views

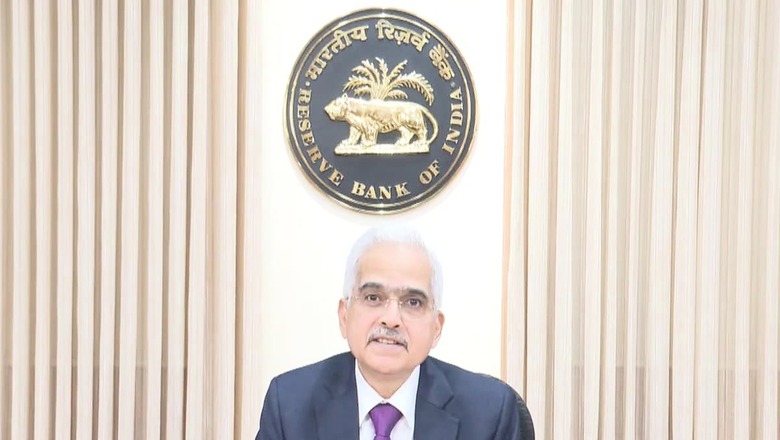

RBI MPC Meeting June 2024: The meeting of the RBI’s Monetary Policy Committee, which started on Tuesday, will conclude on Thursday morning, June 7. RBI Governor Shaktikanta Das will then announce the decision and present the latest monetary policy statement at 10 am on Thursday. Apart from announcing MPC’s decision on the repo rate and other policy interest rates, Das will also discuss the current domestic as well as global economic situation.

After the policy announcement, the RBI governor will also address a press conference which will be telecast at 12:00 pm on the RBI’s X handle on Thursday.

Here is How to Watch RBI Monetary Policy Decisions LIVE Today

The Reserve Bank of India on Wednesday shared a post on X to explain where and how to watch the RBI MPC meet live. “Monetary Policy statement by #RBI Governor @DasShaktikanta at 10:00 am on June 07, 2023. Watch live at: https://www.youtube.com/live/a75wsrluvqg.”

Coming up:Monetary Policy statement by #RBI Governor @DasShaktikantaon June 07, 2024, at 10:00 am.Watch live at: https://t.co/0yUZakOEyMPost policy press conference telecast at 12:00 pm on the same day at https://t.co/NzKpjpoOGG#rbipolicy #rbigovernor #rbitoday… pic.twitter.com/GhV1FWI0Kg— ReserveBankOfIndia (@RBI) June 6, 2024

Facebook: The address will be simultaneously streamed on Reserve Bank of India’s Facebook page.

X: RBI Governor Shaktikanta Das’ address to the country will also be streamed on the Reserve Bank of India’s official Twitter handle @RBI on X.

After the RBI MPC Policy Announcement

“Post policy press conference telecast at 12:00 pm on the same day at https://youtube.com/live/8u4Q9BQ71m0,” the RBI said in a post on X.

What’s Expected?

Given the sticky food inflation, the RBI MPC’s primary target will remain inflation targeting, and the monetary policy committee will highly likely maintain the status quo on the repo rate, keeping the key interest rate unchanged at 6.5 per cent. This will be the seventh time in a row that the repo rate will be kept unchanged.

Madan Sabnavis, chief economist at Bank of Baroda, told News18.com, “There will be a status quo on both the repo rate and the monetary policy stance. The RBI’s tone will also be on a similar line. Inflation is the top priority for the RBI, and the rate cut might wait for now, as the economy is also doing well with the growth rate touching 8.2 per cent in FY24.”

However, there might be a downward revision in FY25 GDP growth due to the high base effect of 8.2 per cent growth in FY24. The inflation target is expected to remain the same, he added.

In the monetary policy review in April 2024, the RBI kept the FY25 GDP projection at 7 per cent while forecasting CPI inflation for 2024-25 at 4.5 per cent. The monetary policy stance continued to be the ‘withdrawal of accommodation’.

“The RBI remains vigilant towards upside risks to food inflation,” RBI Governor Shaktikanta Das had said while presenting the monetary policy in April 2024.

Dharmakirti Joshi, chief economist at CRISIL, also said there will be no change in the repo rate or the stance.

When asked whether a change in the government to a coalition government would impact monetary policy, Bank of Baroda’s Madan Sabnavis said, “Nil. Absolutely no change. The RBI is an independent body that makes decisions based on inflation and growth data.”

Suman Chowdhury, chief economist and head of research at Acuité Ratings & Research, also believes that the RBI will keep its repo rate unchanged.

“CPI inflation for April 2024 remained largely unchanged at 4.83 per cent vis-à-vis 4.85 per cent in March 2024, highlighting the resistance it faces in reaching near the RBI MPC target of 4 per cent. Sequentially, the headline inflation print rose by 0.48 per cent, largely and expectedly driven by food inflation in the summer season,” Chowdhury added.

Comments

0 comment