views

X

Research source

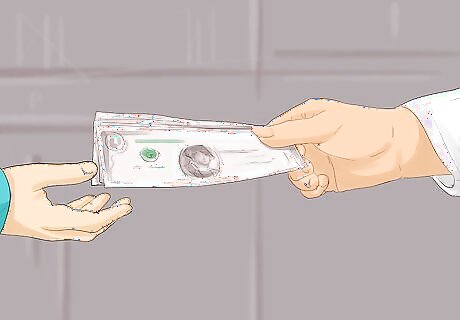

If a billing error is alleged to have occurred, a response to those allegations is most often made by the credit card issuer and/or the merchant. If you are a credit card issuer and you receive notice of a billing error, you are required to respond promptly under federal and state law. If you are a merchant, you will see billing errors in the form of chargebacks. A chargeback occurs when a credit card issuer returns a transaction to your bank (i.e., your acquirer).[2]

X

Research source

As a merchant, you will have to follow the credit card issuer's chargeback procedures in order to retain your transaction funds.

Responding as an Issuer

Analyze the billing error notice. A billing error claim is started when a consumer notifies you (the credit card issuer) of an alleged error. This notification must be sent to you within 60 days of you giving the consumer their credit card statement. The notice will have the consumer's name, credit card information, and a detailed description of the charge they are disputing. When you receive this notice, look it over carefully to ensure it complies with your state's, or the federal government's, billing error law. If the consumer's notice contains all of the correct information and is submitted in a timely manner, you are required to respond accordingly.

Correct the error or acknowledge receipt of the notice. If, after reviewing the notice, there is a clear billing error, you may choose to simply correct the error. This is often the case with punctuation errors (e.g., the comma or decimal is in the wrong place on a consumer's bill) that are easily identified and fixed. However, if you cannot identify a clear billing error, you may have to investigate the consumer's claim. If you cannot identify a clear billing error on the face of the consumer's notice, you need to let the consumer know you will be investigating their claim. To acknowledge receipt of a billing error notice, write a formal letter to the consumer. Your letter should contain your official letterhead, name, title, and address. In addition, your letter should specifically identify the consumer's name, contact information, and complaint. Make sure you reference the letter that was sent to you. This written acknowledgement must be mailed or given to the consumer within 30 days of receiving the notice.

Decide whether an error occurred. If you did not correct the alleged error based solely on the information included in the consumer's notice, you will need to investigate the consumer's claims. To do so, you will need to collect evidence of the disputed transaction in order to determine if the consumer's claims are well-founded. Contact the merchant's (i.e., the person or company that contracts with an acquirer to accept credit card payments at their store) acquirer (i.e., the merchant's bank) and ask about the particular transaction. The acquirer will have to contact the merchant and ask for an accurate copy of their receipt of the transaction. The merchant's receipt will be forwarded to you by their acquirer. The merchant may also forward other compelling evidence to help their case. For example, if a consumer claims they never received the product they paid for, and therefore they should receive a refund, the merchant may submit an email confirmation from a delivery service (e.g., FedEx or UPS) proving that the product was delivered to the consumer's address. Once you have received all of the evidence, you will analyze it and determine whether a billing error occurred. Be aware that your investigation is required to be "reasonable." Therefore, do not simply go through the motions. Instead, ask for all relevant evidence and follow-up when necessary. If your investigation falls short of the reasonableness standard, the consumer may have the ability to successfully dispute your process.

Fix the error. If a billing error occurred, you need to fix the error, credit the consumer's account with the appropriate sum of money, and mail a correction notice to the consumer. These actions need to take place within two complete billing cycles (usually 60 days) after receiving the consumer's notice.

Explain your reasons for denying the claim. If you conclude that no billing error occurred and the charges on the consumer's account were accurate, you need to mail a determination letter to the consumer within two complete billing cycles after receiving the consumer's notice. Your determination letter should explain, in detail, how your investigation was conducted and why you believe no billing error occurred. Include a description of who you talked with and the evidence you received. Explain that, after you looked at all the facts, the billing error that was alleged did not actually occur. This determination letter will be one source of evidence if the consumer appeals your decision. For example, the consumer might appeal your decision by stating your investigation fell short of the reasonableness standard required by law. If this happens, you will want to be able to point to your determination letter to show any administrative agency or court that you conducted a thorough search and came to a plausible conclusion.

