views

X

Trustworthy Source

Internal Revenue Service

U.S. government agency in charge of managing the Federal Tax Code

Go to source

[2]

X

Trustworthy Source

Internal Revenue Service

U.S. government agency in charge of managing the Federal Tax Code

Go to source

Getting Your W-2s from the IRS

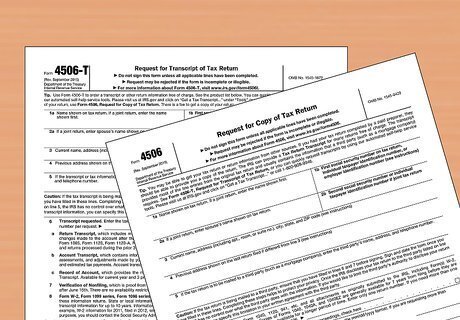

Determine whether you need full copies or transcripts. If all you need is the wage information, you may be able to use a transcript rather than official copies of your returns. A transcript shows most line items from your tax return. However, it doesn’t show any changes made after you filed the return, and it doesn’t include state or local tax information. If you need an actual copy of your W-2, you must request full copies of your tax returns for the years you need. You also must pay a $50 fee for each tax year's returns that you request. However, you will only receive an actual copy of your W-2 if you paper filed your taxes and submitted a copy of your W-2. Keep in mind it may take up to 75 days for the IRS to mail your tax returns to you.

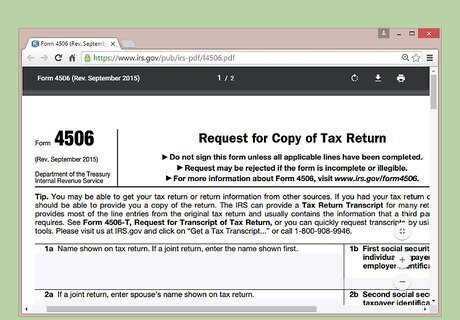

Request a copy or transcript of your return. You can get wage information from the IRS for taxes filed within the past 10 tax years. To request copies of your full return, use Form 4506, available at http://www.irs.gov/pub/irs-pdf/f4506.pdf. If all you need is a transcript, you can use Form 4506-T, available at https://www.irs.gov/pub/irs-pdf/f4506t.pdf. You also can call 800-829-3676 and ask for the IRS to mail you a copy of the appropriate form. You also can look at transcripts for any of the past 10 tax years online for free. Go to the IRS's online transcript tool at http://www.irs.gov/Individuals/Get-Transcript and follow the prompts to verify your identity.

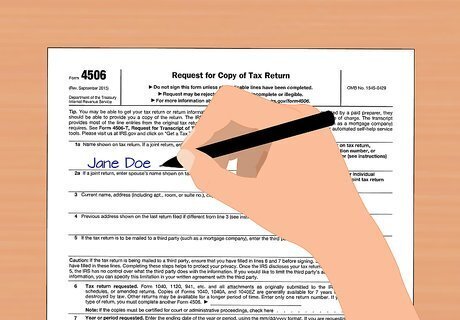

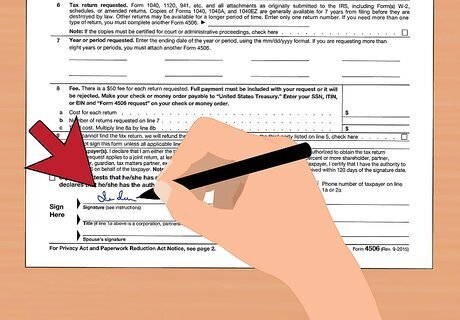

Fill out Form 4506 by printing legibly in blue or black ink. The IRS will reject illegible forms. Some PDF software allows you to type in the fields, although you still must print it out and sign it. Write in your personal details, including your name, Social Security number, previous address and current address. If you filed the return you are requesting jointly with your spouse, you also must include the same personal information about him or her. If a third party needs the tax return sent to them, write in that name. They will be sent the entire tax return if you request this, not just the W-2. Banks and mortgage companies sometimes request tax returns. Enter the type of tax return you are requesting and the ending date for each return you are requesting. You can request up to 8 years of tax returns using one form. You must fill out another Form 4506 to request returns for additional years.

Sign and date the form. If your return was filed under a different name, such as a maiden name, sign the form using that name. Then sign it again using your current legal name. If you filed a joint return, the IRS will provide copies of your return to either spouse. Only one signature is required.

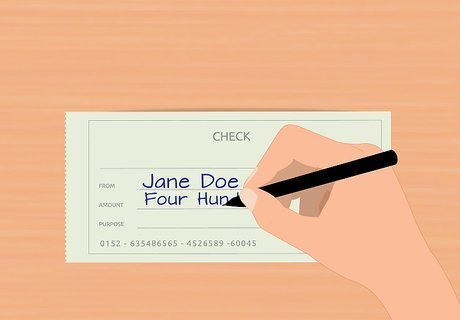

Write a check or money order to the “United States Treasury.” You must include a $50 payment for each return you request. For example, if you requested 8 years of tax returns, you would include $400. If the IRS is unable to find the tax forms, it will refund your money. Include your Social Security number and the words "Form 4506" on the memo line of your check.

