views

- Earn as much as you can through your career by seeking training or education and asking for a pay raise when you’re due for one.

- Start saving money as soon as possible. Save at least 15% of your annual income, putting aside a small portion of every paycheck.

- Invest in your retirement by opening a Roth IRA and 401(k) as soon as you can. Make even more money through smart stock market investments as well.

Getting the Most From Your Career

Seek training or education to increase your earnings potential. Whether it's a four-year college or vocational training, it’s easier to get rich with an education under your belt. During the early stages of a career, employers largely judge you based on your educational background. Plus, having that background will enable you to get a higher salary at the start of your career and in the long run. You could also find a mentor who can help you build valuable career skills. Mentors are experienced professionals who know a lot about their fields and can help you get a head start in your career through extra training.

Ask for a pay raise at your job when you feel you deserve one. As you gain experience at work, document your successes and achievements so you can present a record of your work when it’s time to ask for a raise. That way, your employer can see exactly why you’re such an asset—and they’ll most likely be willing to give you the raise you want.

Get a second job if the first isn’t paying as much as you’d like. Another money-building alternative is looking for a second income stream to supplement your first. This gives you even more money to live on in the here and now while setting aside a little with each paycheck. Basically, the more income you have access to, the more you can stockpile your wealth for the future. Even if you don’t get a proper “job” as your second source of income, you could start up a small side hustle and devote several hours each week to it. Consider your skills and talents. You could start a side hustle doing odd jobs, taking art commissions, or delivering food.

Consider choosing a career with good salary prospects. If you’re still picking your career or feel your current career isn’t getting you enough money, you might want to consider choosing a new career that typically pays well. Study salary surveys indicating the average annual incomes for specific professions; your odds of getting rich increase when you pick a high-paying career. Doctors and surgeons typically have larger salaries. Anesthesiologists can make a whopping $200,000+ per year. Engineers who work with gas and oil companies can make a very good living. In most cases, they make upwards of $135,000 per year. Lawyers top out at just above $130,000 per year, making it a lucrative field if you can put in the time. IT managers and software engineers can make around $125,000 per year. If you're good at programming and a whiz at computers, consider this very well-compensated field.

Look for new jobs and employers to grow your career. Once you've gotten some experience under your belt, consider finding a new, better-paying job in the same industry. You can increase your pay and experience different corporate cultures by changing your environment. Don't be afraid to do this several times! If you're a valued employee, your current employer may offer you a raise or other benefits to keep you. On the other hand, you might be able to get an entry-level job and then work your way up the ranks if you work for a company that pays well and typically promotes internally. Stick it out at your current job if you’re comfortable and see the potential for the future, but don’t be afraid to look for something better if you’d rather be doing something else! Think about the best place to live, too. Certain careers are easier to pursue in specific areas. For example, entertainment jobs are usually numerous in cities like New York and Los Angeles.

Saving Money & Cutting Costs

Set financial goals and decide how much you want to save. The first step to saving money is making a plan. Start by asking yourself questions to determine your exact financial goals. When do you want to retire? Are you saving up for things like a family or a child? What do you want to do once you’re wealthy? Set your goals and figure out roughly how much money you need to save to fulfill your idea of “rich.” When determining how much money you want to accumulate, be sure to make an emergency fund one of your goals if you don’t already have one. Emergency funds typically equal 3 to 6 months of living expenses. Should anything happen, like the loss of a job or a medical emergency—they allow you to pay for what you need without experiencing financial turmoil.

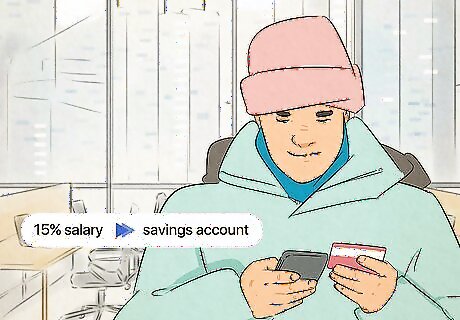

Save 15% of your annual gross income. Every time you get paid, put a chunk of money into your savings and don’t touch it. Calculate 15% of each paycheck and commit to saving that amount every time you’re paid. Then, see if you can start saving even more as time goes on; 15% is a good minimum, but 20% of your total income is an even better goal. Getting rich usually isn’t an immediate process; it’s the result of dedicating saving, budgeting, and investing. The more you save now, the more you’ll have later! Remember: it can be tempting to buy fun things with the leftover money in your paychecks, but being a little more conservative and focusing on savings can help you get rich in the long run.

