views

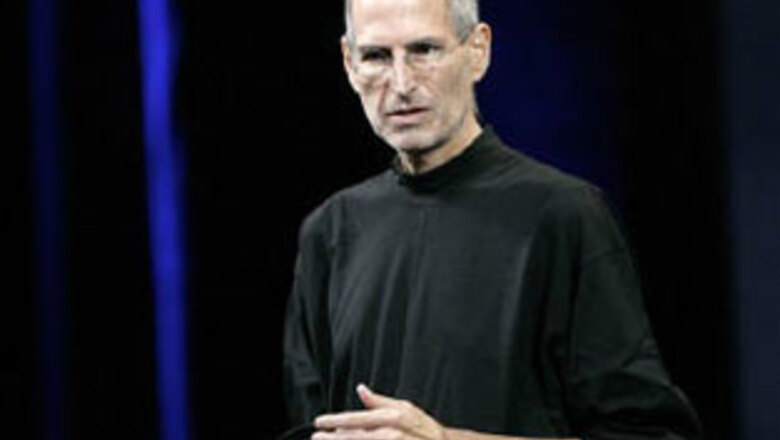

San Francisco: Apple Inc's Chief Executive Steve Jobs is expected to make a big bet on Wednesday that he can sell consumers on the value of tablet computing, looking to define an new category of devices

Whether it's called "iSlate," "iPad" or something else entirely, the tablet is Apple's biggest product launch since the iPhone three years ago, and arguably rivals the smartphone as the most anticipated device in Apple's history.

Jobs is widely expected to take the stage at a jam-packed theatre in San Francisco and, with his famed showman's flair, demonstrate everything the device can do.

Technology enthusiasts expect to see a sleek, full-color, 10-inch gadget with a touchscreen and wireless connectivity designed for all sorts of media, from videos to games to electronic books and newspapers.

Despite the buzz surrounding the new product and consumers' captivation with its consumer electronics, the tablet is not necessarily an easy sell, analysts say. The appetite for a gadget that sits somewhere between a smartphone and a laptop is unproven, though there are plenty of devices already vying for that market, such as Amazon.com's Kindle e-reader.

Apple has been mum, so the market has been rife with speculation about the device.

"Apple has to create a new category here -- that's something it has not done in more than two decades," Forrester Research analysts Charles Golvin and James McQuivey wrote in a blog post. "It's a computer without a keyboard, it's a digital reader with poor battery life and a high price tag, and it's a portable media player that can't fit in a pocket."

They added, "Apple has to tap the 6 million people who will buy e-readers this year and/or the 7 percent of adults interested in buying a netbook and help them see that this new tablet is a new version of all of those things and more."

Looking for growth

Shares of Apple were down 1 percent in early trading on the Nasdaq to about $203, after hitting an all-time high of $215.59 on January 5.

Shares of Apple were down 1 percent in early trading on the Nasdaq to about $203, after hitting an all-time high of $215.59 on January 5.

Apple's market value has catapulted to $185 billion, second only to Microsoft Corp among US tech firms. Apple has seen a 30-fold rise in its share price since 2003, fueled by the iPod's dominance of the music market and, more recently, the iPhone and surging sales of Mac computers.

As iPod sales wane, Apple is hoping the tablet will be a new growth engine. But the move is not without risk. Consumers have never warmed to tablet computers, despite previous attempts by other companies.

Analysts say pricing will be key. Estimates for the tablet range from $600 to $1,000, excluding any potential subsidies from wireless carriers, with Verizon Wireless believed to be the carrier.

In an online poll on reuters.com, 37 percent of more than 1,000 respondents said they would pay $500-$699 for the tablet. Nearly 30 percent weren't interested, while 20 percent said they would pay $700-$899.

Analysts' sales predictions for the tablet vary widely, ranging from 2 million to 5 million units in the first year.

But not all of its products succeed.

The hype about the tablet has been fueled by a steady drip of unconfirmed gossip over the past year, all of it greeted by Apple's public silence. The company has repeatedly declined to comment on what it called "rumors and speculation."

A nugget of information did emerge on Tuesday, courtesy of McGraw-Hill CEO Terry McGraw, who said he plans to put the company's textbooks on the tablet. News Corp's HarperCollins, New York Times and other publishers have also reportedly been in talks with Apple.

In an interview on CNBC, McGraw also let slip that the tablet will run the same operating system as the iPhone, information that Apple presumably would have preferred to save for the Wednesday media extravaganza.

Comments

0 comment