views

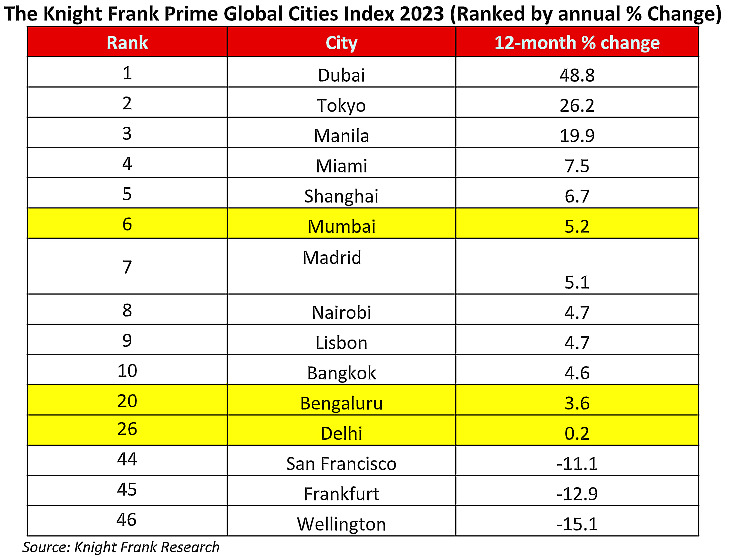

Mumbai Real Estate: Knight Frank, the property consultancy firm, in its report ‘Prime Global Cities Index Q2 2023’ noted that Mumbai recorded the 6th highest YoY growth in prices in Q2 2023. Incidentally, the city is forecasted to record the highest annual price at 5% on the Prime Global Cities Index for the year 2024.

Prime Global Cities Index

The Prime Global Cities Index is a valuation-based index tracking the movement of prime residential prices across 46 cities worldwide. The index tracks nominal prices in local currency.

Also Read: The Great Housing Shift: More People Aim To Buy Home Rather Than Living On Rent

Prime Global Cities Index: Indian Cities

Three Indian cities witnessed healthy growth in prime residential prices in Q2 2023.

In Q2 2023, prime residential prices in Mumbai grew at 5.2% year-on-year (YoY). With an increase of 3.6% YoY in Q2 2023, Bengaluru ranked 20th and New Delhi positioned itself at 26th with an increase of 0.2% YoY.

Dubai Leads The Index

Dubai completed eight quarters at the top position globally with an increase of 48.8% YoY in prime residential properties values. The average annual growth rate reached 1.5% across the covered markets that indicates a positive shift after a recent period of uncertainty.

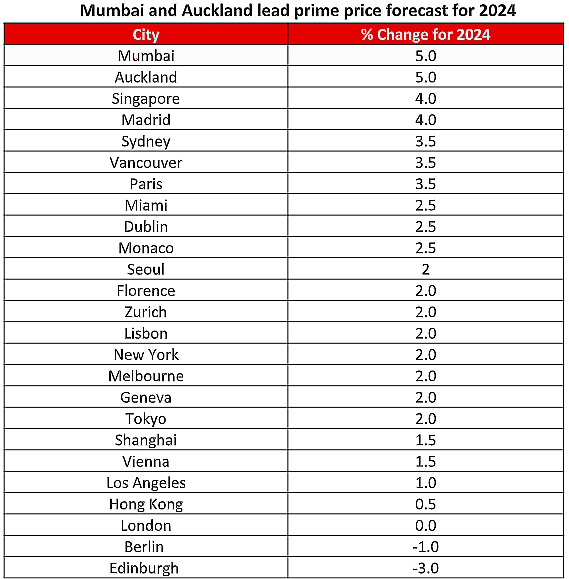

Prime Price Forecast For 2024

Knight Frank has also provided the forecast for 26 global prime residential markets for the year 2024.

In this study, Knight Frank has cited Mumbai and Auckland to lead the highest change in prime residential prices. Both the cities are forecasted to experience an increase in prime residential prices by 5% in the year 2024.

Why Mumbai Real Estate?

Improving GDP figures, the city’s relative value and investment in infrastructure will be the prime influencers in pushing prices higher for the luxury housing market of Mumbai.

The average price for 26-global prime residential markets is expected to grow at 2% in 2024.

Shishir Baijal, chairman and MD, Knight Frank India, said, “While central banks in major developed economies around the world were announcing unprecedented policy rate hikes, the Indian economy, demonstrating stronger growth momentum and better control over inflation, managed to maintain stability in its policy interest rates over last two quarters. This distinctive approach led to the persistence of robust sales levels in the residential markets, in contrast to the market reflections of action taken by most other major economies.”

“Besides, coming out of a prolonged stagnation over the last decade, prime property price movement in the country was also positively influenced by strong sales momentum in the category amid limited ready inventory, and increased construction cost in recent years,” Baijal added.

Liam Bailey, head of research, Knight Frank Global, said, “Global housing markets are still under pressure from the shift to higher interest rates – but the latest results from the Index confirm that prices are being supported by: strong underlying demand, weak supply following disruption to new-build projects during the pandemic, and an ongoing return of workers to cities. As uncertainty over the direction of inflation appears to have reduced in recent months – price adjustments in many markets are likely to be less pronounced than was expected even three months ago.”

Comments

0 comment