views

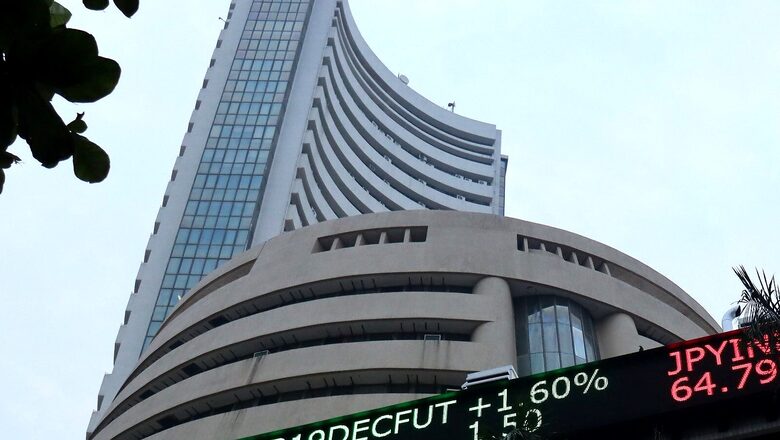

The benchmark indices BSE Sensex opened in red on Monday at 58,781.26 down 234.63 points, or 0.40 points. However, the broader Nifty was also trading in red at 17,494.75, down 90.40, or 0.51 per cent. The Indian markets were trading cautiously on the account of the upcoming US Fed meeting in which more clarity about the tapering will come in.

“Markets are likely to turn volatile from now on. Possible tapering timeline from the Fed this week, rising bond yields in US, strengthening dollar (dollar index above 93) and news of crisis in the large Chinese real estate developer Evergrande are likely to weigh on markets. With valuations in stretched territory, corrections are possible, particularly in the broader market. On the positive side FIIs continue to buy imparting resilience to markets. But this can quickly change. Investors may adopt a wait and watch strategy till clarity emerges,”Dr. V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services said.

On NSE, Hindustan Unilever, HCL Tech, Tech Mahindra, ITC, TCS were the top gainers. On the flip side, Tata Steel, JSW Steel, Hindalco, Bajaj Auto, Eicher Motor were the losers. On NSE, 10 shares advanced, 40 declined keeping the market breadth negative. Sectorally, Nifty Media was the top gainer, however, other indices like Nifty Auto, Nifty Bank, Nifty Metal, Nifty Financial Services were trading in red.

“Benchmark Indices are expected to open on a negative note as trends on SGX nifty indicate a gap down opening with 130 points loss. Asian shares eased and the dollar held firm on Monday ahead of a week graced with no less than a dozen central bank meetings, highlighted by the federal reserve which is likely to take another step toward tapering. US Stocks ended sharply lower in a broad sell-off on Friday, ending a week buffeted by strong economic data, corporate tax hike worries, the delta COVID variant, and possible shifts in the US Federal Reserve’s timeline for tapering asset purchases. Ten-year Treasury yields have risen ahead of the Fed meeting this week where policy makers are expected to start laying the groundwork for pairing stimulus.” Mohit Nigam, Head – PMS, Hem Securities said.

“Oil down on stronger greenback, rising US rig count. Iron ore will be closely watched after falling below $100 a metric ton for the first time in more than a year. Stock specific actions can be witnessed in stocks such as Sobha Ltd (Chief Financial Officer Subash Mohan Bhat has resigned. He will continue in his position till a new CFO is appointed) Bajaj Holdings (Board has approved an interim dividend of Rs 90 per equity share. The record date for the interim dividend will be Sept. 29, 2021). Crucial support for Nifty 50 is 17,300 while Nifty may face some resistance at 17,600.” Nigam added.

On Monday, taking mixed cues from the global markets, Indian market opened on a flat note. Asian stock markets also acted cautiously, Early Monday, MSCI’s broadest index of Asia-Pacific shares outside Japan dipped another 0.2 per cent, after shedding 2.5 per cent last week. Hang Seng fell 2.5 per cent in early trade.

The equity benchmarks on Friday surged to fresh lifetime peaks on Friday but finished with modest losses, snapping their three-session winning streak, as investors rotated out of RIL, metal and IT stocks at higher levels. After gyrating 866 points during the day, the 30-share BSE Sensex settled 125.27 points or 0.21 per cent lower at 59,015.89. The broader NSE Nifty slipped 44.35 points or 0.25 per cent to close at 17,585.15, after touching an intra-day record of 17,792.95. On Frida

Read all the Latest News , Breaking News and Ukraine-Russia War Live Updates here.

Comments

0 comment