views

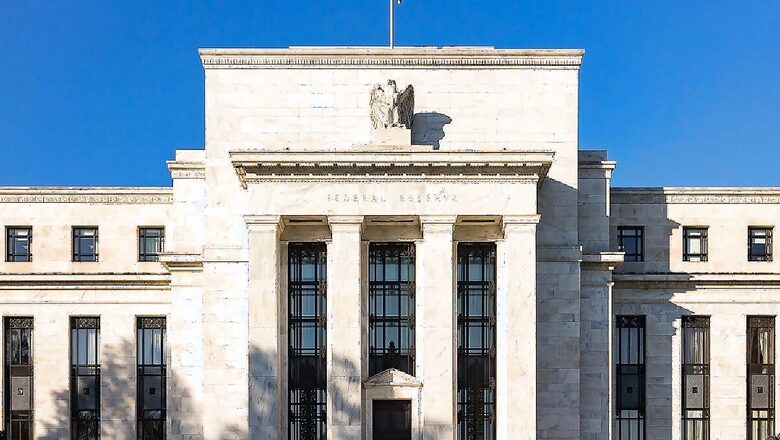

The US Federal Reserve is going to conclude the two-day meeting of its Federal Open Market Committee (FOMC) on June 12. US Fed Chair Jerome Powell will announce the interest rate decision at 2:00 pm ET (or 11:30 pm as per Indian time), to be followed by his press conference. Investors are keenly looking for any indication of the timeline for the rate cuts.

The market is divided on whether the US Fed would cut rates once or twice this year after a strong US labour report. So, the attention will be on policymakers’ updated economic projections and Chair Jerome Powell’s press conference.

US Fed Meeting: Key Things to Watch Out For

It is also to be seen whether Powell’s tone will continue to be hawkish or shift to be a dovish one. Investors also await the ‘dot plot’ in today’s Summary of Economic Projections.

Suman Bannerjee, CIO of Hedonova, said, “The upcoming Fed meeting is crucial as it will likely maintain the fed funds rate target range of 5.25% to 5.5%, its highest since 2001, amidst efforts to control inflation without triggering a recession. Key aspects include updates on the pace of balance sheet runoff and economic projections, particularly for GDP growth, unemployment, and inflation.”

Investors will scrutinize the Fed’s stance on future rate cuts, especially given mixed inflation data and economic slowdown signs. The May jobs report and upcoming inflation data will also heavily influence the Fed’s decisions and economic outlook, he added.

When to Expect the Start of the Fed Rate Cut Cycle

According to the bond market, investors are potentially anticipating the first Fed rate cut at the September 2024 meeting, with a 47.6% probability. The likelihood of at least two rate cuts by the end of the year is also significant, at 36.9%. However, this timeline is contingent on continued positive inflation data and economic conditions. Persistent sticky inflation and economic growth indicators will play a crucial role in determining the exact timing of rate cuts, with the Fed needing to balance inflation control with economic stability.

US Federal Reserve officials on Wednesday will also likely make official what’s been clear for many weeks: With inflation sticking at a level above their 2 per cent target, they are downgrading their outlook for interest rate cuts.

In a set of quarterly economic forecasts they will issue after their latest meeting ends, the policymakers are expected to project that they will cut their benchmark rate just once or twice by year’s end, rather than the three times they had envisioned in March.

The Fed’s rate policies typically have a significant impact on the costs of mortgages, auto loans, credit card rates and other forms of consumer and business borrowing. The downgrade in their outlook for rate cuts would mean that such borrowing costs would likely stay higher for longer, a disappointment for potential homebuyers and others.

Still, the Fed’s quarterly projections of future interest rate cuts are by no means fixed in time. The policymakers frequently revise their plans for rate cuts — or hikes — depending on how economic growth and inflation measures evolve over time.

But if borrowing costs remain high in the coming months, they could also have consequences for the presidential race. Though the unemployment rate is a low 4%, hiring is robust and consumers continue to spend, voters have taken a generally sour view of the economy under President Joe Biden. In large part, that’s because prices remain much higher than they were before the pandemic struck. High borrowing rates impose a further financial burden.

The Fed’s updated economic forecasts, which it will issue Wednesday afternoon, will likely be influenced by the government’s May inflation data being released in the morning. The inflation report is expected to show that consumer prices excluding volatile food and energy costs — so-called core inflation — rose 0.3% from April to May. That would be the same as in the previous month and higher than Fed officials would prefer to see.

Overall inflation, held down by falling gas prices, is thought to have edged up just 0.1%. Measured from a year earlier, consumer prices are projected to have risen 3.4% in May, the same as in April.

Inflation had fallen steadily in the second half of last year, raising hopes that the Fed could achieve a “soft landing,” whereby it would manage to conquer inflation through rate hikes without causing a recession. Such an outcome is difficult and rare.

But inflation came in unexpectedly high in the first three months of this year, delaying hoped-for Fed rate cuts and potentially imperiling a soft landing.

In early May, Chair Jerome Powell said the central bank needed more confidence that inflation was returning to its target before it would reduce its benchmark rate. Powell noted that it would likely take more time to gain that confidence than Fed officials had previously thought.

Last month, Christopher Waller, an influential member of the Fed’s Board of Governors, said he needed to see “several more months of good inflation data” before he would consider supporting rate cuts. Though Waller didn’t spell out what would constitute good data, economists think it would have to be core inflation of 0.2% or less each month.

Powell and other Fed policymakers have also said that as long as the economy stays healthy, they see no need to cut rates soon.

“Fed officials have clearly signaled that they are in a wait-and-see mode with respect to the timing and magnitude of rate cuts,” Matthew Luzzetti, chief U.S. economist at Deutsche Bank, said in a note to clients.

The Fed’s approach to its rate policies relies heavily on the latest turn in economic data. In the past, the central bank would have put more weight on where it envisioned inflation and economic growth in the coming months.

Yet now, “they don’t have any confidence in their ability to forecast inflation,” said Nathan Sheets, chief global economist at Citi and a former top economist at the Fed.

“No one,” Sheets said, “has been successful at forecasting inflation” for the past three to four years.

(With Inputs from Agencies)

Comments

0 comment