views

Understanding the Finance Charge

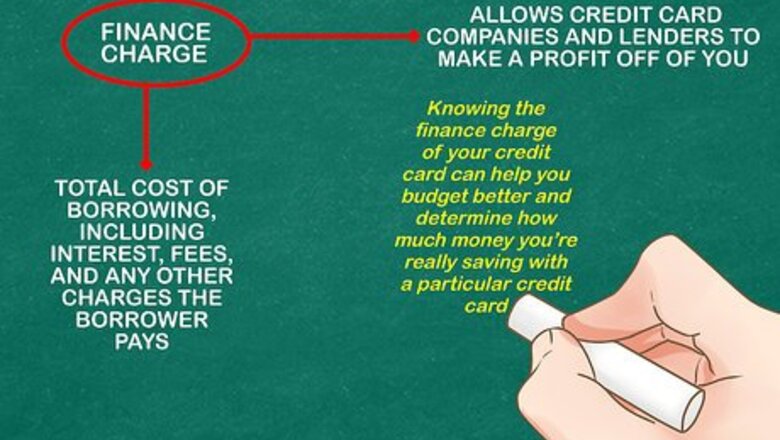

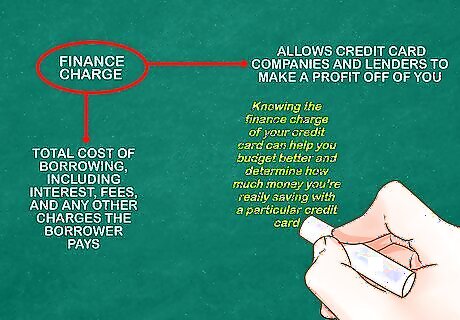

Know what a finance charge is. Credit card terms can be confusing to navigate for many, so understand what a finance charge is and how it affects you. A finance charge is what allows credit card companies and lenders to make a profit off of you. It's more or less a fee charged for the use of your credit card. Finance charges on credit cards, mortgages and car loans have ranges that depend on a borrower's credit score. A finance charges is the total cost of borrowing, including interest, fees, and any other charges the borrower pays. Knowing the finance charge of your credit card can help you budget better and determine how much money you're really saving with a particular credit card.

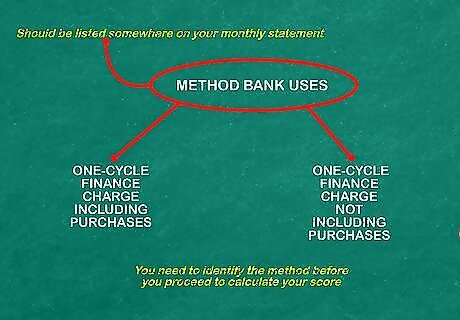

Figure out which method your bank uses. Most banks calculate a finance charge using one of two methods: one-cycle finance charge including purchases, or one-cycle finance charge not including purchases. The methods require a different means of calculation. The name of the methods your creditors use should be listed somewhere on your monthly statement. You need to identify the method before you proceed to calculate your score.

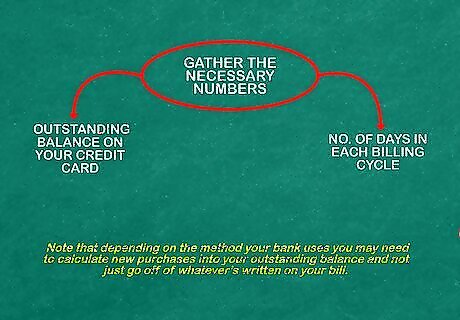

Gather the necessary numbers. A variety of numbers go into each equation for calculating a finance charge. Before you sit down and being punching numbers into your calculator, make sure you know the following information: The outstanding balance on your credit card. That is, the total amount you owe. The number of days in each billing cycle. Please note, that depending on the method your bank uses you may need to calculate new purchases into your outstanding balance and not just go off of whatever's written on your bill.

