views

Mumbai: A tax professionals' body has sought extension of the time for e-filing of income tax returns for the entities "where tax audit report or transfer pricing report or other audit reports are prescribed" till November 30.

Among other things, it has cited non-availability of clerical staff at chartered accountants' offices due to GST roll-out as a reason.

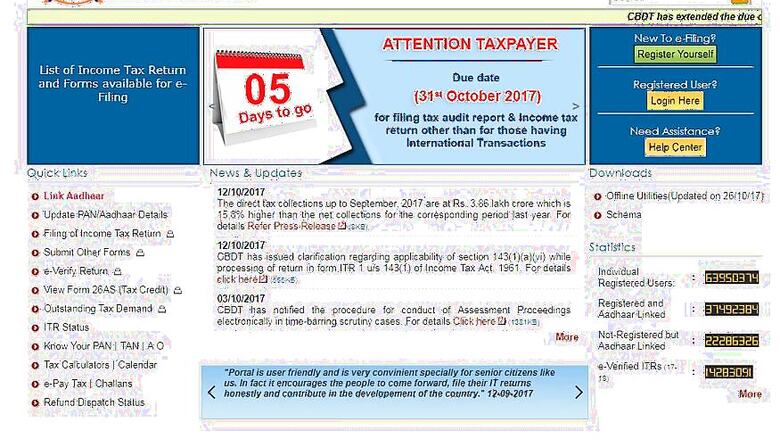

The All India Federation of Tax Practitioners (AIFTP), a body of lawyers, CAs and tax practitioners, welcomed the decision of the Central Board of Direct Taxes to extend the last date of e-filing of IT returns till October 31.

However, saying that its members are facing difficulties in filing returns by this date, it asked for further extension till November 30 in a letter to the CBDT chairman last week.

"This year, professionals are busy in making compliance with GST obligations... the technical glitches in the system have aggravated the problems," the letter said.

Besides, the CBDT has revised e-filing income tax return (ITR) preparation utilities for filing all types of ITR forms, tax audit report under section 44AB and also the schema for tax audit reports, the Federation said.

"Moreover, important changes have been made in audit reports for companies and in audit reports for other than companies. Due to schema updation, respective software has also to be updated, which will take some time," the letter said.

The CA examination is scheduled from November 1 and most of the articled clerks and assistants are on leave, the Federation claimed.

"Under these circumstances, we request you to consider further extension of date for filing of the income tax returns at least for a month, up to November 30, in cases where tax audit report or transfer pricing report or other audit reports are prescribed," the letter said.

Comments

0 comment