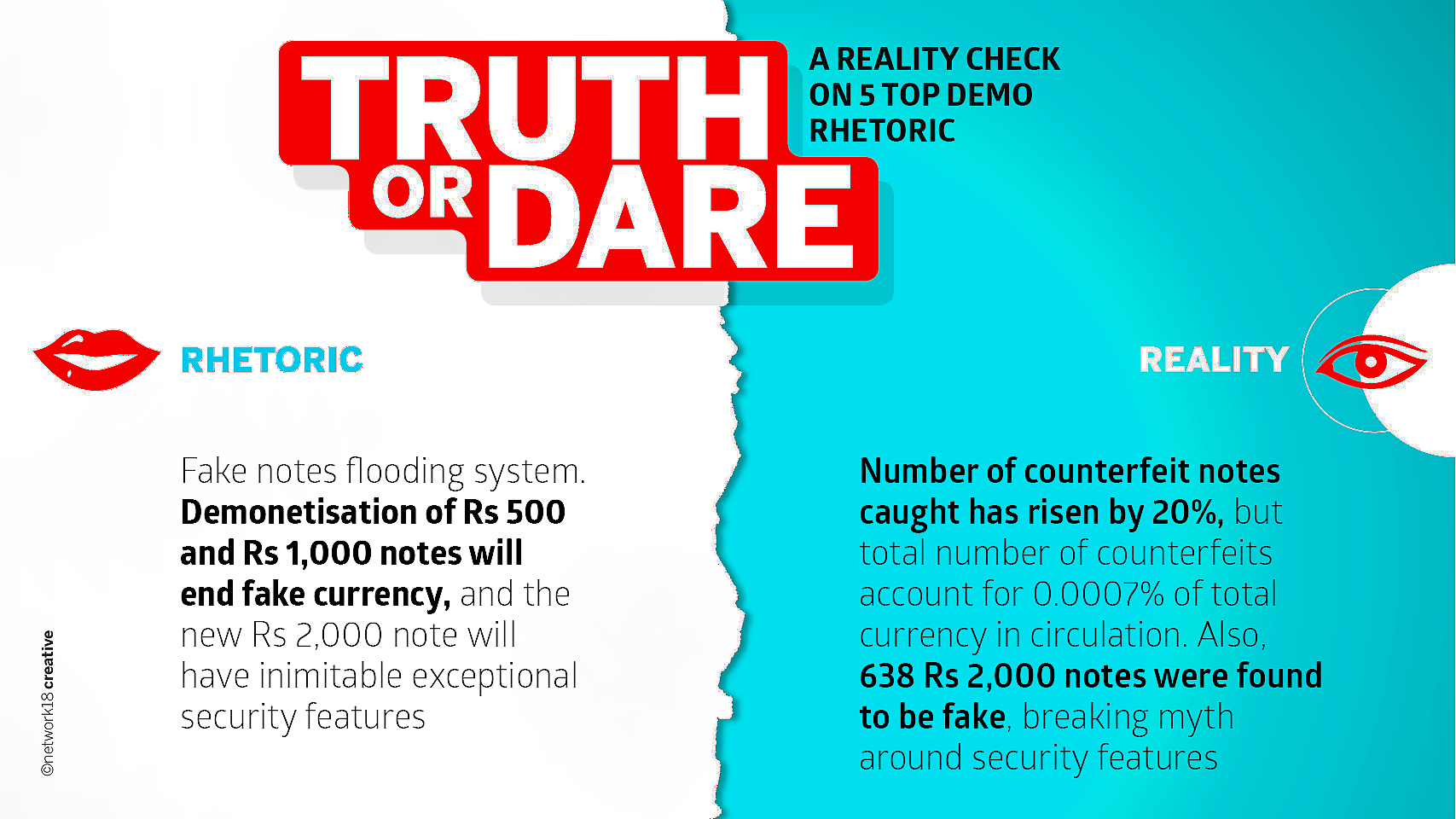

Rhetoric: Fake notes flooding the system. Demonetisation of Rs 500 and Rs 1,000 notes will end fake currency, and the new Rs 2000 note will have inimitable exceptional security features.

Reality: The number of counterfeit notes caught has risen by 20%, but the total number of counterfeits account for 0.0007% of total currency in circulation. Also, 638 Rs 2000 notes were found to be fake, breaking the myth around security features.

