views

Legitimizing the Transaction

Take it seriously. Maybe you don’t have to put on a suit or sit opposite someone behind a big desk like at the bank, but taking out a loan from a friend should not be treated as a trivial matter. Lending and borrowing money is a big deal and should be treated as such. Mixing money and friendship can cause problems, but if it's something sporadic or an emergency, it shouldn't be an issue. If you need help and there are people out there that care for you and are willing to help, that's great. Just make sure you're not using them. Make a presentation or pitch as to why you need the money. No, you probably don’t need to fire up a PowerPoint on the projector, but provide your friend with a clear idea of your intentions for the money. You’re taking advantage of (and thus unduly risking) your friendship if you expect “because I just need it” to be a sufficient rationale for your loan. Be realistic about the amount you need to borrow and your ability to repay it. Do your homework beforehand on precisely how much you need to repair your car, move out of your crummy apartment; take a class to improve your job prospects, etc. And don’t expect “I’ll pay it back as soon as I can” to be enough; project a repayment schedule and time frame.

Insist upon legitimate terms. A friend will probably want to (or at least feel obligated to) take it easy on you and be lax about any interest owed, collateral, or repayment terms. You may see this as an advantage for you, but if you are interested in protecting the friendship, be clear that you will only borrow if the terms are fair and clear for both sides, especially the lender’s. You should discuss repayment plans and charging interest if you're borrowing a large sum of money from a friend. Make it all clear upfront. You can write it all down and sign it as well. Pay interest. This demonstrates your appreciation for your friend’s parting with his/her money and your seriousness in paying it back. Insist upon an amount at least along the lines of the rate for a high-yield savings account at local banks. Otherwise you’re asking for a gift. Offer collateral. This is another way to demonstrate that you are serious about this loan and about paying it back. Offer that TV of yours that your friend envies, or those earrings she always borrows from you. Discuss missed payment options. Be clear that you will do everything in your power to avoid missing a payment, but have a clear plan in place if it does occur. The alternatives can be as formal as a penalty or increased interest rate, or as informal as offering to do your friend’s laundry or mow the lawn for a month.

Put it in writing. Even in today’s increasingly paperless world, nothing legitimizes a transaction like a signed piece of paper. Draw up a document to which you can both refer regarding terms, conditions, and procedures. If you want to draw up a more formal promissory note, there are guides like this linked wikiHow article available online. If you’re really serious, consider having the document notarized. It doesn’t cost much, and likely makes the document legally binding in your state. If you’d prefer a less formal document, even an email or handwritten sheet with clearly defined amounts, repayment plans, interest rates, collateral, and penalties is enough to give each side additional comfort and confidence in the transaction.

Be clear regarding business investments. If the loan is related to a business venture you are starting or currently operate, be particularly clear on the nature of this money transaction. Is this just a loan, or an equity investment? Does this offer any involvement in the business, or share of any profits (or losses, or risks)? If you don’t want your friend involved in the business, don’t give them reason to think they should be, by making the nature of the loan clear. Alternatively, don’t get them unwittingly involved in a failed business venture.

Keeping Friends and Funds

Choose the right friend. You probably have at least a couple of friends from which to choose when asking for a loan, and you might think that the one with the most money is the best option. The personality of the friend and your relationship with him/her is at least as important as his/her bank account, however. Borrow from a friend you know well, trust, and with whom you can communicate comfortably about any range of topics. Remember, money can make for awkward conversations, so having a comfort level with uncomfortable discussions will be to your benefit.

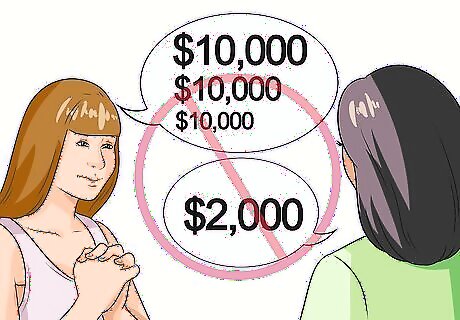

Don’t negotiate. Even if you are a haggler by nature, now is not the time to extract your best possible deal. Show deference and gratitude toward the friend who is being generous enough to offer you assistance, and you’ll reduce the risk of bitterness later. Be clear about the amount of money you need, but present a range of loan options, and take what they offer (or leave it). $2,000 when you need $10,000 is better than nothing, and is also probably better than losing a friend by pressing too hard for more. Refuse the terms politely instead of working for a deal to your liking. Yes, it is going to be awkward to ask a friend for money and then say “no thanks.” But, that is a wound more likely to heal than making a friend feel taken advantage of through loan conditions with which he or she is uncomfortable. It is better to say that you want to consider all your options again.

Take no for an answer. Yes, this is an offshoot of the “no negotiating” advice, but worthy of its own billing. Do not press an unwilling, or even hesitant friend to lend you money. Pressuring a friend to lend money is taking advantage of that friend, and taking advantage of a friend is one of the best ways to lose a friend. Even beyond the damage to your friendship caused by pressuring him/her, you are likely to find yourself offered less advantageous loan terms that you will in turn feel pressured to accept. Just move on to the next friend on your “ask list.”

Make repayment your priority. You owe it to your friend, your friendship, and yourself to take this loan seriously and make every effort to pay it back on time and in full. Set aside funds each month (or other established time frame) for your payment. Seal the cash in a marked envelope, have money taken directly from your paycheck into an account, set up an auto-pay system, do whatever it takes to make sure that money gets into the lender’s hands each month. Pay the loan off early, even only by a bit, if possible. This is a way to earn a few extra points in the friendship.

