views

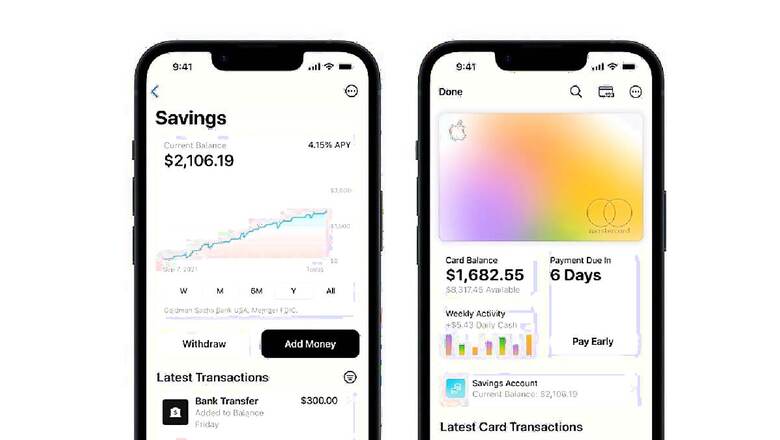

Apple, which offers one of the most expensive premium devices including iPhones, iPads and MacBooks, has launched a high-yield savings account, offering a high 4.15 per cent interest rate, which is more than 10 times the national average in the US.

The 4.15 per cent offered by the scheme, in partnership with Goldman Sachs, is being touted as one of the most promising return rates in the US right now. Is Apple becoming a bank or insurance company? Here’s all you need to know about Apple’s 4.15 per cent savings scheme in particular, and the company’s foray into finance in general:

Apple Savings Account: What’s Special?

- Apple Savings Account is offering a 4.15 per cent interest rate, which more than 10x the national average of 0.35 per cent. It is compared with Bank of America’s APY of 0.01 per cent, Wells Fargo’s 0.15 per cent, Chase’s 0.01 per cent, and the national average APY on savings accounts of 0.35 per cent in the US.

- There is no requirement of minimum deposits and minimum balance. Moreover, there is no fees.

- There is an deposit insurance for a maximum balance of $250,000.

- Users can easily set up and manage their savings account directly from Apple Card in Wallet.

- The Apple Savings Account is seemlessly integrated into Apple Wallet, and provides automatic savings features and goal-setting tools.

- Once a savings account is set up, all ‘Daily Cash’ earned by the user will be automatically deposited into the account

“The Daily Cash destination can also be changed at any time, and there’s no limit on how much Daily Cash users can earn. To build on their savings even further, users can deposit additional funds into their Savings account through a linked bank account, or from their Apple Cash balance,” Apple said in a statement.

Users can also withdraw funds at any time through the Savings dashboard by transferring them to a linked bank account or to their Apple Cash card, with no fees

Apple’s Journey Into Finance So Far:

Apple Pay

In 2014, the company entered the finance sector with the launch of Apple Pay. It is a mobile payment and digital wallet service for contactless payments.

Apple Card

The company moved further into the finance with the rollout of Apple Card in 2019, in partnership with Goldman Sachs. It features instant issuance, seamless integration with Apple Wallet, real-time tracking of transactions, cashback rewards, and credit card management.

Apple Cash

The company in 2019 also launched a peer-to-peer payment service, Apple Cash. Through this, users can split bills, pay friends, and transfer money via iMessage.

Apple Pay Later

Just three weeks ago, the company launched ‘Apple Pay Later’, its ‘buy now pay later’ facility, allowing users to split purchases into four payments with zero interest and no fees in 2023.

The comes days before Apple is starting its first two stores in India — Mumbai’s BKC and Delhi’s Saket. The Mumbai BKC store has opened for public on Tuesday, April 18, while its Delhi’s Saket store will start for public on Thursday, April 20.

Read all the Latest Business News, Tax News and Stock Market Updates here

Comments

0 comment