views

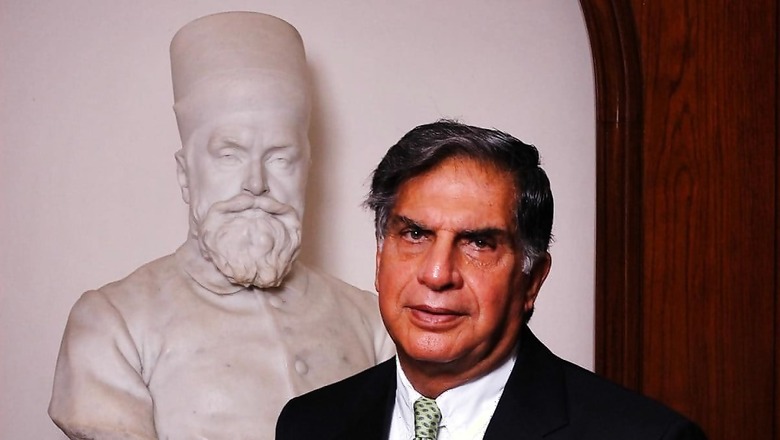

Ratan Tata’s tenure as the chairman of Tata Sons from 1991 to 2012 transformed the Tata Group into a globalised diversified conglomerate from an Indian legacy house, with its market capitalisation ballooning 33 times. The group, with its listed entities’ combined market capitalisation at Rs 30 lakh crore, saw dramatic growth with his strategic decisions and well-timed acquisitions.

In December 2012, Ratan Tata stepped down as Chairman of Tata Sons after 50 years with the Tata group; and was honoured with the title of Chairman Emeritus of Tata Sons.

During Ratan Tata’s tenure at the helm, Tata Group’s revenues grew from about Rs 18,000 crore to Rs 5.5 lakh crore, and the market cap from about Rs 30,000 crore to Rs 5 lakh crore.

When Ratan Tata took over as chairman, he inherited a diverse conglomerate of over 95 companies, many of which were operating independently, with little synergy or strategic alignment. These companies were operating in a diverse range of businesses that included chemicals, hotels, salt, software, steel, soaps, and watches.

One of Tata’s priorities was restructuring and consolidating the group, streamlining operations, and enforcing a singular corporate identity across its various subsidiaries. “I think the group needed cohesion… My concern was that after him [group patriarch JRD Tata], it would be difficult to hold it together,” Tata had said about his taking over as the group Chairman.

The 144-year old Tata group was a “slow, bureaucratic, domestic market focused, loosely connected agglomerate of businesses,” wrote K.S. Manikandan, K. Rajyalakshmi and J. Ramachandran in a paper for Indian Institute of Management (IIM)-Bangalore. Tata transformed it into an “ambitious, integrated business house that realised over 60 per cent of its revenues from global markets,” they wrote.

India’s economic liberalisation and Ratan Tata’s Group captaincy

A key turning point came with the liberalisation of the Indian economy in 1991. Ratan Tata’s appointment as chairman of the group coincided with the liberalisation, which dramatically changed the country’s industrial landscape. Tata recognised the need to innovate and become globally competitive, positioning the conglomerate to benefit from the opening up of the Indian economy to foreign investments and partnerships.

Tata entered into collaborations with multinationals and set up several high technology ventures such as Tata Teleservices (Bell Canada) and Tata Communications in the telecom sector, Tata Petrodyne in upstream oil and gas (with BP), Tata Information Systems in information technology (with IBM) and initiated talks with Singapore Airlines to launch airline services in India.

To fund the new ventures, Tata sold a 20 percent stake in Tata Industries Ltd. to Hong Kong-based Jardine Matheson group for $35 million, according to the IIM-B paper.

It was Ratan Tata under whose leadership the Tata group pursued a globalisation drive with high-profile acquisitions such as Tetley, Corus, Jaguar Land Rover, Brunner Mond, General Chemical Industrial Products and Daewoo. He took over from JRD Tata as Chairman of Tata Sons and Chairman of the Tata trusts in March 1991. Tata Sons is the principal investment holding company and promoter of Tata companies. Sixty-six per cent of the equity share capital of Tata Sons is held by philanthropic trusts, which support education, health, livelihood generation and art and culture.

Tata Steel’s Acquisition of Corus (2007): In what was then India’s largest-ever foreign acquisition, Tata Steel acquired the Anglo-Dutch steelmaker Corus for $12 billion. This acquisition catapulted Tata Steel into the ranks of the world’s largest steel producers and was a major contributor to the group’s rising market value.

Before the acquisition, Tata Steel was largely focused on the domestic market. With Corus, it gained a significant foothold in Europe and became a more diversified and globally recognised steelmaker.

Tata Motors’ acquisition of Jaguar Land Rover (2008): In a bold move, Tata Motors acquired the iconic British brands Jaguar and Land Rover from Ford for $2.3 billion. While initially met with scepticism, this acquisition turned out to be a masterstroke.

Under Tata’s ownership, JLR became profitable, and its global success bolstered Tata Motors’ market capitalisation. By 2015, JLR was contributing more than 90 per cent of Tata Motors’ profits, underscoring the success of this deal.

These acquisitions significantly boosted Tata Group’s overall market capitalisation over the next few years.

TCS: The crown jewel of Tata Group

A pivotal driver of the Tata Group’s market capitalisation growth has been TCS (Tata Consultancy Services), the group’s information technology (IT) services arm. While launched back in 1968, TCS truly spread its wings under Ratan Tata’s strategic leadership. TCS went public in 2004, raising Rs 4,713 crore through its initial public offering (IPO). The company’s stellar performance since then has transformed it into the group’s largest company by market capitalisation, contributing over Rs 15 lakh crore.

TCS’s growth, aided by the global IT outsourcing boom, positioned it as a leader in digital transformation services. The company continues to be the group’s most valuable asset, and its exponential rise in market cap has been a primary factor in the Tata Group’s overall growth.

Key milestone: Tata Group surpassed Rs 30 lakh crore in market capitalisation in 2024, driven by continued strength in TCS, resurgence in Tata Motors, and growth in Tata Steel and Tata Power.

Comments

0 comment