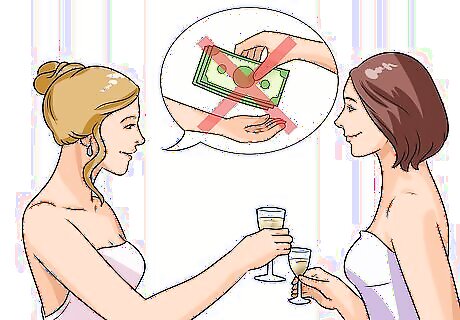

Keep your social and financial relationships separate whenever possible. Don’t bring up the loan at a party or other social gathering, and ask your friend to do the same if it becomes an issue. Discuss it privately and separately to help avoid conflating your friendship with what is essentially a financial transaction. Don’t use this as an excuse to avoid talking to your friend/lender about a missed payment, though. Be forthright and clear about your difficulties and options for dealing with them; just do it in the proper context. Contact them, don’t make them ask you for that late payment. If friendship is your priority, treat your friend with the respect he/she deserves. Be open and honest, in loans as in life.

Considering Other Options

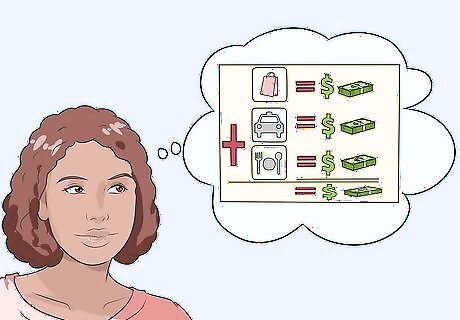

Closely examine your financial situation. Anytime you feel the need to ask for a loan, be it from a buddy or the bank, first closely consider why you are in that position and if you have other options available to you. If low cash flow is a regular problem for you, take the time to examine your household budget and track your spending. There are numerous programs and apps that can help you with this, but a pen and paper can do the job also. Get a clear picture of your financial situation before asking to borrow money. You may find that you have alternatives available to you; at very least, you will be better informed as to the amount you need to borrow and your ability to repay it in a timely fashion.

Look for ways to save or raise funds. Can you cancel your cable service and buy an antenna? Cut coupons? Start mowing lawns or shoveling snow on the side? Sell your car and ride your bike or the bus to work? Consider what you can do for yourself, by yourself before involving another person, especially a friend, in your financial issues. How to Save Money and related wikiHow articles offer many good ideas on cutting costs, including, for instance, automatically depositing funds into a savings account (akin to tax withholding); eating at home and buying groceries in bulk; saving on utilities by conserving electricity, water, etc.; negotiating your rent payment down or finding more affordable housing; and finding cheap/free entertainment options (hiking, community events, etc.). If you want to afford larger purchases in the future, make sure to always save a little money from your paycheck into your savings Likewise, How to Get Money Quickly Without Borrowing It advises options like taking odd jobs, selling non-essential items online or at a yard sale, and participating in surveys and research studies.

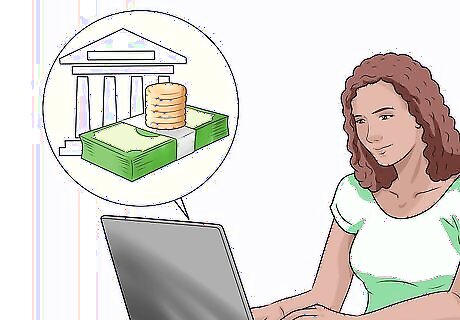

Exhaust other loan options first. Rather than your first option, you may find that it is best to make borrowing from a friend your last option. There are risks involved in any kind of borrowing, but you can at least remove destroying a close friendship as one of them. You may be concerned by the high interest rates, many restrictions, and lack of flexibility you presume you will find with a financial institution. Give banks a look, however; they offer many types of loans and lines of credit that may serve your needs quite well. Also, paying back a bank loan is a good way to build your credit rating. There are numerous peer-to-peer lending websites out there, which offer you the ability to borrow from (or lend to) other people directly, usually (but not necessarily) anonymously. Do your homework in choosing your intermediary site and your lender, however. If you have a specific project, plan, or goal in mind for the money, you can also consider establishing a crowdfunding campaign online.

Open your eyes to the potential pitfalls. It can be hard to imagine things going sour with a good friend over some money, but it can happen quite easily. Indeed, some advise that unless you are willing to lose the person as a friend, don’t consider borrowing money from them. It is estimated that at least 89 billion dollars per year (a 2008 estimate) is borrowed from friends and family in the U.S., and while 95% of Americans say they have lent money to friends or family, 43% of those say they have not been repaid in full. Money may or may not be the root of all evil, as the old saying goes, but it can easily foster suspicion, jealousy, selfishness, and impulsiveness, among other attitudes that have contributed to the destruction of countless partnerships, marriages, and friendships.

Ask for advice or help before money. Friends want to help friends, which is why they may agree to lend money against their better judgment. Give them the chance to help you in other ways first, before putting them in the usually-awkward position of having to decide whether or not to become a lender. Odds are, your friend has been in a financial pinch at some point, so ask him/her for tips on cutting costs or saving more efficiently. Alternatively, might your friend be able to offer any job leads or money-making opportunities? Ask and see. Let your friend see that you value his/her opinions and have explored all options before asking for money.

Comments

0 comment