views

Handling the Situation Internally

Notify insurance companies, if necessary. If you have an insurance policy that covers losses due to employee theft or embezzlement, call your insurance company as soon as you discover the theft, even if you don't have any suspects in mind. Your insurance company may require specific documentation of the steps you take to gather evidence and identify the person responsible. Your policy typically requires you to file a notice of claim within a specific period of time after you discover the loss. If you wait too long, you may lose the ability to file a claim. After you complete your internal investigation, you'll typically file a proof of claim document that sets forth the amount of the loss and the employee or employee you believe is responsible. You may also have to include documentation of the disciplinary action that was taken against the employee.

Gather as much information as you can. Embezzlement cases can be difficult to prove if the evidence connecting the theft to the responsible employee is lost or destroyed. Additionally, you don't want to accuse an employee without substantial evidence that they are responsible. While you're gathering evidence and building your case, suspected employees shouldn't have any reason to believe that they're under suspicion. Otherwise, they may start taking steps to cover their tracks or destroy records you need to prove their actions. If you don't have an individual suspect yet, figure out possible ways the money is being stolen so you can narrow down a list of employees with access. If you interview other employees or potential witnesses, make sure they maintain strict confidentiality. Look at security measures you can implement quietly that would allow you to catch the perpetrator in the act. Their method provides evidence you can use to connect them to prior thefts that occurred in the same way.

Inform board of your suspicions. Once you've gathered basic information about the embezzlement and the person you suspect of doing it, let other owners or board members know about the embezzlement so you can take action collectively. If the person you suspect of embezzling funds is an officer or member of the board, you may have to be more careful. You can't be sure there aren't others who are in on the scheme. Maintain strict confidentiality throughout this stage of investigation, particularly if you have narrowed down your suspicions to specific employees. Publicly identifying an innocent employer as an embezzler could open you up to liability for defamation.

Conduct a thorough audit. Hire an independent forensic accountant to review the books of your company or organization. A diligent report will uncover exactly how much money has been lost to the embezzler, and how long the embezzlement has been going on. While you may have found a recent discrepancy after a routine audit, the embezzlement may have gone on undetected for far longer. Get the accountant to go back through several years of financial records.

Limit the suspected employee's access to funds, if appropriate. You may want to reassign the employee you believe is embezzling funds to limit the extent of the theft. Typically, you only want to do this if it can be done without the employee suspecting they've gotten caught. This can also confirm your suspicions. If you take away the employee's access to funds and the embezzlement stops, that provides circumstantial evidence that they were the person responsible. For example, if you suspect your office assistant of taking money from petty cash, you might allow them to work from home for a few days. While they're at home, monitor the petty cash situation and see if money continues to disappear.

Interview the suspected employee. Once you have sufficient evidence to tie the theft to a particular employee, sit them down for a meeting to discuss the situation. Give them an opportunity to explain their side of the story and come forward voluntarily. Even though you may be upset with the employee, try to remain calm and open-minded. Present your evidence to the employee and give them a chance to explain. The employee may be embarrassed and ashamed, and be eager to keep the matter quiet if they make an agreement with you to repay the money. Don't make any promises to the employee without first talking to an attorney and your insurance agent (if you filed a claim). If the employee does not admit to the embezzlement voluntarily, it may be necessary to suspend them (with or without pay, whichever you view as appropriate) while you take further action.

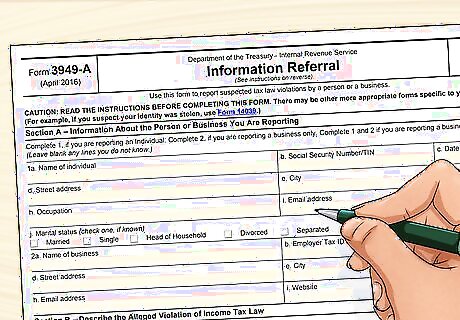

Disclose the diversion of assets to the IRS. Reporting embezzlement to the IRS is required for both nonprofit organizations and for-profit corporations. The amount of money embezzled is considered taxable income of the employee. Avoid reporting the embezzled amounts on a W-2 or a 1099-MISC, as these forms are for reporting income you voluntarily paid to an employee who earned that income. Instead, use Form 3949A. Download a copy of the form at https://www.irs.gov/pub/irs-pdf/f3949a.pdf. Report the embezzled funds as a loss on your company's own tax returns. If you have a tax preparer do your company's returns, be sure to notify them of the embezzlement. Keep your audit report as proof of the loss.