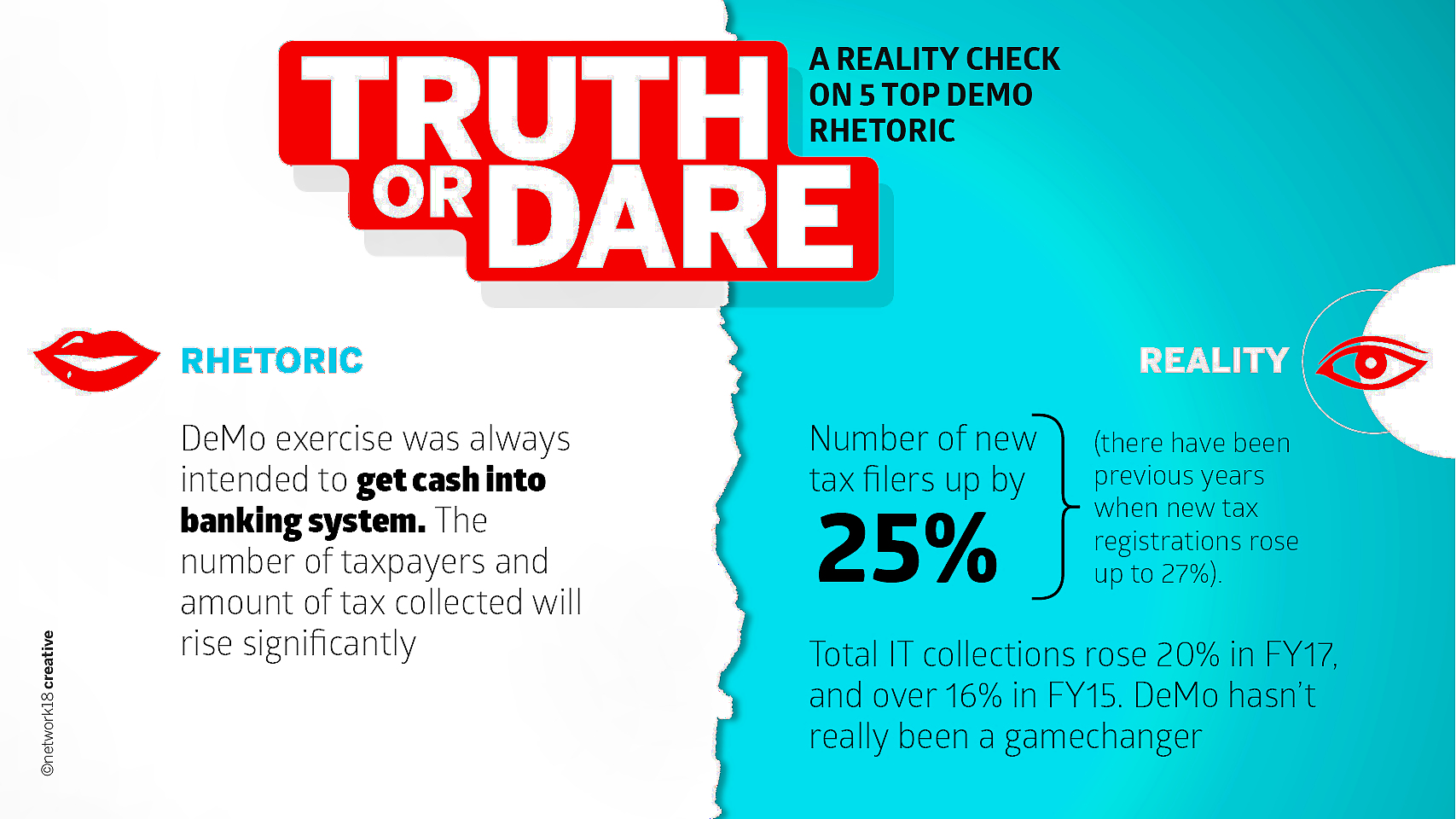

Rhetoric: The demonetisation exercise was always intended to get cash into the banking system. The number of taxpayers and amount of tax collection will rise significantly.