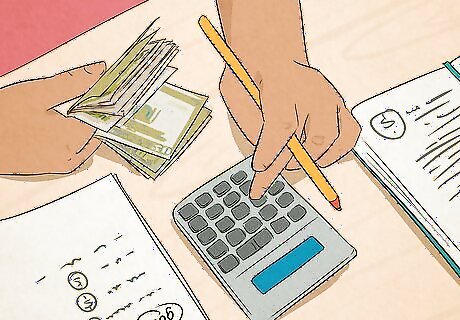

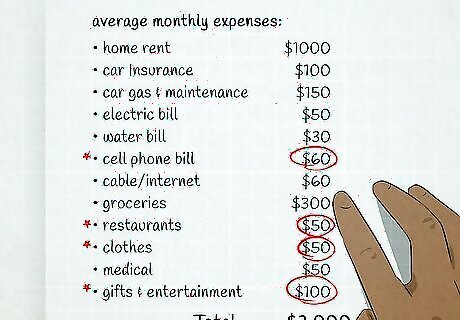

Make a monthly budget and stick to it diligently. Create a monthly budget that covers all of your basic expenses and planned savings as illustrated above while leaving a little bit of "fun" money aside if possible. Sticking by your budget and saving at least some money each month is a good way to lay the groundwork for your efforts to get rich! Try using a budgeting app like Mint or Everydollar to build a budget.

Keep track of all your expenses to save money efficiently. Tracking your expenses is crucial to cutting costs efficiently and adhering to your monthly budget. The closer you monitor your personal spending, the easier it’ll be to stick to the budget and build your wealth! Pick an expense-tracking app (Mint and Everydollar can also do this) and record every single cent that goes in and out of your wallet. After 3 months or so, you’ll be able to find out where most of your money goes and where you can make it go even further.

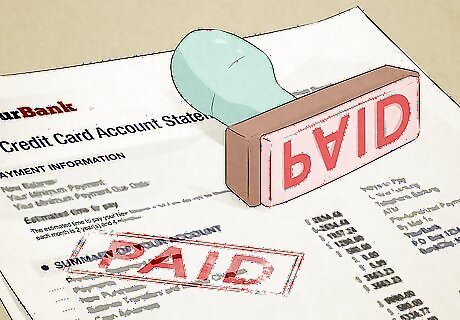

Get rid of all your debts and commit to staying debt-free. Debt will keep draining your money as you make it, making it pretty hard to get rich as long as you have any debt attached to your name. If you have any debt, make paying it off one of your top financial priorities. Once you’re debt-free, do your best to stay that way for the foreseeable future! Try to use cash (or debit) more than you use a credit card. People who use credit cards for purchases often end up spending more money, and it’s easy to get into debt if you can’t pay off your card every month. If you do keep using a credit card regularly, try to pay off the full balance each month on time to gain interest-free credit and avoid late fees. Consider refinancing your home if you have a large 30-year mortgage, take on a 15-year mortgage instead. That way, you can pay off your debt faster and save money by paying fewer interest fees.

Look for ways to reduce your living expenses. There are plenty of corners you can cut in your everyday life to help you save money. Saving a few bucks here and there might not feel like “getting rich,” but it’ll absolutely make a difference in the long run. The money adds up, which is why simple things like reducing the number of times you eat out every month can end up saving a ton of money. If you’re looking for dramatic ways to reduce your living expenses, consider downgrading your car or house. You might be able to make do with an apartment instead of a house or buy a used car instead of a new one. Avoid going to Starbucks every morning. That $4 you spend on designer coffee every morning comes out to $28 per week or $1,460 over the course of a year! Reduce your utility bills like electricity and gas, and be smart about keeping your home warm and cool.

Live a modest lifestyle, even as you start earning more money. As you start accumulating more money from your career, savings, and investments, spending more money and living a more extravagant lifestyle can be tempting. However, the easiest way to maintain wealth and get rich is to resist that urge and continue saving and investing more. Say you’re already living in a great apartment in a nice part of town, paying $1,200 each month in rent. Do you really need to upgrade to a $1,600 apartment just because you could potentially afford to? This doesn’t mean you can’t get into a more livable space if your current conditions aren’t working for you. Just be mindful of when you’re spending money because you can and when it’s really necessary.

Make smart purchases and steer clear of financial black holes. It's hard enough to make a living without spending your hard-earned cash on things that don’t matter and won’t help you get ahead. Reevaluate the things you spend money on, and work on managing your money wisely. Figure out when things are truly “worth it” and when it’s just frivolous spending. For example, things like casinos and lottery tickets are statistically unlikely to help you get rich and are more likely to drain your wallet over time. Consider whether something like a first-class plane ticket is worth the extra $1,000 (or more). Sure, it’s comfortable, but you’ll reach your destination just fine in coach—and you can save that extra money. Avoid purchases that depreciate rapidly—like buying a new car worth $50,000 or more. That can be a waste because it won’t be worth half that much in 5 years; a cheaper car can serve you just as well and be more financially efficient.

