views

Drafting the Deed

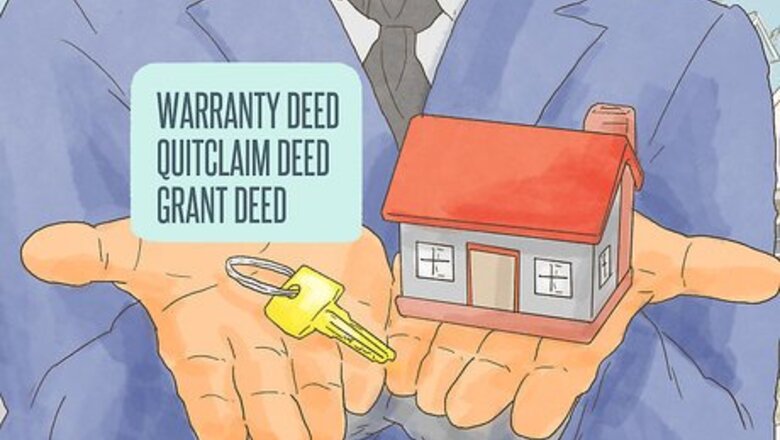

Decide on the type of deed. There are a few kinds of deeds. Each can transfer property. But they differ in the amount of protection that they give the buyer. Warranty Deed. With this deed, the seller guarantees that he or she owns the property being transferred. If the seller does not actually hold title, then the buyer can sue for compensation. A warranty deed provides the buyer with the most protection. You should use it if you don’t know the seller. Quitclaim Deed. With a quitclaim deed, the seller transfers whatever interest in the property that they own. However, the seller does not promise that it actually owns the title to the property. Because quitclaim deeds provide less protection, they are usually used to transfer property between family members or between close friends. Grant Deed. With a grant deed, the seller promises that the title hasn’t been transferred to someone else. Grant deeds are not available in all states.

Get the current deed. To transfer the property, you need the legal description of the property. You can find this information on the current deed. If you don’t have a copy of the deed in your possession, you should go to the Recorder of Deeds office in your county and get a copy. The description of property will be listed under “Legal Description” or “Description.” The property will usually be written as metes and bounds, which usually begins with the following language: “Commencing for reference at the dividing line between the City of.…”

Find the property’s tax ID. You can also use the property’s tax identification number—though you should use this number to supplement the legal description of property. Some deeds will request this number as a form of identification as well. You can get the tax number from your property tax bill or by visiting the local tax assessor’s office.

Obtain a blank deed form. You can find blank deed forms in a variety of places. These “fill in the blank” forms make transferring property easy. To find an appropriate form, you can look in the following places: Your county town office. You can stop in and ask if they have a blank deed form available. Online. There are many deed forms online. You should look for a copy from a reputable source, such as a bar association of attorneys or from your county government. Books. There are books or compact discs of legal forms for sale at many retailers. They often have blank deed forms you can use.

Complete the signature block. At the beginning of the deed, you need to identify the sellers and the buyers. The seller is typically called the “grantor” while the buyer is called the “grantee.” The form should read something like the following: “This deed, made on June 1, 2015 between Michael J. Smith (‘Grantor’) and Alice K. Jones and Adam Y. Jones (‘Grantees’).”

State how the property is being taken. If you are transferring the property to more than one person, then you have to specify how the grantees will hold the property. People can hold a property in the following ways: Tenants in common. The grantees can take unequal shares. For example, you might transfer property to two siblings, one of whom will take 70% ownership and the other will take 30% ownership. Either person can sell their share when they want. Also, when one owner dies, their share can be left to whoever they want. Language to create a tenancy in common would read: “Grantor, for a valuable consideration, conveys to Grantees, Alice K. Jones and Adam Y. Jones, as tenants in common, the following described real estate, together with rents, profits, fixtures, and other appurtenant interests, in Dane County, State of Wisconsin (‘Property’):” Joint tenants. The grantees take equal shares. When one dies, the other grantee gets the share automatically. Sample language: “…to Grantees, Alice K. Jones and Adam Y. Jones, as joint owners with rights of survivorship, and not as tenants in common.…” Tenants by the entirety. This is also called “community property.” Each spouse owns the whole property and neither can transfer their right in the property without the consent of the other spouse. Sample language: “…to Grantees, Alice K. Jones and Adam Y. Jones, husband and wife, as tenants by the entirety, and not as tenants in common….”

Insert the description of property. The form will have a blank space for the legal description of property. You can type in the entire legal description of property on the face of the deed. Often, however, people will state “See Attachment A” and then attach a description of the property. If the description is especially lengthy, you might want to use an attachment. If you use an attachment, clearly label the piece of paper “Attachment A.” Make sure that you describe the property accurately. Have someone else look at the description on the current deed and the description you have typed into the transfer deed. If the description is different, then the deed will probably be invalid.

Executing the Deed

Show your deed to a lawyer. If you drafted your own deed, you might want to show it to a lawyer before executing it. A lawyer can look over the deed and make sure that you have not left anything out. You can get a referral to a real estate lawyer by calling your local or state bar association and asking for a referral. You should be particularly careful when trying to transfer a deed to a couple as joint tenants. The law in this area is fairly complicated, and you could benefit from a lawyer’s advice. If you don’t want to pay for the lawyer, then the buyers could pay for the lawyer to look over the deed.

Get witnesses. In some states, you need people to witness the transfer of real estate property. In other states, like Ohio for example, a deed no longer must be witnessed. To find out if you need witnesses, you should read your state’s law. It should be published online. You can search by typing “your state” and “real estate transfer witnesses” into your favorite web engine. You can also stop by your county manager’s office and ask if they know whether you need your deed witnessed. If you get a printed form from the county, then check if there are signature lines for witnesses. If there are, then you should get witnesses.

Visit a notary public. Whoever is selling the property must sign the deed. Their signatures must also be notarized. You can get a document notarized by signing in front of a notary public. Notaries can be found at most courthouses, town offices, and large banks. You can also find a notary by visiting the American Society of Notaries website and using the Locator function. Type in your address to find the nearest notary. If the property is owned by more than one person, then all owners must sign the deed. To make things easy, you can all go to the notary public at the same time.

Gather sufficient personal identification. You must show the notary sufficient personal identification. Generally, a valid driver’s license or passport should be sufficient. The notary will need to confirm who you are before notarizing the document. All people who are signing the deed need personal identification. You should expect to pay the notary a small fee for his or her services.

Recording the Deed

Find the right office. You need to record the deed in the county where the land is located. The appropriate office might go by different names: County Recorder’s office Land Registry office Registrar of Titles Register of Deeds

Ask to record the deed. Take your deed to the appropriate office and tell the clerk that you want to record the deed. The clerk should look over the deed to see that it has been filled out properly. You will have to pay a fee in order to record the new deed. You should call ahead and ask the clerk the amount and acceptable methods of payment.

Pay a transfer tax. You will probably also have to pay a “transfer tax” to transfer the land. The tax is typically calculated based on the amount paid for the property. Each state has its own rules on who pays the transfer tax. In some states, such as Maine, the tax is divided equally between the grantor and the grantee. In others, like New York, the grantor pays the tax.

Wait to receive your recorded deed. It usually takes four to eight weeks to record the deed and have a copy sent to you. You will receive your copy in the mail. If you don’t receive a copy of the deed after eight weeks, you should call the Recorder’s office and ask.

Comments

0 comment