Dispute withheld payments. If the consumer does not agree with your determination, they may continue to withhold the disputed funds from you. While consumers have the legal authority to withhold payments in certain situations, you also have the legal authority to take certain actions to attempt to retrieve your money. For example, you can encourage the consumer to resolve the dispute with the merchant directly. If this happens, you can ask to receive written notice from the merchant of any resolution and correct the errors at that time. In addition, you can report the amount withheld as "disputed" with any credit reporting agency. However, be careful not to report the amount as "delinquent" unless you are confident the consumer is improperly withholding funds.

Responding as a Merchant

Understand the credit card process. As a merchant, you obtain the ability to make credit card transactions through your acquirer (i.e., your bank) by paying for merchant services. Your acquirer, in turn, contracts with specific credit card issuers so you can accept their credit cards in your system. The credit card issuer issues credit cards from specific credit card companies (i.e., Visa, MasterCard, American Express, Discover) to consumers who use them at your store. When a purchase is made at your store, you will retain a copy of each credit card receipt to deposit with your acquirer. Your acquirer will then pass the information along to the credit card issuer who will charge the consumer for their purchase.

Consider common reasons for chargebacks. When a consumer is unhappy with a specific credit card transaction, they can dispute the charge with their credit card issuer. In response, the credit card issuer might issue a chargeback to your acquirer, which will usually come in the form of a Chargeback Reason Code. These codes will indicate to your acquirer the reason for the chargeback. Common Visa Chargeback Reason Codes include: Reason Code 30: Services not provided or merchandise not received Reason Code 53: Not as described or defective merchandise Reason Code 62: Counterfeit transaction Reason Code 73: Expired card Reason Code 81/83: Fraud

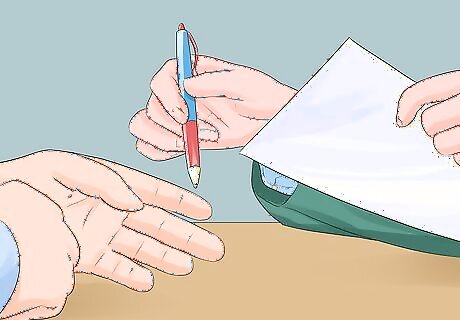

Answer copy requests. If a chargeback is issued by a credit card issuer, the credit card issuer will send a notice to your acquirer. When this happens, your acquirer has 30 days to send a copy of the transaction receipt back to the credit card issuer. If the acquirer does not have a copy of the receipt in question, it may forward the request to you. If this happens, the acquirer will tell you exactly how long you have to respond. When you receive a copy request, you should locate the appropriate receipt, make a copy, and send it back to your acquirer. Your acquirer will forward it to the credit card issuer. Make sure the copy is legible so each party can clearly understand the transaction. However you choose to send the copy, make sure you keep records proving it was sent and received. Some credit card issuers might contact you directly for a copy request. While you are not obligated to fulfill any verbal request from a credit card issuer, you might expedite the process by doing so.

Accept the chargeback. Once the credit card issuer receives the required information for their billing error investigation (including your copy of receipts), they will make a decision. If they conclude a billing error occurred, they will issue a chargeback. When a chargeback is issued, the credit card issuer will send back the disputed transaction to your acquirer along with a valid reason code. At this point, your acquirer can choose to resolve the chargeback on its own or it can forward the chargeback to you. If the chargeback is legitimate, you might have to accept it and move forward. When you accept a chargeback, the money you would have received from the credit card issuer, for the disputed transaction, will not be received. If, however, you have already received the money from the disputed transaction, the chargeback will work to reverse the transaction and you will have to pay the credit card issuer back.