Reality: The number of new tax filers increased by 25%. But this is not first such instance — there have been years in the past when new tax registrations rose by up to 27%. Total income tax collections rose 20% in the financial year (FY) 2017, and over 16% in FY 2015. Demonetisation hasn't really been a game-changer.

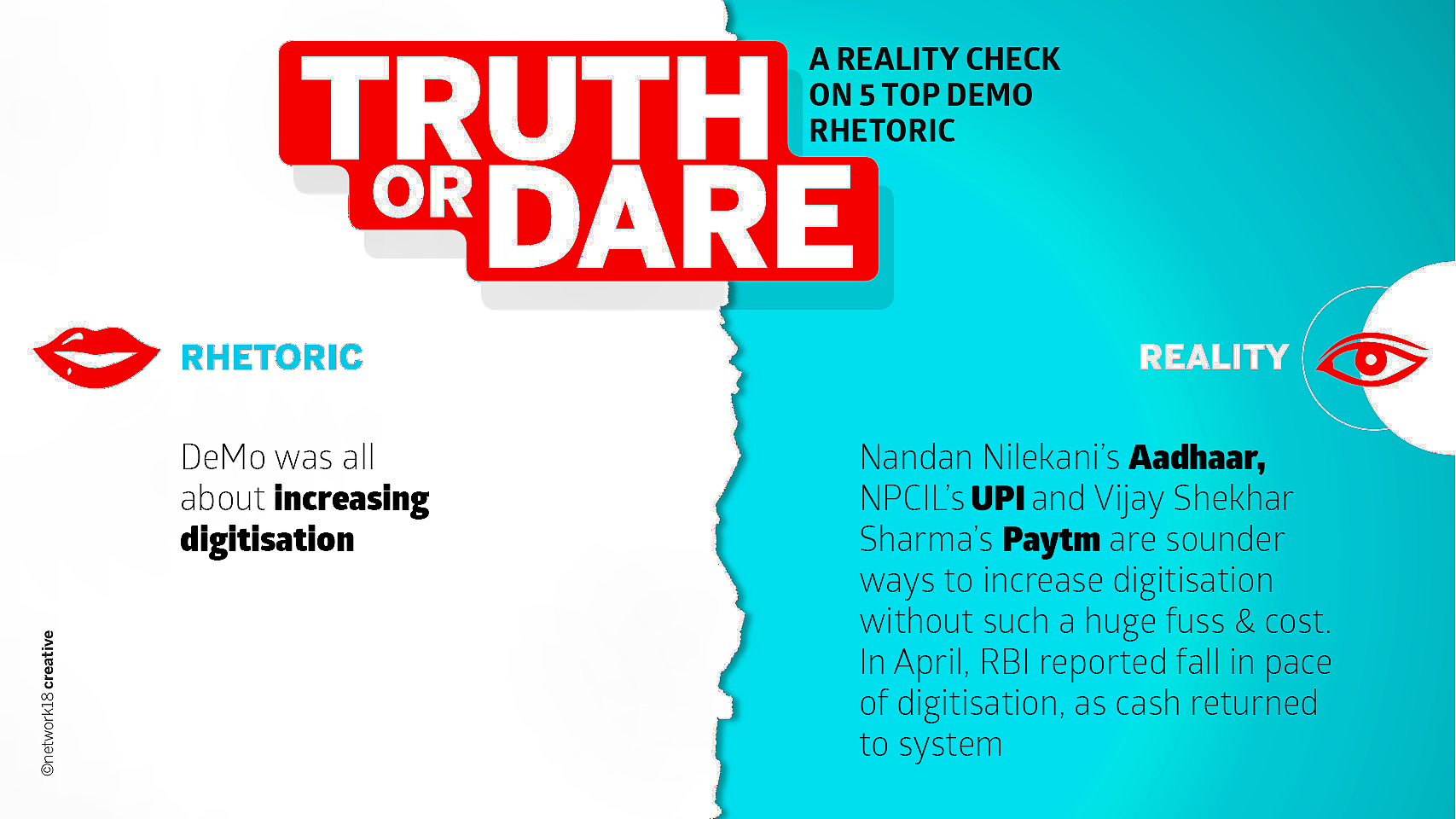

Rhetoric: Demonetisation was all about increasing digitization.