Find the address for your IRS regional office. Make sure you select the correct address. Each state is part of a regional office that processes the forms. Business and individual tax returns are processed at separate addresses. Address your envelope to the "Internal Revenue Service."

Mail your Form 4506 with the appropriate postage. Make a copy of the form and your check or money order for your records before sending. It can take up to 75 days to receive your tax return with the W-2 copy.

Getting Your W-2s from Social Security

Figure out which years you need. The SSA can send you copies of your W-2s for any year from 1978 to the present. If you need several years, keep in mind you may be charged a fee for each year. The fee may be more than the fee to get a complete copy of your tax return from the IRS including any W-2s filed that year. As of January 2019, the fee to retrieve your W-2 from the SSA is $86. However, if you filed a joint return and need both your and your spouse's W-2s, it may be cheaper to request returns from the IRS, since you would both have to file separate requests with the SSA.

Write a letter to the SSA. You must submit your request for W-2s in writing. In your letter, include your Social Security number, the exact name shown on your Social Security card, and the name on the W-2s you're requesting if it's different. For example, if you changed your name when you got married two years ago and need your W-2s from four years ago, you would also need to include your maiden name. Tell the SSA the years for which you need copies of your W-2s and the reason for your request. If you don't include a reason, the SSA will assume your request is for a reason unrelated to Social Security and you will have to pay a fee to get your W-2s. Provide your daytime phone number and the complete mailing address where you want your W-2s sent. When you've finished your letter, print it off and sign it. Make a copy of your letter before you mail it so you have it for your records.

Include payment if necessary. You only get copies of your W-2s from the SSA for free if you need them for a Social Security-related purpose. For example, if you need copies of your W-2s to file tax returns, provide income information, or establish residency, these would be considered non-Social Security-related purposes. As of January 2019, the fee is $86 for each year's W-2 you request. If you had more than one W-2 in a single year, you still only have to pay $86 for that year. You can pay the fees by sending a check or money order made out to the Social Security Administration. Make sure you include your Social Security number on your check. You also can pay by credit card. Simply fill out Form 714, available at https://www.ssa.gov/forms/ssa-714.pdf.

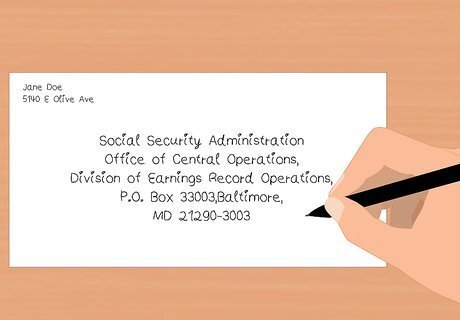

Mail your request. Requests for copies of W-2s must be sent to the SSA's Office of Central Operations. Send your request to Social Security Administration, Office of Central Operations, Division of Earnings Record Operations, P.O. Box 33003, Baltimore, MD 21290-3003. You can expect to receive your W-2s in the mail within three to four weeks.

Getting a Missing W-2

Contact your employer. Sometimes, W-2 forms from employers are not sent, or they get lost in the mail. If you’re missing your W-2, contact your employer before contacting the IRS. Employers have until January 31 of the year taxes will be filed to send a W-2 to employees. If you haven’t received a W-2 by January 31, contact your employer. Make sure your employer has your correct address. If the address was incorrect, the form may have been returned. Allow two weeks for your employer to resend the W-2.

Contact the IRS. If you haven’t received your W-2 by February 14 of the tax year, call the IRS at 1-800-829-1040. You will need to give them your name, address, city and state, zip code, SSN, and phone number. You must also have the following information: Employer’s name, address, city and state, zip code, phone number, and dates of your employment. You will also need an estimate of the wages you earned and the federal income tax withheld. This estimate should be based on information from your pay stub or leave-and-earnings statement, if possible.

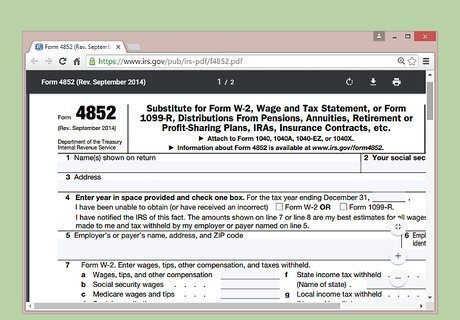

File your tax return on time. Once you have requested your W-2 from the IRS, continue with filing your tax return. You should file your tax return by the deadline of April 15th even if you haven’t yet received your W-2 form. You can file Form 4852, which is a substitute for Form W-2 to use when you have not gotten a W-2 from your employer. Estimate your income and taxes as accurately as possible; you may wish to have a tax preparer help you. If you need more time to file your return, you can get a six-month extension from the IRS. File Form 4868 before the tax deadline of April 15th. If you get the missing W-2 after you’ve filed your tax return, you must correct any information that was incorrect on the return you filed. You can use Form 1040X to amend your individual tax return.

Comments

0 comment