views

X

Research source

With this widespread attention, the process of investing in Bitcoin has recently become easier than ever before. However, it's important to note that Bitcoin isn't an ordinary investment (like, for instance, stock) — it's more like an extremely unstable commodity, so don't buy before you understand the risks.

Buying and Selling BTC

Create a Bitcoin Ledger wallet. Today, buying and selling Bitcoin is easier for beginners than ever. As your first step, you'll want to sign up for something called a Bitcoin wallet. Like its name suggests, your wallet is a digital account that makes it fairly easy and convenient to buy, store, and sell your Bitcoin — think of it like a universal Bitcoin checking account. Unlike a checking account, however, starting a Bitcoin wallet usually takes less than a minute, can be done online, and is quite easy. Sites like Coinbase.com, Coinmkt.com, Blockchain.info and Hivewallet.com are are just a few examples of reputable, reliable and user-friendly sites for beginners to create their first wallet.

Link your bank account to your wallet. Once you have a wallet, it's time to fill it with Bitcoin. Typically, to do this, you'll need to supply the financial details for a real-world bank account just like you would if you were setting up a PayPal account or signing up for another online payment service. Usually, you'll need at least your bank account number, the routing number for the account, and your full name as it appears on the account. You can almost always find these on your online banking account or on your paper checks. Note that you may also be asked to provide contact information, like a phone number. To be clear, linking your bank account to your Bitcoin wallet is not any more of a risk to your personal security than it is to shop online. Virtually all reputable Bitcoin services make a point to advertise their high standards for security and encryption. While Bitcoin services have been targeted by hackers in the past, so too have many major online retailers. It may also be possible to use your credit card to buy Bitcoin instead of your bank account.

Buy BTC with money from your bank account. Once you've supplied your bank information and it's been verified by the Bitcoin service, it should be fairly easy to start purchasing BTC and adding it to your wallet. Usually, on your wallet page, there should be an option labeled "Buy bitcoin" or something similar — clicking this should take you through a straightforward transaction process that uses money from your bank account to purchase BTC. Note that the price of Bitcoin can (and does) change from day to day — sometimes significantly. Because Bitcoin is a relatively new form of currency, its market has yet to become stable. The current dollar-to-BTC exchange rate should be clearly listed when you buy it — as of October 2014, 1 BTC was equal to about $350.

Use your Bitcoin to buy from retailers that accept it. In recent years, an increasing number of businesses have begun to accept Bitcoin as a valid form of payment. Though these businesses still represent a minority, some major names have already made the transition. Below is just a short list of online vendors that accept BTC: Amazon Wordpress Overstock.com Bitcoin.travel Victoria's Secret Subway Zappos Whole Foods If you're market-savvy (or lucky), you can conceivably generate value for yourself this way by buying Bitcoin when its price is low, then purchasing goods when the value of Bitcoin is high to get a favorable deal on the goods. You can then sell these goods to make a profit or simply keep them.

Sell your Bitcoin to another user. Unfortunately, selling Bitcoin isn't quite as easy as buying it. There is no easy way to "cash out" your Bitcoins and receive money in your bank account — instead, you'll have to find a buyer who's willing to pay for them with money (or good/services). In general, one of the easiest ways to do this is to sign up with an online Bitcoin marketplace. Once you find a buyer, you will complete the transaction through the website but will otherwise deal directly with him or her. To use this method, you'll usually have to register a seller account and verify your identity in a process separate from the one used to create your wallet. In the US, CoinCola, CoinBase and LocalBitcoins are three websites that offer this sort of selling service. In the UK, BitBargain and Bittylicious are two reputable options. In addition, some sites like Purse.io allow sellers to give Bitcoin to buyers who then use their own money to purchase goods online and send them to the seller — in essence, this is a roundabout way of using Bitcoin to buy from vendors that do not accept the currency.

Alternatively, sell your Bitcoin on an exchange. Another option for sellers is to use a Bitcoin exchange. These sites work by pairing sellers with prospective buyers. Once a seller is found, the website acts as a sort of intermediary or escrow service, holding the money until both parties are verified and the transaction is completed. Usually, there is a minor fee associated with this service. Selling with this method is not usually an instantaneous process. In some cases, users have even complained that exchange services can take an inordinate amount of time to complete transactions compared to other options. Reputable, well-known exchanges include Circle, Kraken, and Virtex. In addition, some exchange sites like Binance, Bittrex, Bitfinex and Bitcoinshop allow you to trade Bitcoin for other digital currencies (like Dogecoin, Ethereum, Litecoin and Monero).

Using Alternate Options

Consider setting up a regular purchase scheme. If you're serious about investing in Bitcoin, you may want to devote a small portion of each paycheck towards buying the virtual currency — this is a great way to amass lots of Bitcoin over time without any major one-time expenses. Many Bitcoin wallet sites (like, for instance, Coinbase) offer the option to set up regular withdrawals for the purpose of buying Bitcoin. This generally works a little like regular withdrawals for a 401k — you specify a certain amount of money, and this money is withdrawn from your account at regular intervals and used to buy Bitcoin automatically.