Investing Money Wisely

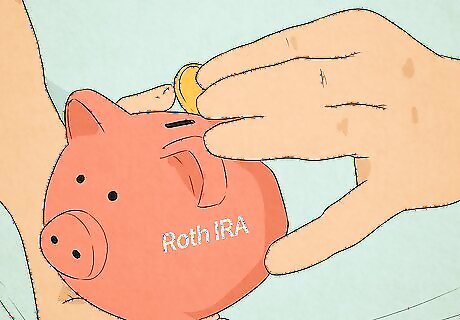

Invest in an IRA or Roth IRA to prepare for retirement. You might not instinctively associate “retirement funds” with “getting rich,” but the truth is, if you save (and invest) your money wisely, you can retire with millions! That starts with making a plan for retirement and taking advantage of tax-deferred retirement plans like IRAs (individual retirement accounts). The tax treatment they provide will help you save money faster. Roth IRAs are especially valuable. Working individuals can contribute an annual sum of up to $5,500 in their Roth IRA, and their money then gathers compound interest. So, if you wait until retirement age to take money out of your Roth IRA, it won’t be taxed because it was already taxed when you first earned it. Basically, you’ll make a ton of money without having to give any away! Set up a Roth IRA account as soon as possible, even if you can’t contribute much money at first. The earlier you start investing, the more money you’ll have later.

Contribute to a 401(k) account to save money for retirement. 401(k)s are accounts set up by your employer, where pre-taxed contributions can be invested. If your employer offers 401(k)s with contribution matching, that’s a great way to give yourself a solid monetary foundation for retirement. Between a 401(k), an IRA, and any other pension or Social Security funds you get, you can retire rich if you invest early. Contribution matching is probably the closest thing you’ll find to “free money” in your life! Be sure to take advantage of it if your employer offers. Don’t rely entirely on Social Security for your retirement. Social Security was never designed to be the only resource for retirees in their later years, so it’s important for you to invest your own money too!

Put money in the stock market. Invest money in stocks, bonds, or other vehicles of investment that’ll give you an annual return on investment (ROI) large enough to last you through retirement. Choose wisely: look for good stocks and passive funds with solid fundamentals and excellent leadership in industries that are poised to grow in the future. Then, let your stock sit and make you money over time. For instance, if you have one million dollars invested and you get a reliable 7% ROI, that's $70,000 per year, less inflation. If you're starting with a small amount of money to invest, index funds might be a good option for you, as they have low fees and can give you some relatively safe exposure to the stock market. Don't be fooled by day traders who promise you quick profits. Buying and selling dozens of stocks every day is essentially gambling. If you make a few bad trades — which is easy to do — you can lose a lot of money.

Invest in relatively stable assets like real estate and rental properties. If you have the ability, consider investing in real estate to build your fortune. No investment has concrete guarantees, but historically, many people have done well for themselves by accumulating real estate because that kind of investment appreciates in value over time. For example, some people think that an apartment in Manhattan is almost guaranteed to increase in value over any five-year period. Apartments and apartment buildings are valuable real estate because you can rent them out to other people as well. You could also invest in potential development land in a steadily growing area; that kind of real estate is also likely to grow in value over time.

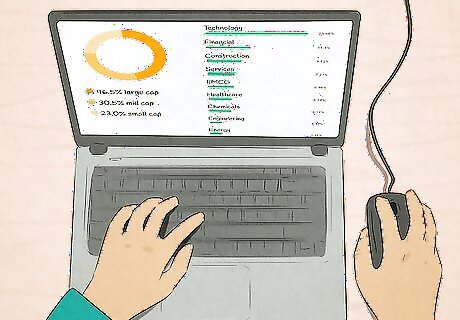

Diversify your portfolio of investments. One of the best ways to get rich through investments is to invest in a lot of different asset classes rather than pouring all your money into one or two investments. Putting all your eggs in one basket can be risky financially, especially during stock market fluctuations. A diverse portfolio protects you and puts you in the best position to make lots of money from your investments. You can take on riskier investments (if you want to) when you’re young and have the time to recoup any money you lose. As you get older, shift to investing in less-risky assets to protect your fortune.

Get help from a financial advisor if you want investment advice. If any part of getting rich feels overwhelming, you don’t have to do it alone! Financial advisors can help you make sense of your current finances and help you create a plan to build your wealth moving forward. They can also maintain your current investment portfolio for you.

Comments

0 comment