views

The RBI’s Monetary Policy Committee on Friday decided to raise the repo rate by 50 basis points (bps) to 5.9 per cent with immediate effect. It maintains policy stance at ‘withdrawal of accommodation’. In the past four subsequent monetary policy reviews since May this year, the RBI’s rate-setting panel has raised 190 basis points in total.

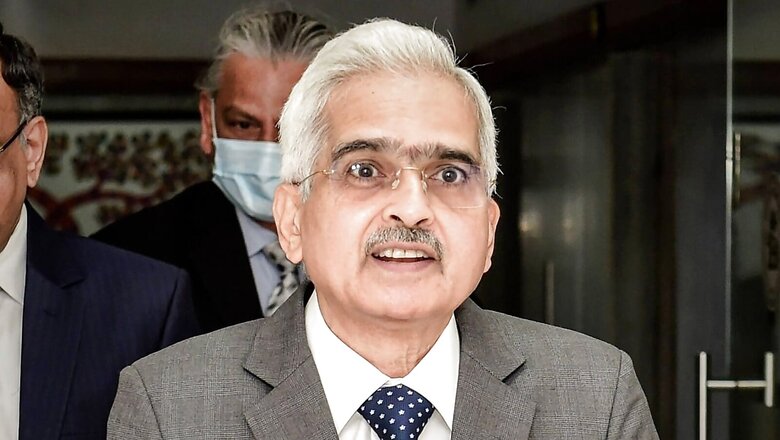

While presenting the latest bi-monthly monetary policy statement, RBI Governor Shaktikanta Das said, “The world has been confronted with one crisis after another. Now, we are in the middle of another storm of global monetary tightening.”

The repo rate is the interest rate at which the RBI lends to the commercial bank. The hike in the repo rate will raise the loan EMIs for borrowers as the lenders are expected to follow the suit.

The RBI governor said the MPC was of the view that persistence of inflation necessitates further withdrawal of monetary accommodation. The decision to raise the repo rate by 50 basis points was voted by 5 out of the 6 MPC members, to remain focused on ‘Withdrawal Of Accommodation’.

Das said, “The standing deposit facility (SDF) rate is now at 5.65 per cent and the marginal standing facility (MSF) rate at 6.15 per cent.” The SDF is the lower band of the interest rate corridor, while the MSF is the upper band.

He said the global economic outlook continues to be bleak. Financial conditions are tightening and recession fears are mounting. Inflation continues to persist at alarmingly high levels across jurisdictions. The enduring effects of the pandemic and the geo-political conflict are manifesting in demand-supply mismatches of goods and services.

“The MPC was of the view that persistence of high inflation necessitates further calibrated withdrawal of monetary accommodation to restrain broadening of price pressures, anchor inflation expectations and contain the secondround effects. This action will support medium-term growth prospects. Accordingly, the MPC decided to increase the policy repo rate by 50 basis points to 5.9 per cent and to remain focused on withdrawal of accommodation, while supporting growth,” he said.

India’s retail inflation in August soared to 7 per cent, compared with 6.71 per cent in July. The country’s GDP growth in the June 2022 quarter stood at 13.5 per cent.

The latest RBI action follows the US Federal Reserve effecting the third consecutive 0.75 percentage point interest rate increase, taking its benchmark rate to a range of 3-3.25 per cent earlier this month.

Vivek Iyer, partner and leader (financial services risk) at Grant Thornton Bharat, said, “The RBI MPC increase of repo rate of 50 basis points comes as no surprise to the market as the same was widely expected. The governors mention of doing away with forward guidance is a clear indication of the hawkish stance that the RBI is going to be adopting for the next few cycles, with policy responses evolving in response to changes in the external environment.”

Suvodeep Rakshit, senior economist at Kotak Institutional Equities, said, The 50 bps hike in the repo rate was in line with our expectations though we had expected a slightly more hawkish tone to the policy communication. We see the tone as more neutral and the RBI seems to be confident of balancing out the external as well as domestic risks.”

Rakshit added that the stance of liquidity withdrawal was also unchanged. Durable liquidity will move towards neutral by end-FY2023. “Overall, we believe the RBI will be more data dependant from hereon. We continue to expect another 35 bps hike in December followed by a pause with the RBI assessing Fed actions, and impact of past rate hikes on domestic growth and inflation.”

Read all the Latest Business News and Breaking News here

Comments

0 comment