Consider buying Bitcoin locally. If you'd like to keep your money in the local community, consider using a service that allows you sell to people near you. Rather than pairing you with anonymous online buyers from anywhere in the world, certain sites give you the option of searching for sellers in your local area. If you choose to meet with these sellers in person, observe all of the normal precautions you would for meeting someone you met online — meet in a public location in the daytime and, if possible, don't show up alone. See our article on the subject for more information. Localbitcoins.com is one of the most prominent local bitcoin marketplaces online. The site allows you to search for buyers in over 6,000 cities and 200 countries, including the US.

Consider buying into a Bitcoin investing company. One option that's often advertised as being "less risky" than buying and selling Bitcoin directly is to put money into an investment agency. The Bitcoin Investment Trust, for instance, allows users to buy and sell stock in the company just as they would for any other company. The Trust then uses the money to buy and sell Bitcoin with the goal of making money for the investors. Because the company deals solely in buying and selling Bitcoin, the company's share price is directly tied to the price of Bitcoin. However, some users find this option preferable because the professional investors at the Trust are (presumably) experts and because it allows them to forgo the process of finding sellers and managing their Bitcoin accounts on their own.

Consider "mining" Bitcoin. Ever wonder where Bitcoins come from? In fact, new Bitcoins are created through a complicated computing process called "mining." In very simplified terms, when mining BTC, your computer competes with other users' computers to solve complex problems. When your computer solves the problem first, you are awarded Bitcoin. The supposed benefits of mining include the fact that you are essentially "making" BTC for yourself without using any of your real-world money. However, in practice, maintaining competitive status as a Bitcoin miner can involve substantial investments in specialized hardware. The entire mining process is a complicated one that is beyond the scope of this article. For more information, see our Bitcoin mining article. In addition, it's important to understand that because Bitcoin are awarded in "blocks" of multiple Bitcoin at once, it's usually in your best interest to join an established "pool" of miners, which will allow you to work together towards solving the block and share the rewards. Going it alone can make you very uncompetitive as a miner — you may go a year or more without making a single Bitcoin.

Making Money on Your Investment

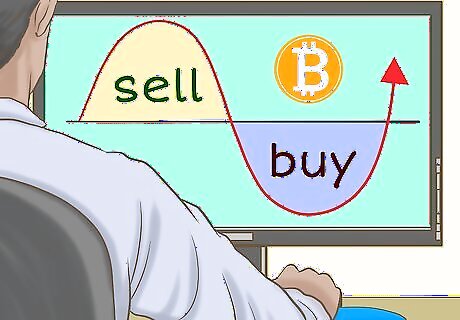

Buy low, sell high. At its core, the strategy for buying and selling Bitcoin isn't much different than that for buying and selling stocks or commodities in the real world. Buying Bitcoin when the dollar exchange rate is low and selling it when the exchange rate is high is a money-making proposition. Unfortunately, since the Bitcoin market is so volatile, it can be extremely difficult to predict when the Bitcoin price will rise or fall, so any Bitcoin investment is inherently risky. As an example of the Bitcoin market's volatility, in October 2013, the price for Bitcoin was hovering around $120-$125 per Bitcoin. Within a month and a half, the price had shot up almost tenfold to nearly $1,000 per Bitcoin. A year later, the price was a third of its peak value at about $350 per Bitcoin. It is unknown when the next price spike will occur (if ever).

Stay up-to-date on Bitcoin market trends. As mentioned above, it's impossible to predict which way the Bitcoin market will go with certainty. However, your best hope for making money off of a Bitcoin investment is probably to monitor trends in the marketplace frequently. Because the Bitcoin marketplace can fluctuate rapidly, money-making opportunities like spikes in the exchange rate can appear and disappear in a matter of days, so keep a close eye on the exchange rate for your best chance at success. You may also want to become a member of Bitcoin discussion forums (like, for instance, the forums at Bitcointalk.org) so that you can communicate with other investors about market predictions. Keep in mind, however, that no investors, no matter their expertise, can predict the Bitcoin market with certainty.

Use Bitcoin wealth to purchase more stable investments. One possible way to gain some stability out of your Bitcoin wealth is to use it to buy more stable investments, like stocks or commodities. Certain sites will allow you to do this — for instance, Coinabul.com allows you to purchase gold with BTC. You might even want to sell your Bitcoin and use the money to invest in the stock market or in bonds. While a conservative stock portfolio generally offers the best potential for stable, moderate growth, most financial experts agree that even relatively risky stocks generally have a lower capacity for fluctuation than the Bitcoin market.

Never put more money into Bitcoin than you can afford to lose. As with any sort of risky investment, it's best to think of the money you put into Bitcoin as money you're "playing" with — if you profit, that's great, but if you lose it, you won't be financially ruined. Don't put more money into Bitcoin than you can't reasonably survive without. Bitcoin can vanish in the blink of an eye (and have done so in the past), so the consequences for gambling too much money on Bitcoin can be dire. Don't buy into the sunk cost fallacy — the idea that you're "too deep" into an investment to pull out. Missing a price spike and selling at a slight loss is better than waiting and selling at a large loss.

Comments

0 comment