views

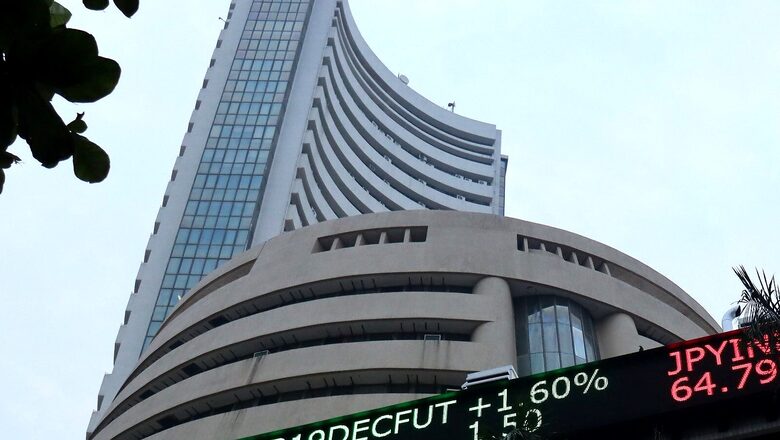

The benchmark indices the BSE Sensex and Nifty50, both opened in a positive territory. Taking mixed global cues, the BSE Sensex was up 37.42 points or 0.07 per cent at 57375.63, and the Nifty was up 7.50 points or 0.04 per cent at 17083.80. About 977 shares have advanced, 392 shares declined, and 74 shares are unchanged.

On NSE, at 0946 hours IST, Dr Reddy, HDFC Life, Cipla, Titan and Ultra Cement were the top gainers, however, on the flip side, Hero Motor, Tech Mahindra, Bajaj Finance and Bajaj Finserv are laggards. On BSE, Kitex Garments is the top gainer and Bannari Amman Sugar is the loser. Sectorallly, Nifty IT, Nifty Media, Nifty Auto were trading in the red. However, Nifty FMCG was the top gainer. On the other hand, BSE MidCap rose 0.75 per cent and BSE SmallCap rose by 0.62 per cent.

“Benchmark Indices are expected to open on a flat to slightly positive note as suggested by trends on SGX Nifty. On the technical front; Markets continued to form higher high and higher low in the Nifty 50 which indicates an uptrend. We believe 17,150 is an immediate resistance in Nifty 50 and a move above this level can push the momentum towards 17,300 levels in the short term. On the downside, 16900 remains crucial support in Nifty 50,” Mohit Nigam, head-PMS, Hem Securities said.

Taking mixed cues from global markets, Indian markets opened on a flat note on Thursday. The global markets are cautious as the US employment data is scheduled to come this week, thus markets are looking up to this data. Apart from US markets which touched an-all time high yesterday, but Asian markets opened on a flat note. The Hang Seng Index rose 0.67 per cent, or 175.23 points, to 26,203.52. The Shanghai Composite dipped 0.20 per cent, or 7.20 points, to 3,559.90, while the Shenzhen Composite Index on China’s second exchange fell 0.22 percent, or 5.32 points, to 2,412.57. On the other hand, Japan stocks also opened with gains. The benchmark Nikkei 225 index was up 0.48 percent or 135.43 points at 28,586.45 in early trade, while the broader Topix index advanced 0.21 percent or 4.23 points to 1,985.02.

“Both Wall Street and Dalal Street have been one-way streets for quite long now, with only minor dips. And, the exuberant retail investors have been buying on every dips. This ‘ buy on dips’ strategy has been rewarding retail investors and, therefore, they can be expected to continue with that strategy until there is a sharp correction and negative signals in the market. The scepticism of ‘smart money is evident in the ‘off and on’ response of FIIs who have again turned buyers for three days in a row after turning sellers on a sustained basis for many days. FIIs are just chasing momentum now and therefore no serious significance need to be given to their recent buys. But an important trend emerging in FPI inflows is their buying into debt: Rs 12144 cr in August. This is the first positive monthly figure in 2021 and is likely to continue. For FIIs risk-reward is in favour of debt at this stage of the market” Dr V.K Vijay Kumar chief investment strategist at Geojit Financial Services said.

Read all the Latest News, Breaking News and Assembly Elections Live Updates here.

Comments

0 comment