views

In Person

Visit a bank in your destination country. If you've already traveled into the Eurozone, you're in luck — it's not usually hard to get your hands on Euros. For example, most European banks will sell Euros to non-citizens at very reasonable rates. Best of all, most banks in major European cities will have at least some staff members that speak English. If you're not comfortable awkwardly asking for an English speaker, you can always use the ATM (see below for more information). Exchange rates at European banks tend to be quite good. Many banks will not charge a transaction fee for the service (though some will). Note that the hours of operation for banks in Europe can be different than they are abroad. Banking holidays will also vary from country to country. If possible, check when the bank is open online before making your trip.

Alternatively, visit a bank in your home country. You can also buy Euros at most major banks in the UK, Canada, Australia, and the US. This is handy if you want to have a small amount of European currency in your wallet when you step off the plane. Some traveler's guides strongly recommend this. Others, however, favor buying Euros in Europe to avoid the risk of traveling with large amounts of currency. Fees at banks in the English-speaking world can vary from place to place and based on whether or not you have an account. Anecdotally, American banks are said to have less-favorable dollar-to-euro exchange rates than their European counterparts.

Try a postal bank. Believe it or not, many European post offices (especially in major cities) will have small "mini-banks" inside that will be able to change your money from your home country's currency to euros. Not all post offices will have these mini-banks, but the ones that do are claimed to have some of the best exchange rates available. Even some post offices in the English-speaking world will have small banks or exchange bureaus available to exchange your currency. This is by no means guaranteed, however, so check online or via phone before visiting if possible.

Visit an international airport. Since busy airports are host to thousands (sometimes millions) of passengers from around the world every day, they will usually have their own currency exchange booths and kiosks. Any of these will be happy to convert your cash into Euros — whether you're in your home country or the Eurozone. You may want to avoid this option if you have other choices available. While airport exchanges are convenient, according to some sources, they often have some of the least-favorable exchange rates. Note that airports that don't receive a great deal of international traffic (like smaller regional airports) may not have their own exchanges.

Visit a currency exchange. Some major cities and tourist locations will have currency exchanges completely separate from banks, post offices, airports, and so on. These can range from small kiosks to bank-like brick and mortar locations, depending on where you are. The most well-known currency exchange service for most Americans is Travelex, but you may be able to find other currency exchanges (also called bureaus de change) in the following locations: At major transportation hubs (airports, train stations, etc.) Near tourist destinations/landmarks Near hotels, resorts, etc. Near commercial areas (markets, malls, etc.) If you haven't left for Europe yet, try using Travelex's store locator here to find a currency exchange near you.

Try a European ATM. It's important to note that most ATMs in Europe — those at banks and those elsewhere — will allow you to buy Euros by debiting your checking account. This can be an exceptionally convenient option since there are likely to be hundreds of ATMs in any major European city. In addition, most ATMs will operate in a variety of languages including English. With ATMs, the fees you incur can vary greatly depending on the bank you use. Some banks may charge a "foreign transaction" fee in addition to the standard ATM fee, which can make using ATMs expensive. Thus, it is usually cheapest to make a few big withdrawals, rather than many small ones. If you intend to use ATMs in Europe, notify your bank in your home country before leaving. If not, your bank may interpret the financial transactions in Europe as fraudulent activity or identity theft.

From Home

Use a currency exchange website. Planning your trip to Europe well in advance? If you have enough time left before your trip to be able to receive mail, you may be able to order Euros online. This is an easy process — simply visit a major currency exchange site (like, for instance, travelex.com, follow the prompts to place your order, and provide proper payment information. With this option, you can usually choose to have the Euros delivered to your home. Some sites even offer free shipping on orders over a certain value. You usually may also pick your order up at a currency exchange location.

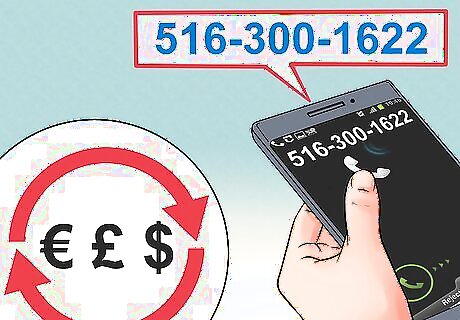

Check major currency exchange sites for phone order options. Most services that allow you to order Euros online will also give you the option to order over the phone. This is true both for major exchange websites like Travelex.com and for smaller local or regional exchanges. In the latter case, contact options can vary from location to location. To contact Travelex via phone, call 516-300-1622.

Order the euros from a bank or exchange. In addition to Travelex and other currency exchange sites, you can also usually order foreign currency from your bank. Depending on your bank, you may be able to place this order either online or over the phone. In either case, the basic process is the same: you contact the bank, place your order, and the currency is delivered to your home. Be sure to allow time for the Euros to arrive before you must leave for your trip. If time is short, you may be able to pick the Euros up in person shortly after placing your order.

Keep in mind that all methods will charge a fee. Nearly every location that allows you to buy Euros will charge you a small fee to do so. Usually, this is done by taking a percentage "cut" of your money — for instance, a currency exchange might give you 90% of your money's value in Euros and keep the remaining 10%. It is difficult to get a perfectly "fair" exchange between your native currency and Euros, so plan accordingly. Your best bet to avoid these sorts of costs may be to visit a bank that you are a member of. However, even in these cases, there may be minor fees for changing your currency.

Remember that the price will be affected by the currency market. The values of the world's currencies are constantly changing. Depending on how valuable your home country's currency is compared to the Euro, you may enjoy a favorable exchange rate or be forced to deal with an unfavorable one. In general: It's best to buy Euros when your home country's currency is relatively strong compared to the Euro. This means that each unit of currency you spend will get you more Euros for your trip. On the other hand, for the opposite reason, it's not favorable to buy Euros when your currency is weak compared to the Euro. Visit xe.com for an up-to-speed look at the exchange rates between the world's most important currencies.

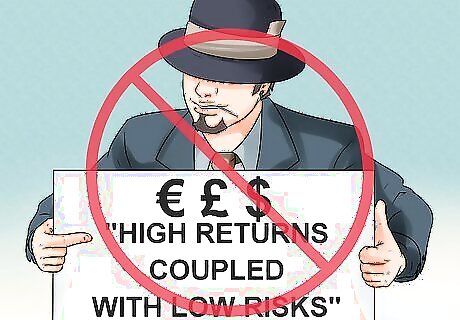

Be wary of scam artists. It should go without saying that it's only wise to buy Euros from licensed, reputable agencies with names you trust. Paying a little extra in exchange fees is always better than unwittingly committing a crime in a foreign country. Don't accept an offer from a stranger to change your money to Euros — you may end up short-changed or with a wallet full of counterfeit currency, which is a serious crime. The U.S. Commodity Futures Trading Commission additionally warns against so-called "forex" (foreign exchange) investment opportunities. In these schemes, unwitting investors are tricked into buying large amounts of foreign currency with promises of "high returns coupled with low risks." In reality, the scam artists steal the money — and often get away with it, because it is difficult for police to pursue criminals across national borders.

Comments

0 comment