Reporting to Law Enforcement

Call the local police or sheriff's department. For most cases of employee theft, your local law enforcement agency handles the investigation. Call a non-emergency number or go to the office in person to file your report. Bring all the evidence you have, both of the embezzlement and its connection to a particular employee or employees. Tell the officer who takes your report when you first noticed the possible theft, and what actions you've taken since then. Get a copy of the written police report. It may be available immediately, or you may have to go back for it. Make copies for your company records. Get the name and badge number of the officer who completed the report so you can contact them directly if you need to follow up.

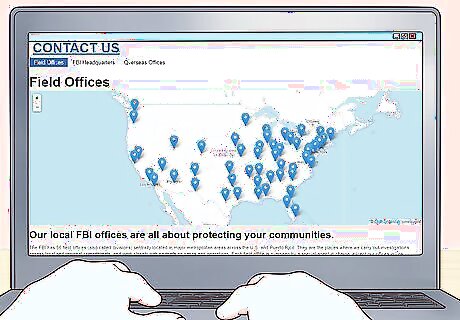

Notify the FBI, if appropriate. If the embezzlement occurred in more than one state, or if it violated federal law, the FBI and the US attorney handle any criminal investigation and prosecution. In some instances, such as if bank or securities fraud are involved, you are required to report the activity to federal authorities. To find your nearest FBI field office, go to https://www.fbi.gov/contact-us/field-offices. You can click on the nearest location on the map or scroll through the alphabetical list. Let the FBI agent know if you've already filed a report with local law enforcement. They may want a copy of the written police report.

Cooperate with the criminal investigation. After you file your report with law enforcement, they will investigate your workplace and potentially interview employees about the embezzlement. Make financial files and records available, and identify potential witnesses they can interview. The investigator will gather information and turn the case over to the prosecutor. The prosecutor's office likely will contact you for additional information and documentation of the theft.

Participate in restitution discussions. If the prosecutor brings charges against the employee, the employee's attorney will likely attempt to plea bargain for a lighter sentence. Make sure any plea bargain includes full restitution of the amounts embezzled from your company. If the employee is convicted after trial, the judge will likely make restitution part of the employee's sentence. If the employee does not repay the funds as agreed, they may face additional prison time.

Recovering the Misappropriated Funds

Work out an agreement with the employee. Depending on the extent of the embezzlement and personal factors, you may decide that you don't want to report the incident to law enforcement. If the employee volunteers to repay the funds they've embezzled, draft a contract with the help of an attorney. If an employee immediately confesses and agrees to repay the money, this is usually the easiest way to proceed. Other methods, including a criminal or civil trial, are uncertain and consume time and money. Have an attorney draft the contract to ensure it's legally enforceable. Include consequences if the employee fails to repay the money by a certain date, or to make installment payments as agreed.

Get payments through criminal restitution. If you report the crime to law enforcement and the employee is charged and convicted, the court will order the employee to repay the money they embezzled. This may take some time if the employee first must serve a prison sentence. Unlike a voluntary agreement or a civil suit, an employee ordered to make restitution by a criminal court faces jail time if they don't follow the order. Another benefit of criminal restitution is that it's a lot harder for the employee to skip town and disappear. If an employee signs a voluntary agreement and then disappears, you'll have to track them down before you can enforce the contract in a court of law.

Sue the employee in civil court if you don't get criminal restitution. In some cases, you aren't able to get a full recovery through criminal restitution. In others, you may choose not to file criminal charges at all. Suing the employee in civil court is another way to recover your money, although it can be more complex and results are not guaranteed. You have a lower burden of proof in a civil case than in a criminal case. Therefore, if there was not enough evidence to convict the employee on criminal charges, you may still be able to win restitution in a civil trial.

Comments

0 comment