views

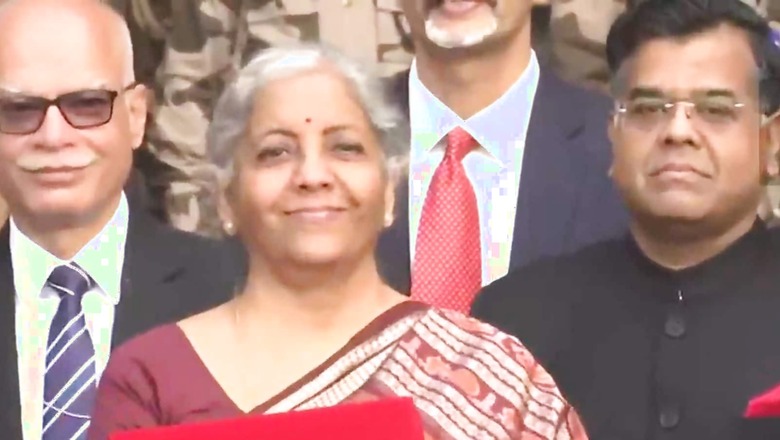

Finance minister Nirmala Sitharaman announced the introduction of the digital rupee by the Reserve Bank of India in Union Budget 2022. The digital rupee or central bank digital currency will be introduced using blockchain, said the finance minister while presenting the Budget.

She also announced the ‘digital Rupee’ which will be issued by the Reserve Bank of India in the financial year 2022-23. The central bank digital currency (CBDC) will use blockchain technology, she said. The tax regime is expected to include all transactions carried out with cryptocurrencies, including the sale of non-fungible tokens (NFTs). If digital assets are gifted, the tax will have to be paid by the recipient, she added.

Nischal Shetty, CEO at WazirX, said: “India is finally on the path to legitimising the crypto sector in India. It’s phenomenal news that India launching a blockchain-powered Digital Rupee is phenomenal news. This move will pave the way for crypto adoption and put India in the front seat of innovation. It’s also interesting to note how our government is beginning to recognise crypto as an emerging asset class given how our FM was referring to it as a virtual digital asset. The biggest development today, however, was clarity on crypto taxation. This will add much-needed recognition to the crypto ecosystem of India. We also hope this development removes any ambiguity for banks, and they can provide financial services to the crypto industry.”

Vipin Kumar, CEO Technoloader Pvt. Ltd., said: “It’s a big bang to a revolutionary journey in India; People seem to welcome this devastating move, as 30 per cent tax slab laved to rumors about crypto ban; it gives a legitimacy boom in bigger Crypto sphere. Our Government is lightening up the path to a progressive stance. It leads to leverage job opportunity in IT and Blockchain industry. Such glance of government will take India to a top-notch position in blockchain industry”

What is CBDC?

A central bank digital currency (CBDC) is a digital version of a country’s fiat currenciey, like the Rupee or the Dollar. Since they’re backed by the central reserves, they are as stable as their physical counterparts, unlike decentralised cryptocurrencies such as Bitcoin and Ether. The move is seen as a big push for the government’s “Digital India” programme.

Sumit Gupta – Co-founder and CEO, CoinDCX, said: “Introduction of CBDC sends a clear signal of India being a digital-first, efficiency-driven, and transparency-led system. CBDC with the backbone of Blockchain will help us hold a powerful position in the global economy. We welcome the move and congratulate the govt for this visionary move.”

It also comes amid deliberation over the regulation of cryptocurrency. The RBI had earlier voiced “serious concerns” around private cryptocurrencies on the grounds that these may cause financial instability.

On Monday, Principal Economic Adviser Sanjeev Sanyal said the government will take a balanced view on the issue of regulation. “There are some financial stability issues. But there are also other arguments that are made in terms of innovation and so on….obviously a balanced view on this will be taken,” he said.

Read all the Latest Business News here

Comments

0 comment