views

Requesting Checks Online From Your Bank

Visit your bank's website. To order checks from your bank, you'll need to visit your bank or credit union's website. If you've never visited their site before you can simply search online for your bank or credit union. If you're ordering checks for the first time, you may need to visit your bank in person or call over the phone so that your bank can verify your identity and your account information.

Enter your user ID and password. If you already have an online account, simply enter your username or ID and password to access your banking page. If you're enrolling for the first time you'll need to confirm your identity, your account information, and you'll most likely need to choose a user ID and password, though the process will vary slightly by bank. There will be some variance from one bank to another, but you'll most likely need to enter your account number, your ATM/debit card number, your ATM PIN, and part or all of your Social Security Number.

Navigate to your account information. Once again, there will be some variance from one bank's website to another. You will need to select either "my account," "checking account," or "accounts services," depending on your financial institution. For Bank of America customers, you'll navigate to "Help & Support," then choose "Checking and savings accounts." From there, simply click "order checks," and you'll be able to customize the design of your checks. For Citizens Bank customers, navigate to the "Accounts Services" section and choose "order checks." For JPMorgan Chase customers, you'll click the "Customer Center" tab, navigate to "Manage Accounts," and choose "Order checkbooks or deposit slips." For TD Bank customers, select the "Customer Service" tab and choose "Order Checks." For Wells Fargo customers, select "Account Services" and click "Order Checks & Deposit Tickets."

Update and confirm your information. Before you finalize your check order, you'll need to update any information that may have changed. If all your information is still the same, you'll simply need to confirm that your account details are correct. Verify your name and address. If you've moved since your last checks were ordered, or if you know you will be moving to a new address in the immediate future, be sure to update your address with the most current information. If you've changed your name (for example, after marriage), you'll want to update that information as well, though for name changes you may need to contact a bank representative over the phone or in person. Verify your account number and/or routing number to confirm that you are ordering checks for the right checking account. If you have multiple checking accounts, ensure that you're choosing checks for the correct account.

Complete the order and wait. Once you've chosen your check design and updated/confirmed your information, you can finalize your order. The cost of ordering checks will vary from one bank to another, but should not be terribly expensive (usually around $25 or less). You may have to give your credit/debit card information, or your bank may allow you to withdraw the cost from your checking account. Then you'll simply wait for the new checks to arrive. Your checks will arrive by mail. The time it takes for your checks to be printed and sent will vary, depending on your bank and the delivery options you choose. Some banks offer expedited shipping, but you will have to pay more for this option. Depending on your bank, you may be able to track your checks' delivery status online. Check under the "order checks" tab of your bank's online account section. If your bank offers this service, you should see something like "review order status." Johnathan Mun Johnathan Mun, Bank Risk Management Expert Before processing a check order, the bank should review the account for any signs of fraudulent activity. Verifying that sufficient funds are available to cover the cost of the check order is also prudent.

Getting Checks Online From a Vendor

Choose an online vendor. If you don't want to order checks through your bank, or if you simply want to shop around for a better deal, you can order checks through an online third-party vendor. You can search around online to find the best deals by entering "order checks online" or "cheap check orders" in a search engine. Be sure that the site you use is secure and legitimate. Once you've found a low-cost check service, you may want to search online for reviews of that service/company to ensure that they are not a fraudulent or scamming company.

Provide your information. If you're ordering through a third-party vendor, you'll need to provide the website with your account information. Unlike your bank's website, the third-party vendor will not be able to simply link with your bank account. If you already have existing checks from your bank, your information will be on the checks. If not, you may need to contact your bank to learn this information. You'll need to provide: your bank's routing number (the nine-digit figure located in the bottom left-hand corner of a check, bracketed by a vertical bar and a colon) your checking account number (located in the bottom-center of a check, usually preceding the individual check number of that check) your address and possibly your phone number the number you want your checks to start on (optional) the date you opened your checking account (not always a requirement, but may be, depending on the state you live in)

Complete your order and wait. Depending on where you order checks from, they will most likely be cheaper than you'd pay through the bank. You'll still have to pay, though, and you'll need to provide the website with your payment information. Then simply wait for the checks to arrive by mail or courier. The cost, delivery options, and delivery time will vary, depending on which service you use.

Verify that your checks are secure. Once your checks arrive, you should ensure that they are safe and secure. You can do this by looking for a padlock icon on the checks. You will most likely see it on the right-hand side of the check, under the box where you'll enter the amount. That icon means that the company (and its checks) have been verified by the Check Payment Systems Association (CPSA).

Finding Alternatives

Call your bank. If you have a bank or credit union but don't have access to their website (or if your financial institution doesn't offer online banking), you should be able to call and order checks over the phone. You should have your bank's phone number on some paperwork or business card from the bank. If not, you can look up your bank's telephone number in the phone book, or by searching online (assuming you have access to the internet). You will most likely need to talk to someone from your financial institution's customer service department. They may have separate phone numbers for personal accounts customer service and business accounts customer service.

Visit your bank in person. Most banks will allow you to order checks by visiting a local branch in person. You can either visit your regular branch, or search online or in the phone book to find the bank branch closest to you.

Try using online checking. Many banks offer online checking (also called paper-free checking or online bill pay). This checking option is often free, as it saves the bank money by not having to print account statements. You can even schedule payments to be automatically sent weeks or months in advance, so you know your checks will arrive on time.

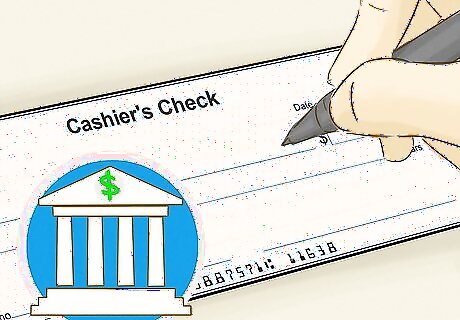

Ordering Cashier's Checks

Learn when cashier's checks are needed. For most purchases, you can write a personal check to cover the cost, and that amount will be deducted from your checking account. For larger purchases, though - for example, paying a down payment on a house or car, or for some security deposits - you'll need a cashier's check. A cashier's check is purchased at the bank, and the amount is withdrawn from your account immediately. This helps ensure that the check will not bounce or be cancelled prematurely, as it basically guarantees payment by the bank to your intended recipient.

Visit your bank. You'll most likely need to request a cashier's check in person at your bank, though some banks may let you order a cashier's check online if you're already a customer. If you need to visit the bank in person, you can simply go to your regular bank location, or search online or in a phone book to find a location near you. If you do not currently have a checking or savings account at any bank, you may still be able to request a cashier's check by paying cash to the bank of your choosing, with an additional fee for the service. You may want to call a bank first to find out if you can request a cashier's check if you do not have an account at that bank. You'll need to bring a valid photo ID with you in order to request a cashier's check. Cashier's checks may have a cap.

Speak to a bank teller. Once you arrive at the bank, let the bank teller know that you need a cashier's check. You'll need to tell him or her how much the check should be for and to whom it should be addressed. Cashier's checks usually come with a fee. If you are a customer with that bank, your payment will likely be less than that of someone who is not a customer. For example, at Bank of America, if you have a checking or savings account you will be charged $10 for a cashier's check. If you do not, you'll be charged $20.

Sign the check. Once the bank teller has made out your check and you've paid any fees for a cashier's check, you'll need to sign the check. Then you'll be on your way. You can use your cashier's check to make whatever payments you need to.

Comments

0 comment