Resubmit the transaction to your acquirer. If you do not agree with the chargeback, you can resubmit the transaction to your acquirer. Your acquirer will have to review the submission and, if it agrees with your stance, it will re-present the chargeback to the credit card issuer. When you and your acquirer resubmit and re-present a chargeback to the credit card issuer, you should make sure you have the evidence to back up your claim. Remember, the credit card issuer has already determined once that the transaction was an error. They will not overturn their own decision without clear evidence of a mistake. If the credit card issuer agrees with the re-presentation of the chargeback, your money will be cleared and you will receive the transaction funds.

Submit to arbitration. If the credit card issuer still does not agree with the transaction between you and the credit card holder, the credit card issuer will usually have the option of submitting to arbitration in order to determine who is financially liable for the disputed transaction. Arbitration is most commonly filed by the credit card issuer with the credit card company. For example, Visa issuers can submit to arbitration directly through Visa. During arbitration, the credit card company (e.g., Visa, MasterCard, Discover) will decide which party is responsible for the transaction. The credit card company will review any documentation filed by either party and will make a decision based on that information. The credit card company's decision is usually final and it must be followed.

Pay chargeback fees. When you receive a chargeback, the credit card issuer and credit card company will charge you fees. First, the credit card issuer will charge you "retrieval fees", which are assessed so the credit card issuer can investigate the disputed charge. These fees can range from $5 to $15. Second, if a chargeback is issued by the credit card issuer, they will charge you a chargeback fee, which usually ranges from $15 to $40. If you work with Visa or MasterCard, they have strict limits on how many chargebacks you can incur before you have to take part in chargeback monitoring programs. These programs will usually be coupled with fines that can reach $5,000.

Preventing Chargebacks as a Merchant

Be clear about your policies.While not required, one way to help avoid chargeback claims is to clearly lay out your policies on your sales receipts. These policies should be pre-printed near the customer signature line. Make sure the policy is legible on every copy of the receipt. These policies will help you make your case to the credit card issuer should a chargeback claim arise. For example, if you do not allow refunds after 30 days, state, "No refunds after 30 days." In this scenario, if a credit card issuer starts a chargeback claim because a consumer said they were charged for an item they bought and returned 40 days later, you would have evidence that no refund should be given, and no chargeback should be initiated, due to the clear policy statement on the consumer's receipt.

Deposit receipts promptly. As a merchant, you are required to deposit your sales and credit receipts with your acquirer within a specified period of time. For example, Visa requires you to process every transaction within 180 days of it occurring. However, these time limits may change based on certain factors and most merchant agreements require you to make receipt deposits within one to five days of the transaction. If deposits are not made in a timely manner, it can result in "late presentment" chargebacks (i.e., Visa Reason Code 74), which occur when you fail to deposit receipts within the required time frame. Failure to deposit receipts with your acquirer can cause you to lose money and negatively affect customer service.

Log transactions carefully. Make sure that incorrect transactions are properly voided and every consumer is only charged once for their purchase. If transactions are entered into the system more than once, or you deposit both your copy and the bank copy of a transaction receipt, or you deposit the same transaction with multiple acquirers, you can cause the consumer to be charged multiple times for their purchase. If this happens, consumers will likely dispute the multiple charges and the credit card issuer will submit a "duplicate processing" chargeback (i.e., Visa Reason Code 82) against you.

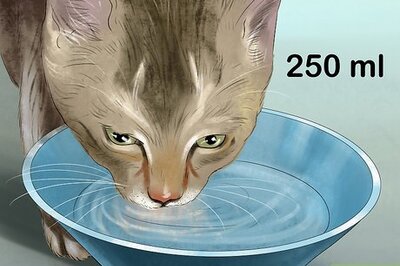

Keep consumers informed. If you are delivering items to a consumer, keep them up-to-date regarding any delays. In addition, let the consumer know when they can expect to have the product at their door. When you communicate with your consumers, you reduce the likelihood that they will dispute a charge.

Ship merchandise before depositing receipts. When you deposit a credit card receipt with your acquirer, it will relay the information to the consumer's credit card issuer and the consumer will be charged on their credit card. If consumers see a charge on their monthly statement before they receive your product or service, they might dispute the charge. Therefore, only deposit receipts after you ship the product or provide the service to the purchaser.

Comments

0 comment