views

X

Research source

Investments

Buy dividend stocks that distribute income on a quarterly basis. It can take you a lot of time (and money) to build up enough dividend stocks in your portfolio to live off of. But if you invest consistently and reinvest your dividends until you get to the point that you can live off of your passive income, dividends can be a great passive income stream. For example, if you have $1,250,000 worth of stocks that yield 4% annual dividends, you would be making around $50,000 a year in passive income. Investing in the stock market can be risky—there's no guarantee that you'll make this income, or any income at all, from your investments. However, stocks that consistently issue dividends tend to be among the most stable. They're also going to have a higher price tag per share.

Invest in bonds that will pay off when they mature. If you're building a portfolio to generate passive income, put a good portion of your cash into bonds. When you buy a bond, you're essentially loaning money to a company or government. When the bond matures, the company or government pays back your loan—with interest. You can buy bonds from any broker that sells stocks and other investments and they'll sit in your portfolio until they mature. You could potentially sell them before then, but that's usually not going to be in your best interest. When the bond matures, you'll get back the money you initially invested, plus interest. You can then turn around and reinvest all of that money, or keep it to live off of. Pay attention to the bond rating. The higher the rating, the more likely that the bond will be paid back. Bonds with lower ratings may potentially pay more, but they come with a lot more risk that the company or government behind the bond will default.

Keep your savings in an account that earns interest. You don't want to have all your money tied up in stocks and bonds, but you can still put your savings to work for you. Certificate of deposit (CD) accounts tend to earn interest at a higher rate than regular savings accounts. Make sure the interest you earn from your savings outpace inflation. You typically can't withdraw from these accounts for several years after you open them, so don't use one for your emergency fund or money you might need to access quickly. The nice thing about these accounts is that the income is guaranteed—even though you might have to wait several years to get it.

Real Estate

Get into real estate crowdfunding if you're starting from scratch. With real estate crowdfunding, you don't necessarily need to have a fortune stockpiled to start making money. You and other investors pool their money together to purchase an investment property and your return on your investment is based on the proportion of the funding you paid in. You can get started with real estate crowdfunding online through sites such as Fundrise and Roofstock. Real estate investment trusts (REITs) are another option. You can buy shares of these through your stock broker, just as you would shares of stock.

Start with a property that you can also use. If you've always wanted to have a beach house or a loft in the city, this could be your chance. Look for a property you're interested in using part of the time and rent it out the rest of the time to cover the costs (and maybe even make a little extra). House-sharing services, such as Airbnb or HomeAway, allow you to market short-term rentals relatively easily. You can block off times when you want to use the property yourself.

Expand your ownership gradually with additional properties. It takes some time to generate truly passive income from real estate. Wait until the mortgage on your first property is at least 50% paid before you start shopping for another property to add to your holdings. That way, your real estate business isn't underwater. Keep your eye open for good deals so you can jump on them quickly. Being fast and flexible is an important part of buying investment real estate. Stay in contact with real estate professionals, including brokers, agents, and attorneys, so you're ready to go when a potential deal catches your eye.

Hire a property management service so you can be hands-off. Being a landlord is anything but passive. If you want your real estate to generate passive income, you can't be involved with the day-to-day grind of managing the property and its tenants. Property management services do the work for you so all you have to do is collect the income your properties generate. If you don't use a property management service, you'll likely find that you don't have enough time to manage your rentals properly—especially if you also have a day job. Check reviews of property management services before you pick one. Stay away from those that get consistently poor reviews from tenants. While it's no secret that many tenants have a less-than-friendly relationship with their landlords, consistent negative reviews indicate this company will likely do more harm than good for your business.

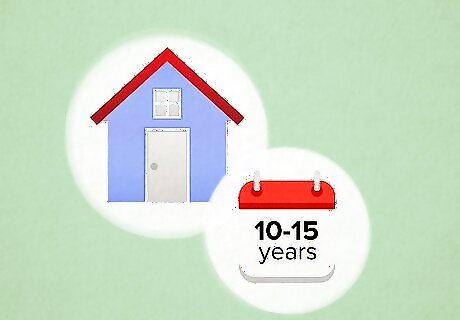

Hold real estate for the long term so it increases in value. While "house flipping" is trendy, it takes a lot of constant work. To earn passive income off of real estate, plan on holding onto it for at least 10-15 years, if not longer. You'll see dips in the real estate market, but property typically increases in value over time. If your property is being managed by a property management company, it shouldn't require a lot of day-to-day work on your part. However, it will still require your attention from time to time. Periodically (such as whenever tenants move out) inspect your property and see what needs to be repaired or what can be inexpensively upgraded so you can increase the rent you're getting from the property.

