views

New personal income tax rates for the salaried class were announced by Finance Minister Nirmala Sitharaman on Wednesday. In the new tax system, the income tax rebate is been increased to income up to Rs 7 lakhs, according to FM Sitharaman.

While presenting the budget, Sitharaman unveiled a new income tax system. The new tax system is still a choice for taxpayers, though. The standard personal tax exemption threshold last underwent an update in 2014.

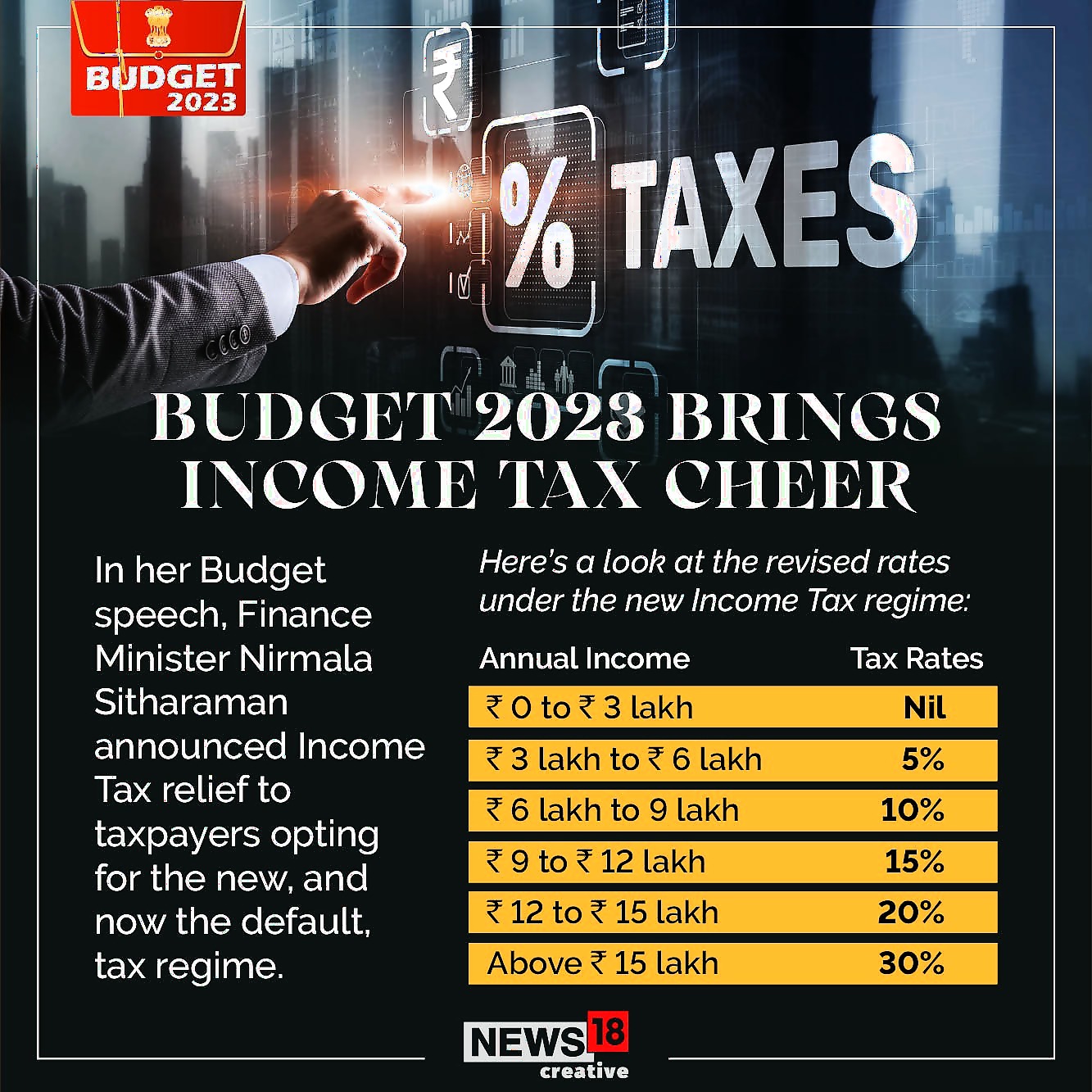

NEW INCOME TAX RATES

The average processing period for income tax returns has been lowered from 93 days to 16 days, she added. According to Sitharaman, “The government plans to roll out next-gen unified IT Return forms and increase grievance redressal.”

Details:

She also tweaked the concessional tax regime, which was originally introduced in 2020-21, by hiking the tax exemption limit by Rs 50,000 to Rs 3 lakh and reducing the number of slabs to five.

In the Budget for 2023-24, Sitharaman said currently individuals with total income of up to Rs 5 lakh do not pay any tax due to rebate under both the old and new regimes.

“It is proposed to increase the rebate for the resident individual under the new regime so that they do not pay tax if their total income is up to Rs 7 lakh,” Sitharaman said.

She further said under the new personal income tax regime, the number of slabs would be reduced to five.

“I propose to change the tax structure in this regime by reducing the number of slabs to five and increasing the tax exemption limit to Rs 3 lakh,” Sitharaman said.

Under the revamped concessional tax regime, no tax would be levied for income up to Rs 3 lakh. Income between Rs 3-6 lakh would be taxed at 5 per cent; Rs 6-9 lakh at 10 per cent, Rs 9-12 lakh at 15 per cent, Rs 12-15 lakh at 20 per cent and income of Rs 15 lakh and above will be taxed at 30 per cent.

“I propose to extend the benefit of standard deduction to the new tax regime. Each salaried person with an income of Rs 15.5 lakh or more will thus stand to benefit by Rs 52,500,” Sitharaman said.

The government in Budget 2020-21 brought in an optional income tax regime, under which individuals and Hindu Undivided Families (HUFs) were to be taxed at lower rates if they did not avail specified exemptions and deductions, like house rent allowance (HRA), interest on home loan, investments made under Section 80C, 80D and 80CCD. Under this, total income up to Rs 2.5 lakh was tax exempt.

Currently, a 5 per cent tax is levied on total income between Rs 2.5 lakh and Rs 5 lakh, 10 per cent on Rs 5 lakh to Rs 7.5 lakh, 15 per cent on Rs 7.5 lakh to Rs 10 lakh, 20 per cent on Rs 10 lakh to Rs 12.5 lakh, 25 per cent on Rs 12.5 lakh to Rs 15 lakh, and 30 per cent on above Rs 15 lakh.

The scheme, however, has not gained traction as in several cases it resulted in higher tax burden.

With effect from April 1, these slabs will be modified as per the Budget announcement.

Standard Deductions

The “standard deduction” would rise from the existing level of Rs 50,000 to Rs 52,500 annually.

In addition to the fundamental exemption limit, the standard deduction is a base amount that is not taxed, offering assistance to all tax payers. A rebate, which is sort of a partial return from the tax due, is not the same as a deduction. Income tax deductions may be claimed from income, but tax payable rebates may be claimed from income.

Thirteen years after it was eliminated in 2005–2006, the former finance minister Arun Jaitley reinstated the “standard deduction” of Rs 40,000 in the budget for 2018 to replace the transit allowance of Rs 19,200 and medical expense of Rs 15,000.

The standard deduction was increased the following year to Rs 50,000 annually.

Read all the Latest Explainers here

Comments

0 comment