views

State Bank of India (SBI), India’s largest lender, has announced a 25 basis points (bps) reduction on the marginal cost of funds-based lending rate (MCLR) of one-month tenure. This will make short-term loans, like personal loans, car loans and working capital loans, cheaper for SBI borrowers.

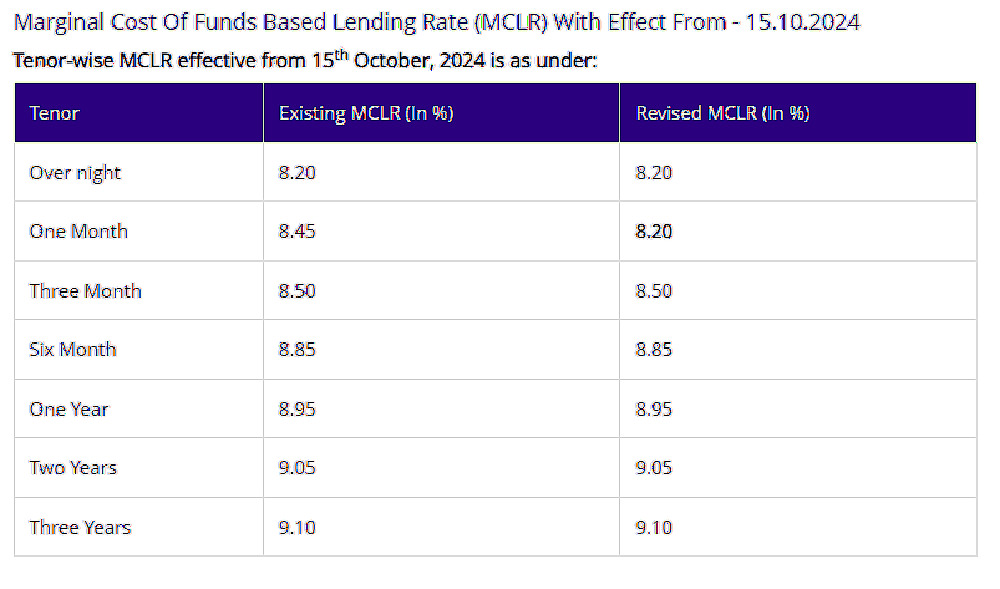

According to the state-owned lender’s website, one-month MCLR has been slashed from 8.45 per cent to 8.20 per cent, effective October 15, 2024. However, MCLR on other tenures remains the same.

MCLR rate remains 8.2 per cent for overnight, 8.50 per cent for three-month tenure, 8.85 per cent for six months, 8.95 per cent for benchmark one-year tenure, 9.05 per cent for two years, and 9.10 per cent for three years.

SBI’s move to cut the MCLR comes weeks after India’s largest private sector bank HDFC Bank in September reduced its 3-month MCLR.

The Reserve Bank of India is set to start rate cut cycle in India from December 2024 or February 2025. Till now, economists expected rate cuts to start from December 2024 but the latest CPI inflation print for September of a nine-month high of 5.49 per cent has economists revisit their views on rate cut timing. Currently, India’s benchmark repo rate stands at 6.5 per cent.

MCLR, or Marginal Cost of Funds-based Lending Rate, is the minimum interest rate below which banks usually cannot lend to customers. It determines how much interest borrowers will pay on loans. When MCLR goes down, loan interest rates can also decrease, making loans cheaper for borrowers.

Comments

0 comment