views

Even as the ITR deadline of July 31 is just four days away, income tax professionals are taking to social media to flag technical glitches on the e-filing portal, ranging from the website not working to login issues to document upload problems.

“Income tax site is not working since morning. Today is 27th July 2024 btw, Due date is 31st july 2024, Just telling you in case if you dont know. Hey Infosys team at IncomeTaxIndia, please make it work. We also have to file TDS return also. Not just ITR,” CA Harshil sheth said in a post on X.

Income tax site is not working since morningToday is 27th July 2024btw, Due date is 31st july 2024, Just telling you in case if you dont know

hey @Infosys team at @IncomeTaxIndia , please make it work

we also have to file TDS return also .. Not just ITR

— CA Harshil sheth (@CA_HarshilSHETH) July 27, 2024

Another user uploaded a video of the income tax website not working properly and said, “Only 1 to 2% of 150 crore are filing ITR. When income tax portal cannot handle even 1 to 2% returns, what if 10% started filing,” a user, named iM Raghav, wrote on X.

Only 1 to 2% of 150 Cr are filing ITR.When income tax portal cannot handle even 1 to 2% returns, what if 10% started filing.#IncomeTax #incometaxreturn #extendduedate pic.twitter.com/wwSzt0bmjj

— iM Raghav (@justaapian) July 27, 2024

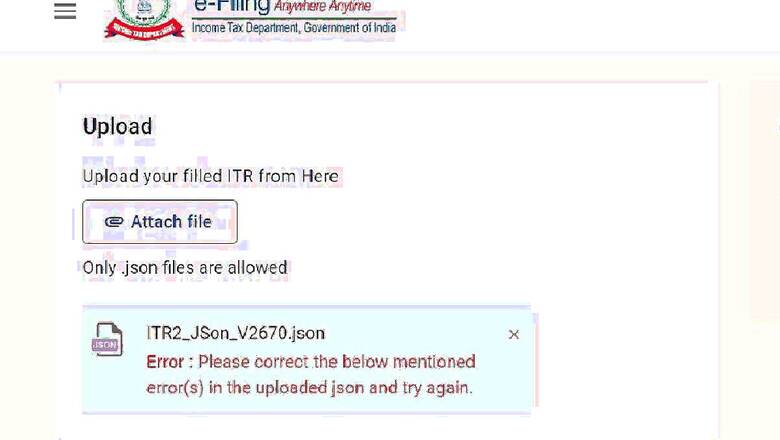

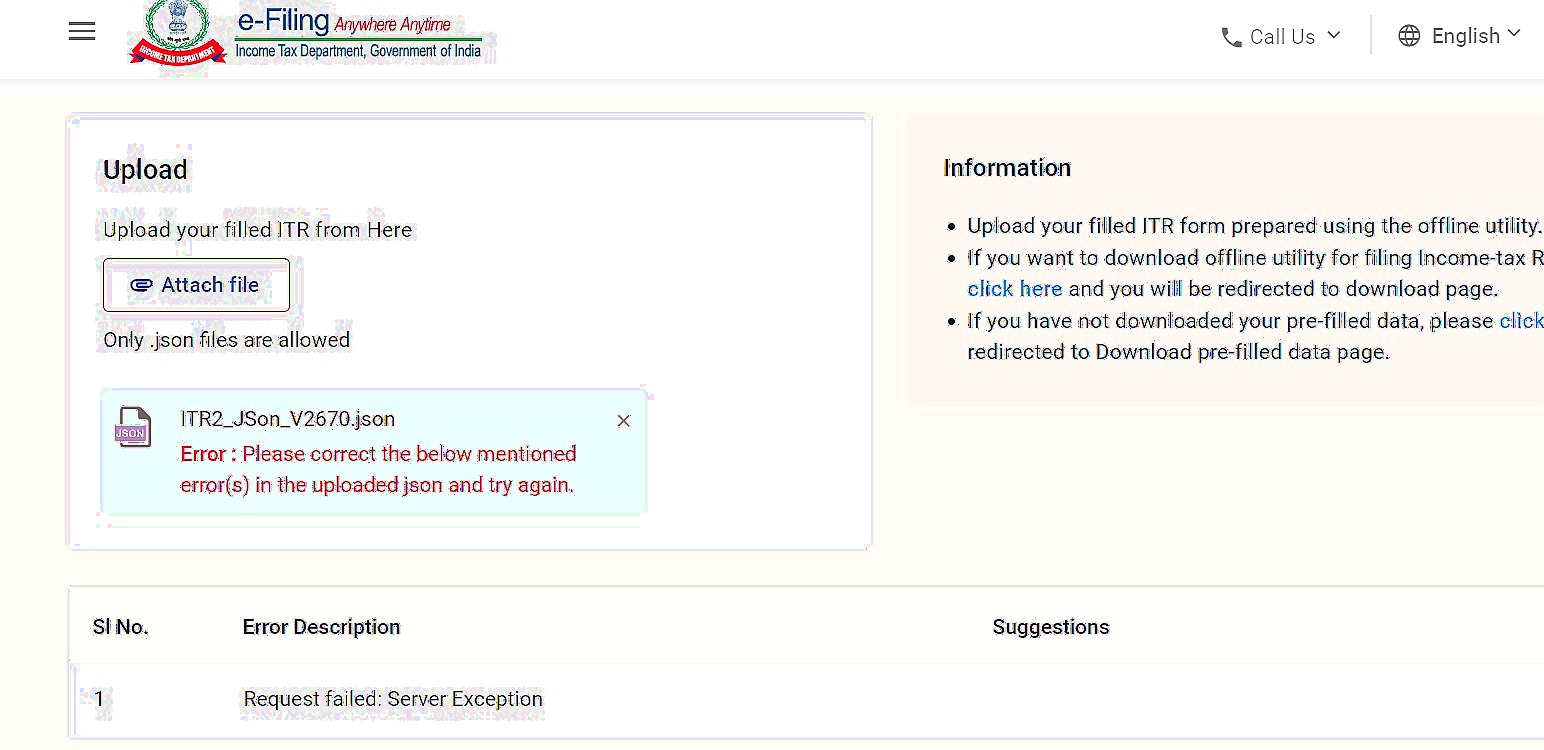

A community group of tax professionals posted a screenshot of the income tax portal and said, “This is the condition of the income tax website now. How are we supposed to file our returns on time with the website in this state? And on top of that, you are bombarding people with reminder emails and messages to file their income tax returns on time. Hilarious.”

Another X user, named Mahendra Kumawat, tagged the income tax department and FM Nirmala Sitharaman and said “Fom last 15 mins try into login but no luck. If login, can’t download my last year AY 2023-24 ITR form to see previous data. Screenshot attached.”

@IncomeTaxIndia @nsitharaman Fom last 15 mins tryinto login but no luck. If login, cant download my last year AY 2023-24 ITR form to see privious data. screenshot attached. pic.twitter.com/2BGngQqnTr— mahendra kumawat (@mahendra_2010) July 27, 2024

Another tax professional CA Chirag Chauhan said, “Why ITR filing deadline should permanently shifted to August 31. Can we make changes.”

