views

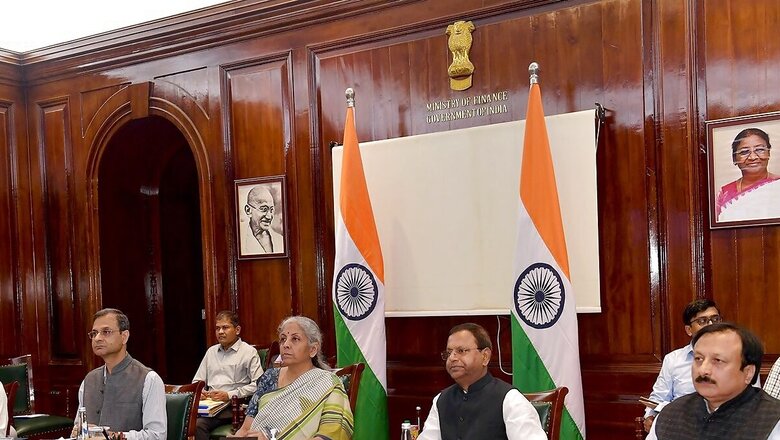

The GST Council on Wednesday decided that 28 per cent GST will be levied at face value of entry level bets placed in gaming platforms and casinos. The Centre will bring amendments to the Central GST law in the ongoing monsoon session of Parliament, following which states will pass the amendments to State GST law in their respective assemblies.

The amended provisions in the GST law, which would specifically define online gaming, online money gaming, virtual digital assets used to pay for online games, and supplier in case of online gaming, will be effective from October 1.

The decision will be reviewed after 6 months of its implementation or April 2024 by the GST Council to see if any change in rule is required.

The GST Council — the highest decision making body of the new indirect tax regime that comprises Union finance minister and representatives of all states — discussed the language of amendments that will be needed to enable taxing of online gaming and casinos.

What The Proposal Says?

Finance minister Nirmala Sitharaman said for the purpose of GST levy, the valuation of supply of online gaming and casinos will be done based on the amount paid at the time of entry into the game and not on what they pay in each game from winning amount.

“The Council recommended that valuation… may be done based on the amount paid or payable or deposited with the supplier by or on behalf of the player, excluding the amount entered into games bets out of winnings of previous games and bets and not on the total value of each bets placed. Entry (level) whatever they pay to get chips and not what they pay in each game,” Sitharaman said.

Giving an example, the minister said if a bet is placed for say Rs 1,000, and the player wins Rs 300, then if the player again places a bet of Rs 1,300, then GST will not be levied on the winning amount.

So GST will be levied at the entry level in case of online gaming and casinos.

Offshore gaming platforms

Offshore gaming platforms will have to register with GST authorities and pay taxes, failing which the government will invoke provisions of the Information Technology Act and block those sites.

“We are setting up DG GST intelligence officers cell which will be alert to all these websites, portals, not only pertaining to online gaming but all digital services being provided without tax being paid… then on a regular basis we will be monitoring them and taking action under Information Technology Act,” revenue secretary Sanjay Malhotra said.

“We will undertake amendments to the CGST Act at the earliest, in this session itself. From October 1, it will be implemented,” Sitharaman said.

Asked about the impact of the Council decision on the ongoing legal cases in online gaming, Malhotra said the decision of the GST Council is only clarificatory in nature as online gaming was always an actionable claim in the nature of betting and gambling on which 28 per cent GST is leviable.

“The Karnataka High Court had not upheld that stand and we have already filed an SLP yesterday. So we are in appeal and whatever is decided by the Supreme Court will prevail for the period till we have amended the law and issued the notification,” the Secretary said.

The Council had at its meeting last month decided to levy a 28 per cent GST on full face value of bets placed and Wednesday’s meeting was to deliberate on the tax law changes that would be required to implement it.

Sitharaman said the Delhi finance minister opposed 28 per cent tax on online gaming and wanted the matter to go back to a group of ministers. Goa and Sikkim, whose revenues come from casinos, said 28 per cent GST should be levied on GGR (gross gaming revenue) or platform fees and not on face value.

Sitharaman, however, said other states, including Chhattisgarh, West Bengal, Karnataka, Gujarat, Maharashtra and Uttar Pradesh, wanted the decision taken at the Council meeting last month to be implemented at the earliest.

Tamil Nadu, which has banned online gaming in the state, had expressed apprehension that with the GST Council deciding to levy 28 per cent GST on online gaming would it be legalised in the state.

Malhotra said just by including online gaming within the purview of Act and making them liable to tax will not result in legalising online gaming in their state if they have banned it.

E Gaming Federation (EGF) and Federation of Indian Fantasy Sports (FIFS) in a joint statement said the government has addressed the industry’s concerns on the issue of repeat taxation.

L. Badri Narayanan, executive partner, Lakshmikumaran & Sridharan Attorneys, said the Council’s decision to levy GST on deposits made at entry level has brought a sigh of relief for the sector.

“The council has recommended parity in treatment for casinos and online games of skill. With the said amendment, the valuation mechanism for Casino and Online gaming are kept at par i.e., GST will be charged only on the value of coins purchased and money deposited in wallet respectively, rather than levying GST on each game played. This is a welcome clarification for the industry stakeholders,” Narayanan added.

Narayanan highlighted that the decision is in alignment with the recent developments in income tax provisions linked to deposit of amount to wallet. Bank to bank transfer of money will create ease of transparency, traceability and monitoring for stakeholders. We need to await the fine print of amendments in relation to definition, place of supply , offshore gaming etc.

Sudipta Bhattacharjee, partner, Khaitan & Co, said the GST Council clarified that vis a vis online real money games (‘fantasy’ games as well as other real money games) the GST at 28 per cent will be applicable on the actual cash/equivalent deposits made by players on an online gaming platform to commence gameplay and not on the winning amounts being redeployed by players for further gameplays.

“While this will certainly afford some amount of relief to the online real money gaming sector, many smaller startups in this segment may still get very badly hit once this higher GST comes into force,” Bhattacharjee said.

(With PTI inputs)

Comments

0 comment