views

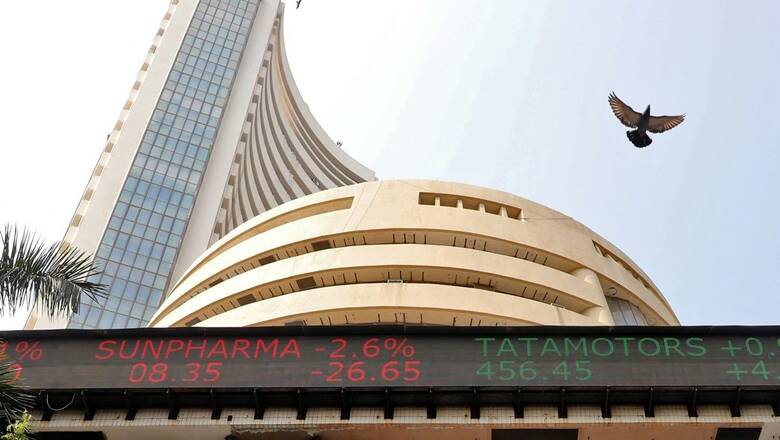

Reversing the early morning trade, the Sensex on Monday, August 14, rose 79.27 points to settle at 65,401.92 points, while the Nifty ended the day 6.25 points higher at 19,434.55 points. However, the rupee declined 15 paise to close at 82.97 (provisional) against the US dollar.

During the day, the Sensex opened lower by about 460 points at 64,862 in the early morning trade. After an initial dip hitting the day’s low of 64,821, the BSE benchmark index started picking up and hit the day’s high of 65,517.82 before settling at 65,401.92, which is 79.27 points higher than Friday’s close of 65,322.65.

Among 30 Sensex companies, 13 companies closed in the green. Among the top gainers were Reliance Industries (up 1.73 per cent), Infosys (1.58 per cent), Hindustan Unilever (1.26 per cent), Larsen & Toubro (0.88 per cent), and ICICI Bank (0.70 per cent).

Among the losers were JSW Steel (down 2.47 per cent), SBI (-2.37 per cent), Tata Steel (-1.79 per cent), Bajaj Finserv (-1.39 per cent), and UltraTech Cement (-1.20 per cent).

Shrikant Chouhan, head of research (retail) at Kotak Securities, said, “Markets continued to witness wild fluctuations due to weak Asian cues but early optimism in European indices aided recovery in local markets with the help of buoyancy in IT stocks. However, deflation and demand slowdown in China coupled with concerns over more rate hikes in developed economies going ahead has been taking the sheen out of equity markets.”

He added that investors are also wary of steady selling by foreign investors in local markets this month, which is causing traders to limit their exposure. All eyes will be on CPI and WPI inflation numbers and if the reading is higher, more correction could be in the offing.

“Technically, after an early morning selloff, the Nifty took support near the 50-day SMA (Simple Moving Average) and bounced back sharply towards the end. For the day traders now, 19350 would act as a trend decider level, above which the pullback rally could be seen which would drive the market up till 19500-19560. On the flip side, a fresh selloff could be seen only after the dismissal of 19350, and below the same, the index could retest the level of 19300-19250 or 50-day SMA,” Chouhan said.

Comments

0 comment