Why ITR filing deadline should permanently shifted to 31 AugustCan we make changes before Final Bill #Budget2024 @nsitharaman pic.twitter.com/4mwl5YH46y

— CA Chirag Chauhan (@CAChirag) July 27, 2024

The income tax department on Saturday also updated the offline utility (ITR 1 to ITR 4).

So far, over 5 crore ITRs have been filed for the current assessment year 2024-25 (or financial year 2023-24). Last year, till July 31, a total of 6.77 income tax returns were filed. It means a huge number of taxpayers, over 1.7 crore, are yet to complete their filings with only 4 days remaining for the July 31 deadline.

The income tax portal has been facing significant technical glitches for the past few days.

Amid this, tax professionals are also expecting an ITR deadline extension by one month, till August 31, apart from fixing the portal.

The income tax portal has been updating reminders to file ITR on time. “Do remember to file your ITR if you haven’t filed yet. The due date to file ITR for AY 2024-25 is 31st July, 2024,” the income tax department said in a post on X.

Last year, the country witnessed an unprecedented surge in ITR filings, with about 6.77 crore returns submitted by July 31, 2023. This record high underscored the growing compliance among taxpayers and the effectiveness of the tax administration’s efforts to streamline the filing process.

The Income Tax Bar Association (ITBA), which is the oldest association for tax professionals in India established in 1947, has also urged the finance ministry to extend the deadline.

“It is bring to your attention that once again the income tax portal is not functioning properly for almost a month by now. There are many glitches like — slow speed of portal, upload-related issues, non-responsive pages, no response from UIDAI for Aadhaar-based OTP verification,” the ITBA has said in a letter to the finance ministry.

In the letter to the government, the ITBA that in light of the portal not functioning properly and heavy reporting requirement, the government is kindly requested to:

1) Instruct the technical team, vendor and officials responsible for maintenance of the portal to ensure that it functions smoothly just like the last year which can cater the increasing taxpayer base.

2) Extend the due date for the assessment year 2024-25 from July 31, 2024, to August 31, 2024.

In the previous assessment year 2023-24, India saw record high ITR filings of around 6.77 crore till July 31, 2023. However, till December 31, 2023, the number of ITRs filed increased to 8.18 crore.

Comments

0 comment