Internet Content

Find your niche or area of expertise. The key to generating passive income through internet content is finding something that you're an expert at, something that you have to offer that no one else (or very few others) have. If you have extensive education and experience in a particular area, this might be easy for you to figure out. Otherwise, you might have to do a bit of soul searching. For example, if you're a CPA and passionate about personal financing, you might start a personal finance blog to help people straighten out their money situation. This works for creatives too! If you're passionate about doing Renaissance-style oil paintings of cartoon characters, you can turn that into passive income online. Make sure your niche is something you're passionate about so you're consistently curious and excited about it. Excitement and enthusiasm about a topic are contagious and will bring more people to your site.

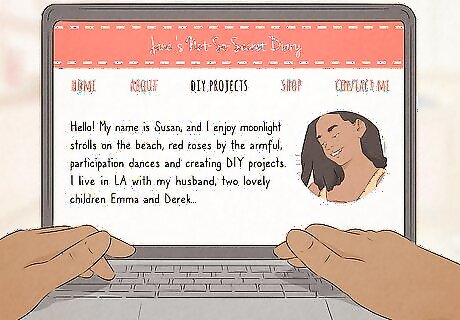

Create a website or user account to house your content. The traditional way to generate passive income online is to create your own website and start writing a blog—but you don't necessarily need to do this. If you're not very tech-savvy and aren't a good writer, you can still build a brand that generates passive income by creating other types of content, such as videos or pictures. A basic website is relatively inexpensive to put up (think less than $100, including domain registration and hosting) and can serve as your launching pad for all of your online endeavors. But you can also launch from a social media platform, such as a Facebook page or an Instagram account.

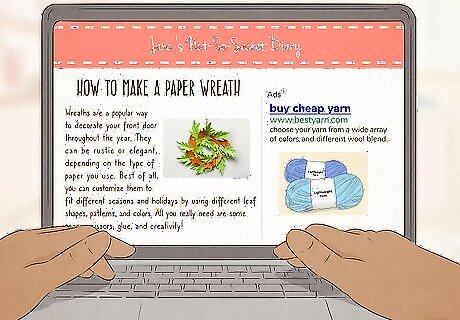

Put display ads on your website to generate passive income. If you do have a website, adding advertising is a basic way to earn passive income. It might not amount to much at first, but you'll get more money when your website gets more visits. You do the work of building traffic to your website through promotion while the display ads sit there and earn you income. Display ads are usually set up through networks. Once you sign up for the network, you don't have to do anything (other than sit back and watch the money roll in). The advertising network pays you based on the traffic to your site. Display ads are potentially earning you money 24/7 and you don't have to do a thing—the definition of passive income.

Promote other products and services with affiliate links. With affiliate links, unlike with display ads, you only get money if your readers click the link and buy something. This means you'll have to do a little more work promoting these products to convince your readers to buy them. But if you can be persuasive, you can earn quite a bit of passive income this way. You don't necessarily have to start a blog to build up a steady stream of passive income with affiliate links. You can use social media as well, including platforms such as Instagram or YouTube.

Put up a paywall on your blog. With a paywall, you require your readers to pay a monthly subscription fee to access the bulk of your content. This won't do you much good if you don't have a lot of traffic. But once you get to the point where you're getting tens of thousands of visitors a month, you'll likely have some readers interested enough to pay for your content—and this is where a paywall comes in. Some blogging platforms, such as Medium, allow you to put content behind a paywall to generate passive income from subscribers. It doesn't require a lot of effort on your part and you'll earn money every time a subscriber pays their monthly fee. If you don't have a blog, you can also use a service such as Patreon to pick up money for additional content. For example, if you have a YouTube channel, you could offer bonus videos through a Patreon account for subscribers only.

Expand across multiple platforms to generate additional income streams. You can certainly stick with one platform to get your message and content out—but why not 3 or 4? As long as you keep them all active and consistent, you can reach more people if you work across several platforms. When it comes to social media, each platform caters to a slightly different user. Facebook and Twitter are nearly universal, attracting a broad mainstream. LinkedIn content is primarily professional, based on industry issues, politics, and economics. For more creative and entertaining content that appeals to younger users, try Instagram or TikTok. You don't have to post on social media as much as you post on your main account or website, but keep it predictable. For example, you might tweet 3 times a week. You can curate posts from others that fall in line with your own niche and personal branding to fill in the gaps of your own content.

Publish a book based on your internet content. If your blog takes off, why not earn a little extra income with a book? Plenty of people prefer to read a book over scrolling a blog, and you can include some of your best (and most popular) content along with some new stuff. The number of followers or subscribers you have online gives you a general idea of how many books you might sell—but don't expect all of those people (or even most of them) to buy your book. The ones who interact with your posts on a regular basis are most likely to buy it. If you have a particular area of expertise, you might also think about writing a "how-to" book that falls into your niche. For example, if you're great at organizing and de-cluttering, you might write a book that teaches people some of your favorite tricks.

Comments

0 comment