Calculating One-Cycle Finance Charges

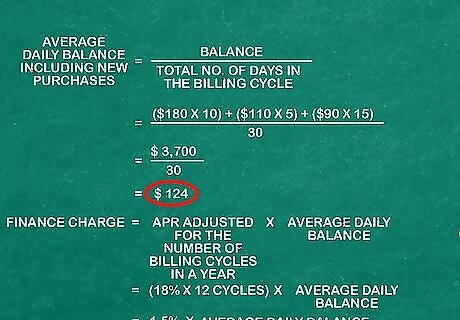

Calculate the average daily balance including new purchases. This is generally the most common method credit card companies use to calculate a finance charge. It is also the most expensive, as new purchases and balances are accounted for immediately with no grace period to avoid accruing interest. Some credit card companies allow a grace period between the purchase date and the date the bill is due, so that if you pay your bill completely on time, there is no interest charged. Add up the outstanding balance for each day in your billing period. Include any new purchases made to this balance. For example, if your balance was $180 for 10 days, you get $1,800. Then, say your balance was $110 for 5 days. You get $550. Then, for 15 days, your balance was $90. You get $1,350. Once you have a range of numbers spanning the complete billing cycle, add all these numbers together. For example, $1,800 plus $550 plus $1,350 comes to $3,700. Divide this number by the total number of days in your billing cycle. Most billing cycles are 30 to 31 days. The number you get is the average daily balance that is then used to calculate the interest owed. For the above example, the average daily balance would be 3,700 divided by 30, coming to approximately $124. The finance charge is the APR (Annual Percentage Rate) adjusted for the number of billing cycles in a year times the average daily balance. For example, if the APR is 18% with 12 billing cycles, the monthly rate would be 1.5%. The finance charge would be the 1.5% of the average daily balance.

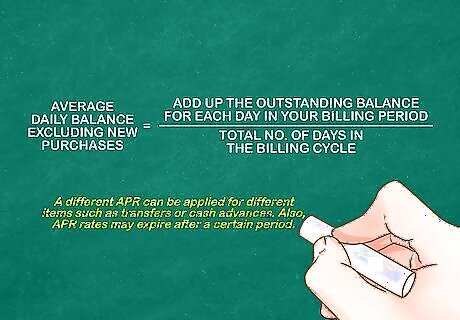

Calculate the average daily balance excluding new purchases. Sometimes, new purchases are not accounted for when adding up your outstanding balance. Add up the outstanding balance for each day in your billing period. The calculation is basically the same as before, only you do not account for new purchases. Once again, divide this number by the number of days in the billing cycle. This is your finance average daily balance.The finance charge is the APR (Annual Percentage Rate) adjusted for the number of billing cycles in a year times the average daily balance. Note that a different APR can be applied for different items such as transfers or cash advances. Also, APR rates may expire after a certain period.

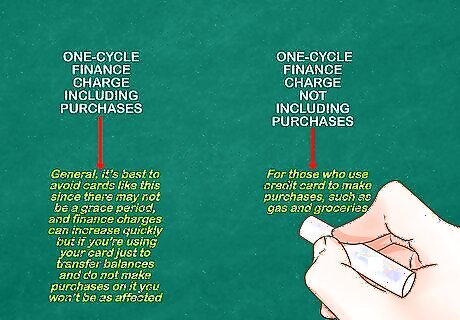

Understand the implications of each method. These two methods, while similar, are vastly different in how they affect you as a credit card user. If you're using your credit card to make purchases, such as gas and groceries, you should look for a card that excludes new purchases from the daily balance. This way, you have a small grace period between billing cycles each month. In general, it's best to avoid cards that include new purchases in your daily balance. Depending on the credit card company, there may not be a grace period, and finance charges can increase quickly. If you're using your card just to transfer balances and do not make purchases on it, however, you won't be as affected. Note that the balance on which interest is calculated can vary from issuer to issuer including ending balance, previous balance, and so on.

Comments

0 comment