views

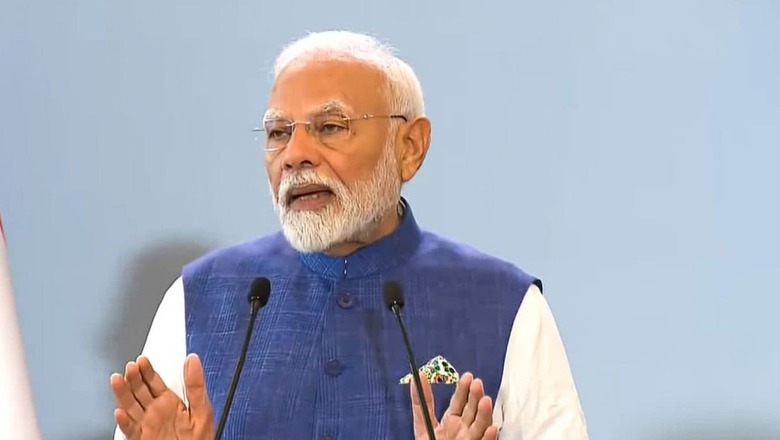

Prime Minister Narendra Modi’s government on Tuesday completed 100 days since its came to power for the third consecutive term. As the Modi government 3.0 completed 100 days, various ministers in the Cabinet highlighted the achievements of their ministries in this durations.

Among other sectors, Modi 3.0 has laid special focus on the ease of doing business in India. From relief in taxes to encouraging innovation, several steps have been taken by the government at the Centre to make it easier for Indians to build businesses.

Boost For Startups

To provide financial relief to start-ups and promote innovation, the 31 per cent Angel Tax, which had been burdening startups since 2012, was abolished by the Modi government 3.0. “To bolster the Indian start-up eco-system, boost the entrepreneurial spirit and support innovation, I propose to abolish the so-called angel tax for all classes of investors,” Finance Minister Nirmala Sitharaman had announced during the Union Budget 2024 presentation.

The corporate tax for foreign companies has been reduced from 40 per cent to 35 per cent to ensure India is globally more competitive and attractive for investment.

The Modi government 3.0 has also taken steps to boost innovation in the country. To make India a leader in the global space economy, a Rs 1,000 crore venture capital fund will be set up for space sector startups.

The Gen-Next Support for Innovation Startups (GENESIS) program has been approved to support Start-Ups in Tier-II and Tier-III cities.

The government has also announced that Under the National Industrial Corridor Development Program, 12 industrial nodes will be created that will provide facilities for investors and ensure the ease of doing business.

Focus on MSMEs

Meanwhile, the MUDRA loan limit has been increased from Rs 10 lakh to Rs 20 lakh, benefiting traders who have successfully repaid their previous loans.

A Credit Guarantee Scheme has also been launched for MSMEs, allowing small traders to obtain loans without collateral. This will make it easier for them to purchase machinery and other goods.

E-commerce export hubs will be developed in PPP mode for MSMEs and traditional artisans, providing export services and offering easy access to the global market.

Comments

0 comment