Reality: Nandan Nilekani's Aadhaar, NPCIL's UPI and Vijay Shekhar Sharma's Paytm are sounder ways to increase digitisation without such a huge fuss and cost. In April, the RBI itself reported a fall in the pace of digitisation as cash returned to the system.

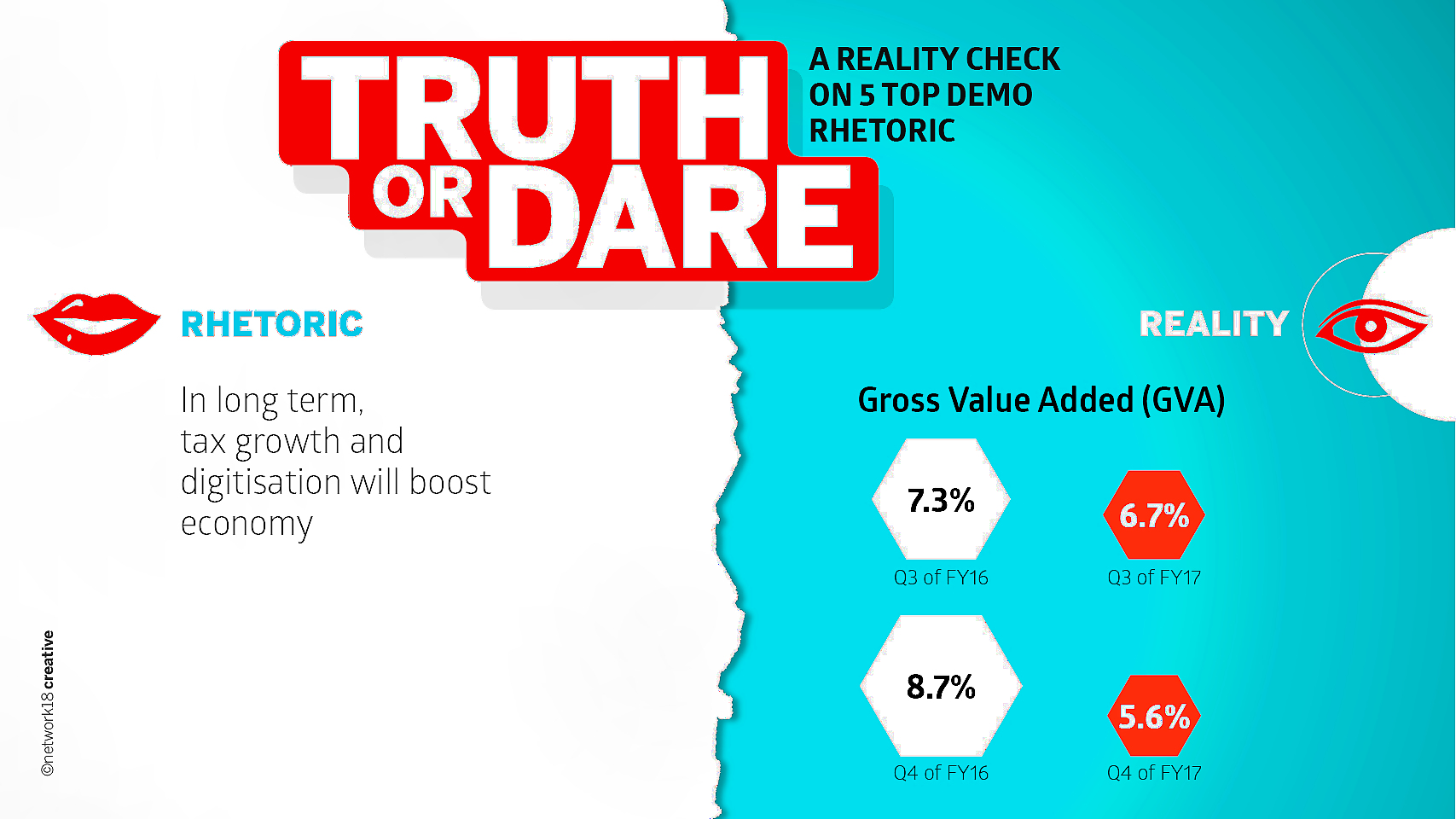

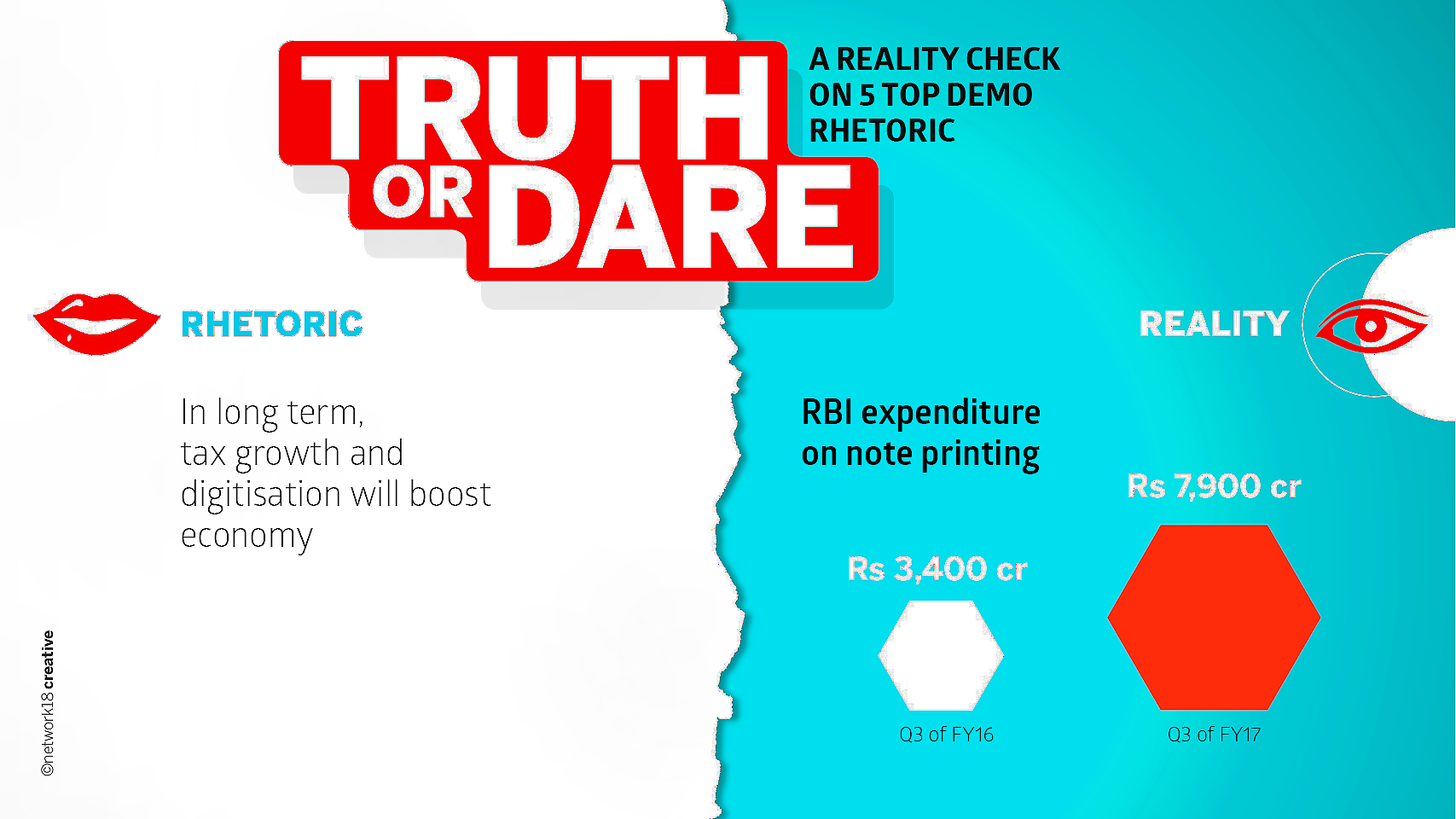

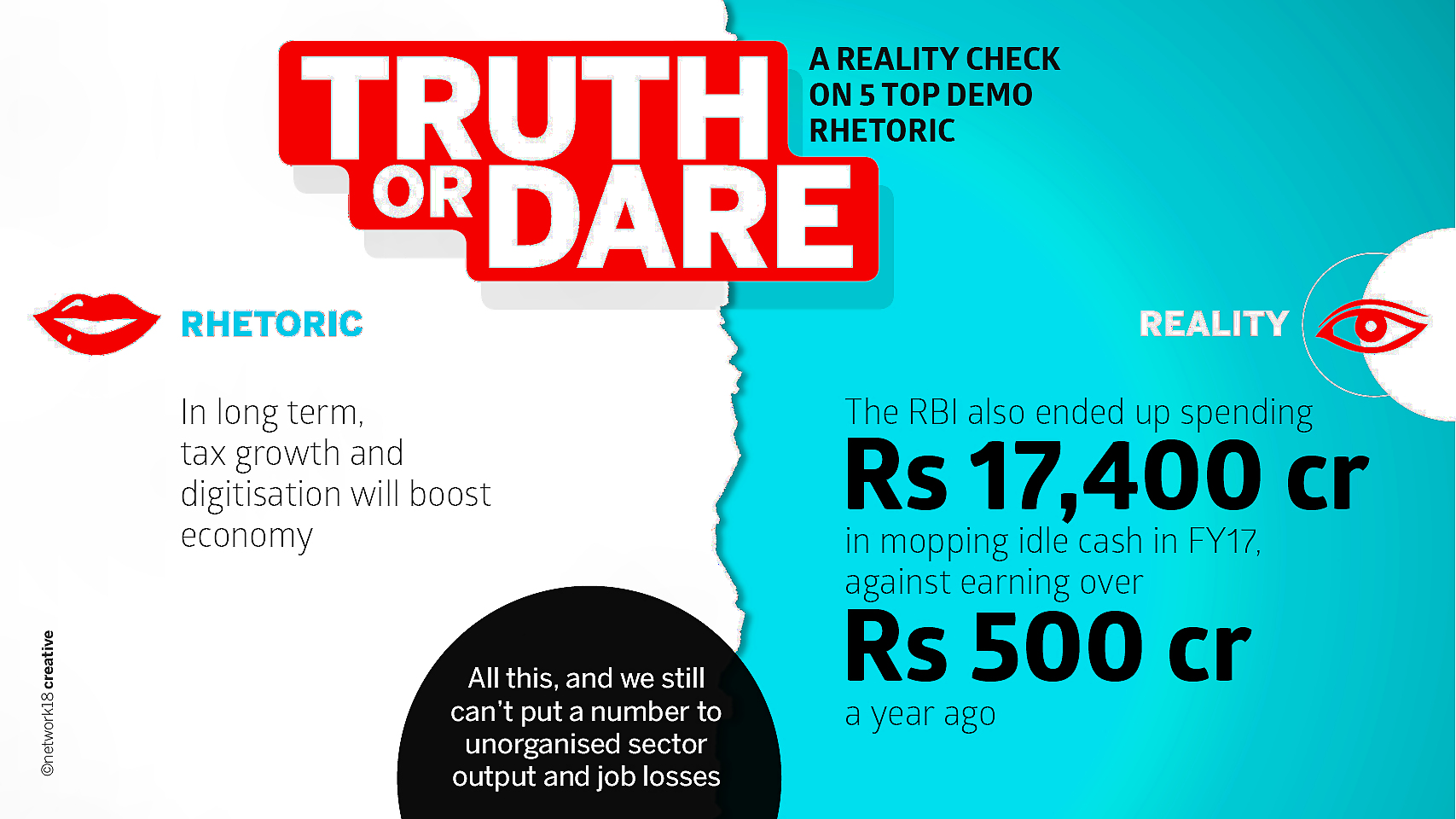

Rhetoric: In long term, tax growth and digitisation will boost the economy.

Reality: Short-term costs — Gross Value Added (GVA), the measure of the value of goods and services produced in an area, industry or sector, in Q3 of FY17 was 6.7%, compared with 7.3% a year ago. GVA in Q4 of FY17 was 5.6%, compared with 8.7% a year ago. The RBI spent Rs 7,900 crore on note printing in FY17, compared with only Rs 3,400 crore in FY16. The RBI also ended up spending Rs 17,400 crore in moping idle cash in FY17, against earning over Rs 500 crore, a year ago. All this, and we still can't put a number to unorganised sector output and job losses.

The only clear short-term gain seems to be that Prime Minister Narendra Modi emerged as an undisputed crusader against the 'evil rich'. Behind all the rhetoric, was that the unspoken reality after all?

Comments

0 comment